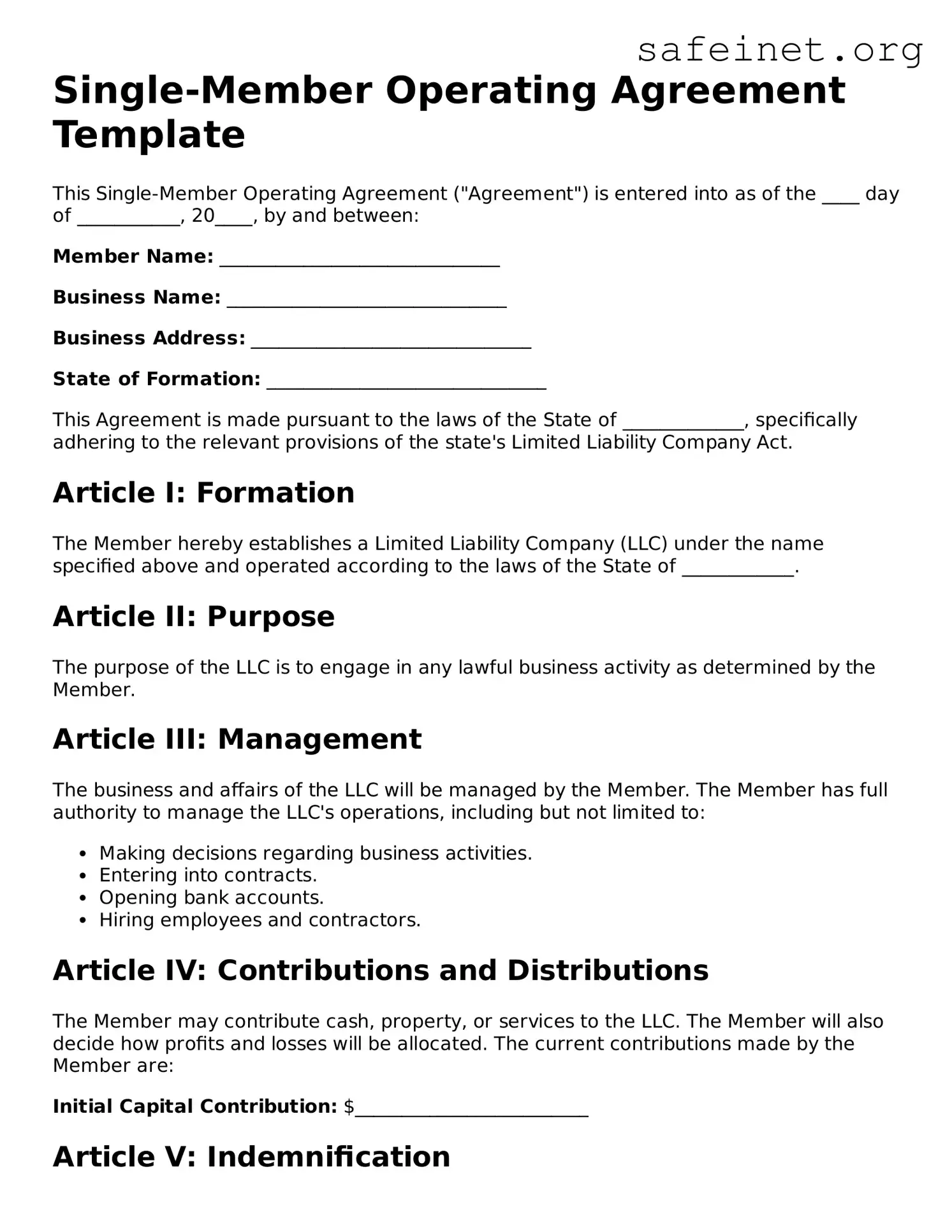

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is entered into as of the ____ day of ___________, 20____, by and between:

Member Name: ______________________________

Business Name: ______________________________

Business Address: ______________________________

State of Formation: ______________________________

This Agreement is made pursuant to the laws of the State of _____________, specifically adhering to the relevant provisions of the state's Limited Liability Company Act.

Article I: Formation

The Member hereby establishes a Limited Liability Company (LLC) under the name specified above and operated according to the laws of the State of ____________.

Article II: Purpose

The purpose of the LLC is to engage in any lawful business activity as determined by the Member.

Article III: Management

The business and affairs of the LLC will be managed by the Member. The Member has full authority to manage the LLC's operations, including but not limited to:

- Making decisions regarding business activities.

- Entering into contracts.

- Opening bank accounts.

- Hiring employees and contractors.

Article IV: Contributions and Distributions

The Member may contribute cash, property, or services to the LLC. The Member will also decide how profits and losses will be allocated. The current contributions made by the Member are:

Initial Capital Contribution: $_________________________

Article V: Indemnification

The LLC shall indemnify the Member to the full extent permitted by law against any losses or expenses incurred as a result of their membership or management of the LLC.

Article VI: Dissolution

The LLC may be dissolved by the Member at any time. Upon dissolution, the Member shall take the necessary actions to wind up the LLC’s affairs and distribute remaining assets.

Article VII: Governing Law

This Agreement shall be governed by the laws of the State of ____________.

IN WITNESS WHEREOF, the Member has executed this Single-Member Operating Agreement as of the day and year first above written.

_____________________________

Member Signature

Date: ____________________________