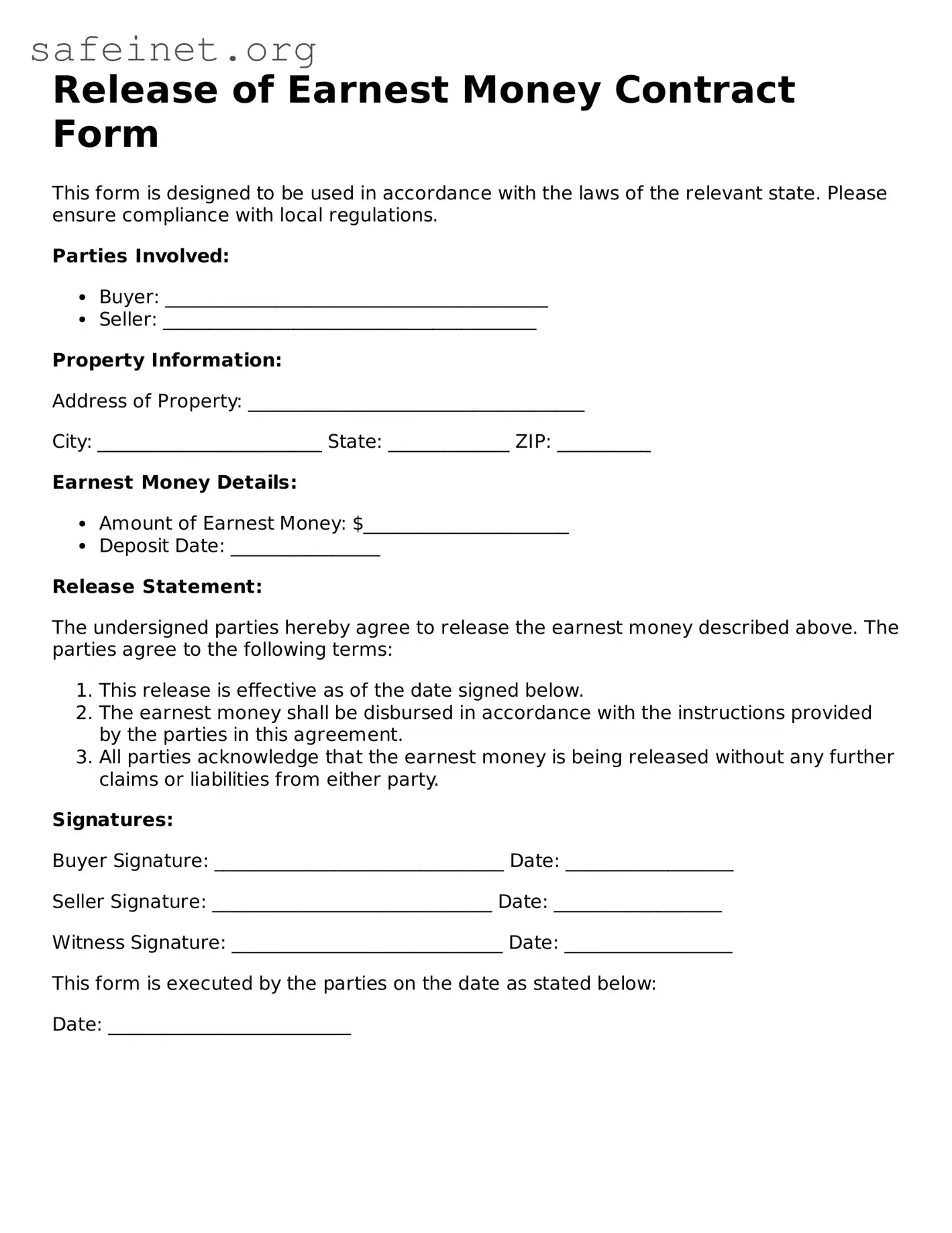

Release of Earnest Money Contract Form

This form is designed to be used in accordance with the laws of the relevant state. Please ensure compliance with local regulations.

Parties Involved:

- Buyer: _________________________________________

- Seller: ________________________________________

Property Information:

Address of Property: ____________________________________

City: ________________________ State: _____________ ZIP: __________

Earnest Money Details:

- Amount of Earnest Money: $______________________

- Deposit Date: ________________

Release Statement:

The undersigned parties hereby agree to release the earnest money described above. The parties agree to the following terms:

- This release is effective as of the date signed below.

- The earnest money shall be disbursed in accordance with the instructions provided by the parties in this agreement.

- All parties acknowledge that the earnest money is being released without any further claims or liabilities from either party.

Signatures:

Buyer Signature: _______________________________ Date: __________________

Seller Signature: ______________________________ Date: __________________

Witness Signature: _____________________________ Date: __________________

This form is executed by the parties on the date as stated below:

Date: __________________________