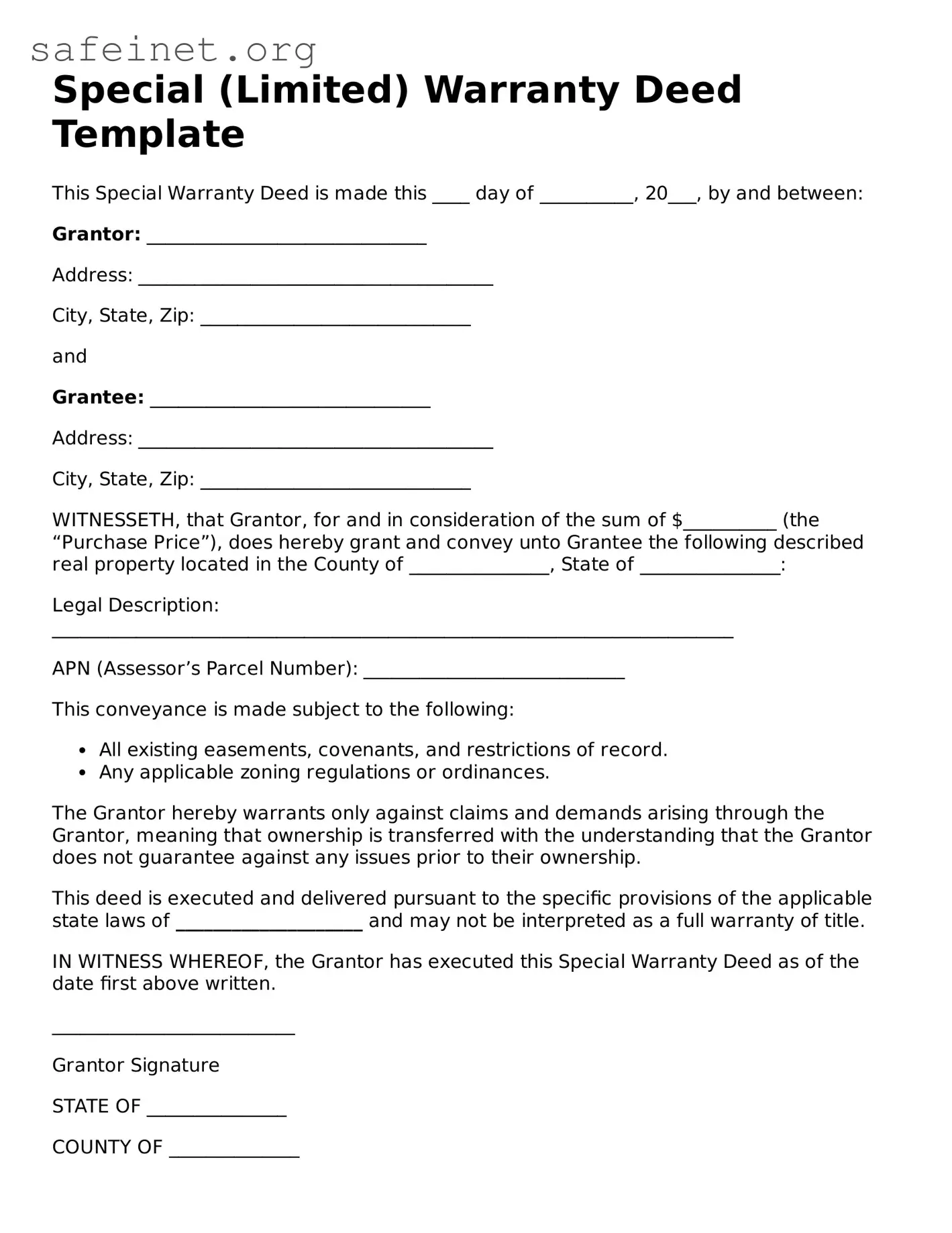

Special (Limited) Warranty Deed Template

This Special Warranty Deed is made this ____ day of __________, 20___, by and between:

Grantor: ______________________________

Address: ______________________________________

City, State, Zip: _____________________________

and

Grantee: ______________________________

Address: ______________________________________

City, State, Zip: _____________________________

WITNESSETH, that Grantor, for and in consideration of the sum of $__________ (the “Purchase Price”), does hereby grant and convey unto Grantee the following described real property located in the County of _______________, State of _______________:

Legal Description: _________________________________________________________________________

APN (Assessor’s Parcel Number): ____________________________

This conveyance is made subject to the following:

- All existing easements, covenants, and restrictions of record.

- Any applicable zoning regulations or ordinances.

The Grantor hereby warrants only against claims and demands arising through the Grantor, meaning that ownership is transferred with the understanding that the Grantor does not guarantee against any issues prior to their ownership.

This deed is executed and delivered pursuant to the specific provisions of the applicable state laws of ____________________ and may not be interpreted as a full warranty of title.

IN WITNESS WHEREOF, the Grantor has executed this Special Warranty Deed as of the date first above written.

__________________________

Grantor Signature

STATE OF _______________

COUNTY OF ______________

Before me, a Notary Public in and for said County and State, personally appeared ________________________ (Grantor Name), to me known to be the person who executed the above instrument and acknowledged that he/she executed the same as his/her free act and deed.

Given under my hand and official seal this ____ day of ____________, 20__.

______________________________

Notary Public

My Commission Expires: _____________