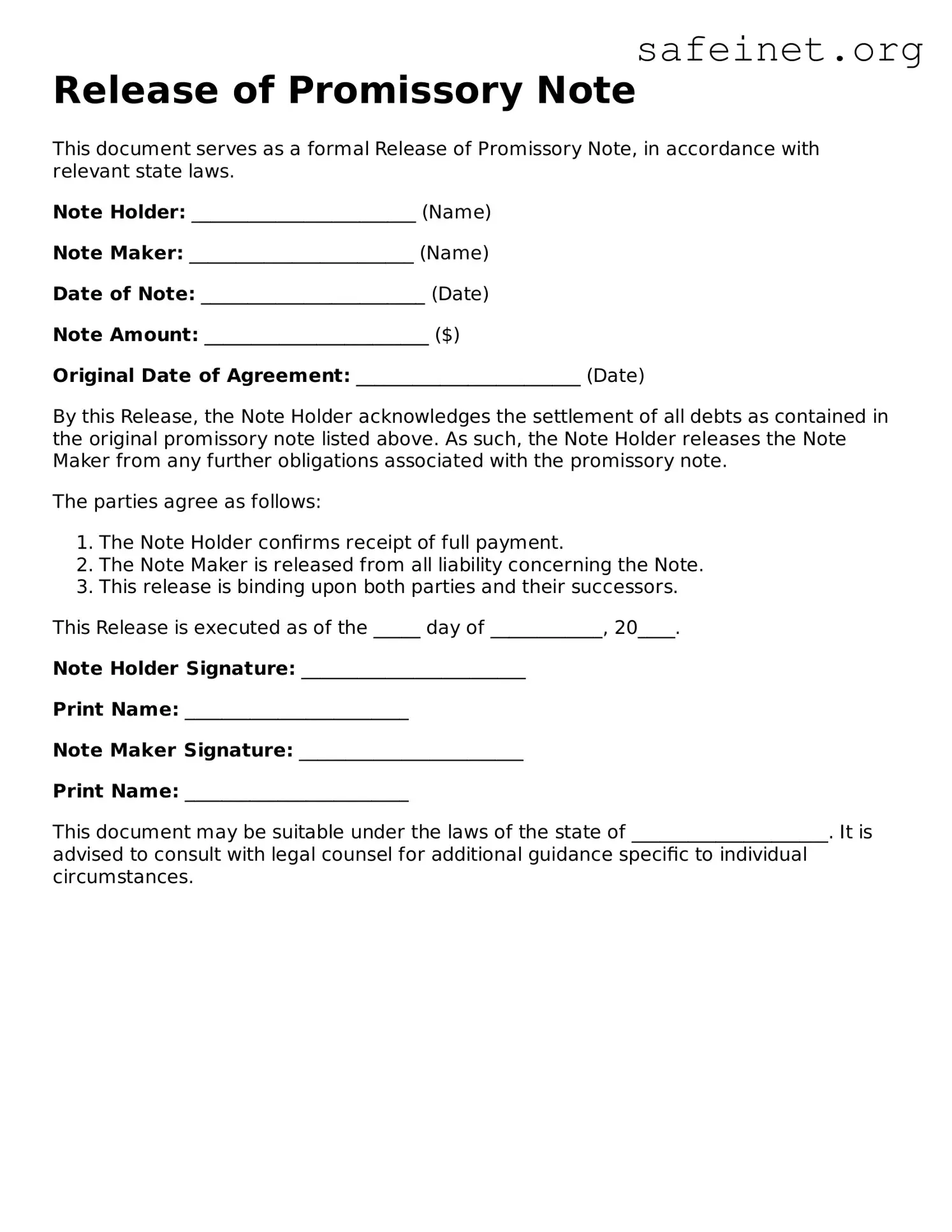

Release of Promissory Note

This document serves as a formal Release of Promissory Note, in accordance with relevant state laws.

Note Holder: ________________________ (Name)

Note Maker: ________________________ (Name)

Date of Note: ________________________ (Date)

Note Amount: ________________________ ($)

Original Date of Agreement: ________________________ (Date)

By this Release, the Note Holder acknowledges the settlement of all debts as contained in the original promissory note listed above. As such, the Note Holder releases the Note Maker from any further obligations associated with the promissory note.

The parties agree as follows:

- The Note Holder confirms receipt of full payment.

- The Note Maker is released from all liability concerning the Note.

- This release is binding upon both parties and their successors.

This Release is executed as of the _____ day of ____________, 20____.

Note Holder Signature: ________________________

Print Name: ________________________

Note Maker Signature: ________________________

Print Name: ________________________

This document may be suitable under the laws of the state of _____________________. It is advised to consult with legal counsel for additional guidance specific to individual circumstances.