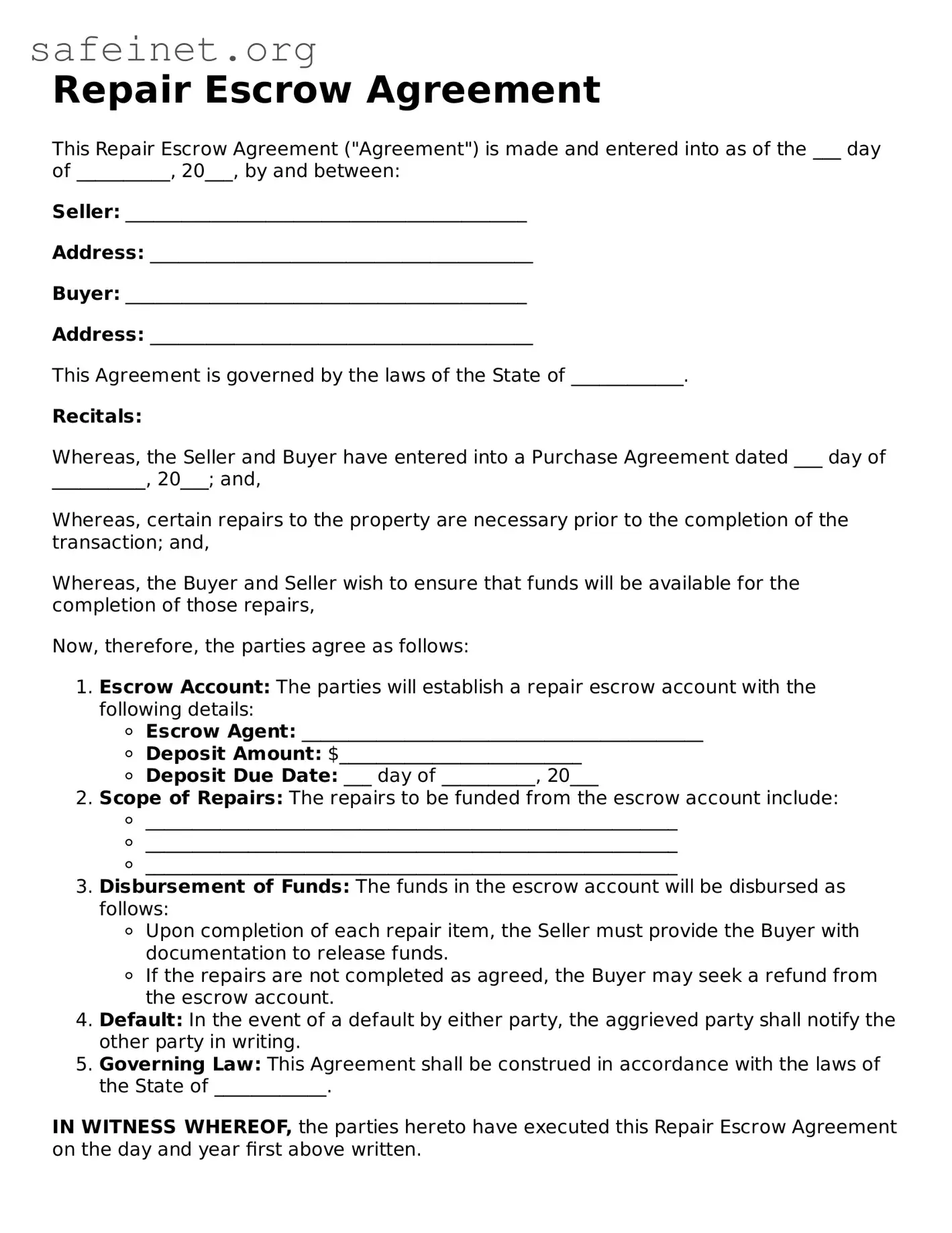

Repair Escrow Agreement

This Repair Escrow Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and between:

Seller: ___________________________________________

Address: _________________________________________

Buyer: ___________________________________________

Address: _________________________________________

This Agreement is governed by the laws of the State of ____________.

Recitals:

Whereas, the Seller and Buyer have entered into a Purchase Agreement dated ___ day of __________, 20___; and,

Whereas, certain repairs to the property are necessary prior to the completion of the transaction; and,

Whereas, the Buyer and Seller wish to ensure that funds will be available for the completion of those repairs,

Now, therefore, the parties agree as follows:

- Escrow Account: The parties will establish a repair escrow account with the following details:

- Escrow Agent: ___________________________________________

- Deposit Amount: $__________________________

- Deposit Due Date: ___ day of __________, 20___

- Scope of Repairs: The repairs to be funded from the escrow account include:

- _________________________________________________________

- _________________________________________________________

- _________________________________________________________

- Disbursement of Funds: The funds in the escrow account will be disbursed as follows:

- Upon completion of each repair item, the Seller must provide the Buyer with documentation to release funds.

- If the repairs are not completed as agreed, the Buyer may seek a refund from the escrow account.

- Default: In the event of a default by either party, the aggrieved party shall notify the other party in writing.

- Governing Law: This Agreement shall be construed in accordance with the laws of the State of ____________.

IN WITNESS WHEREOF, the parties hereto have executed this Repair Escrow Agreement on the day and year first above written.

_____________________________

Seller

_____________________________

Buyer

_____________________________

Witness