What is a Receipt Template form?

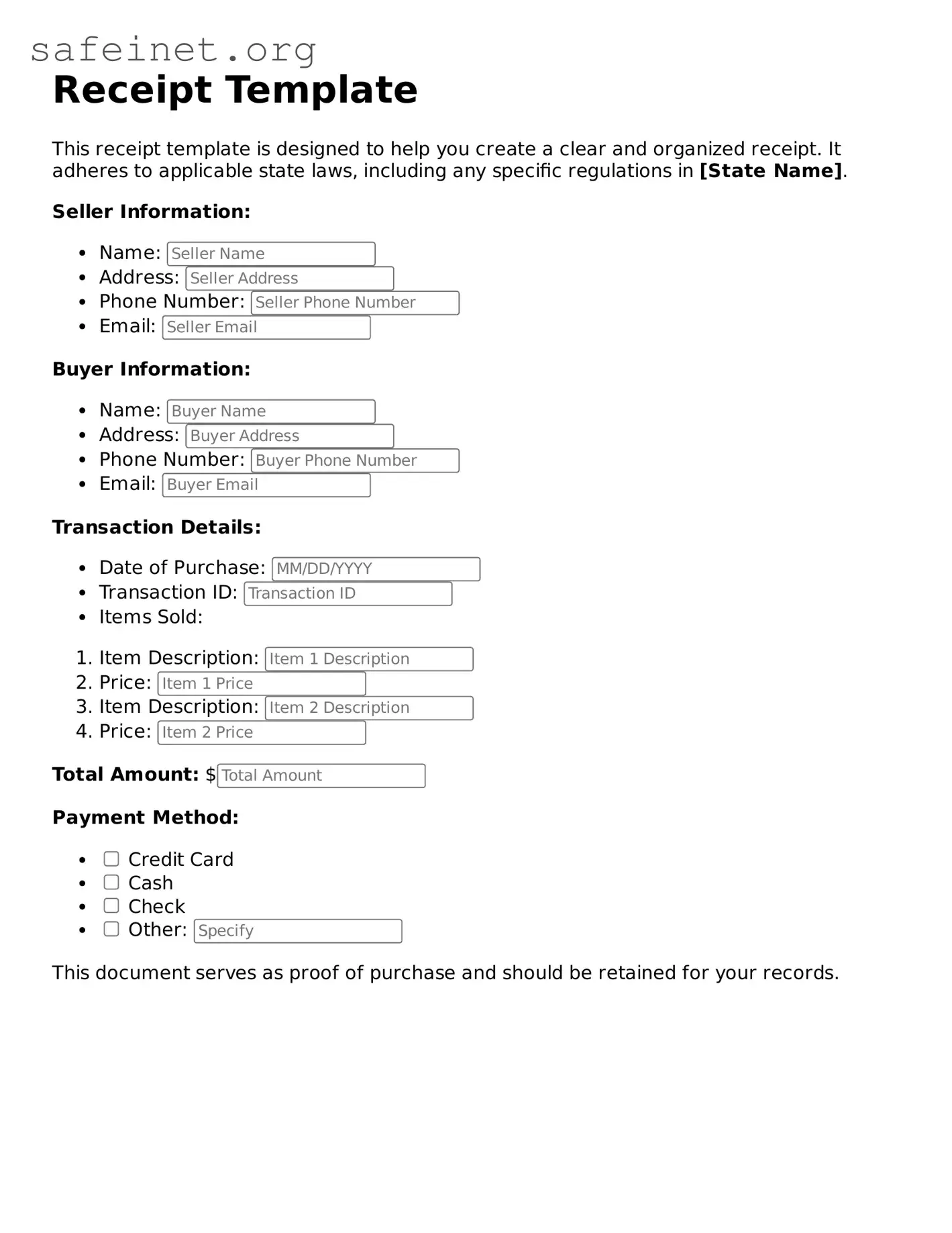

A Receipt Template form is a pre-designed document that allows individuals or businesses to create receipts easily. It typically includes fields for the date, the name of the seller, the buyer's information, item descriptions, quantities, prices, and total amounts. Using a receipt template saves time and ensures that all necessary information is consistently recorded.

How do I fill out a Receipt Template form?

To fill out a Receipt Template form, start by entering the date of the transaction. Next, provide the seller’s name and the buyer’s details. List each item purchased, including descriptions, quantities, and individual prices. Finally, calculate the total amount due and include any applicable taxes or discounts. Review the completed form for accuracy before issuing it.

Can I customize the Receipt Template form?

Yes, the Receipt Template form can be customized to fit specific needs. You can modify fields, add your logo, or alter the layout. Customization may help align the receipt format with your branding or match specific business requirements. Check your software or tool’s options for flexibility in editing the template.

Is a Receipt Template form legally binding?

A Receipt Template form serves as evidence of a transaction and can be legally binding if it meets certain criteria. It should clearly outline the agreement between the seller and the buyer, including the items purchased and the payment terms. For legal purposes, ensure that all relevant information is complete and accurate. Always retain copies of receipts for record-keeping.