What is a Real Estate Purchase Agreement?

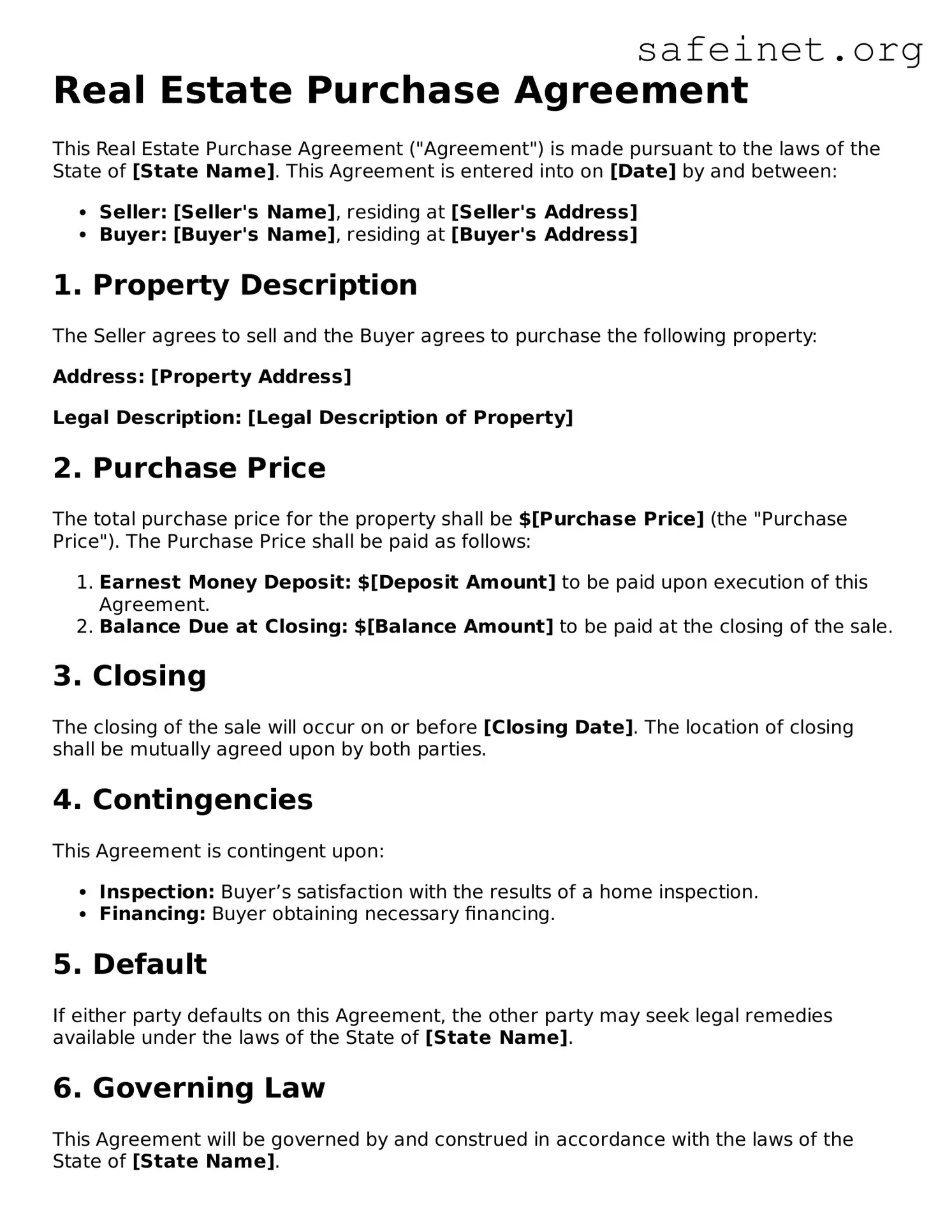

A Real Estate Purchase Agreement (REPA) is a legal document that outlines the terms and conditions of a real estate transaction. It serves as a contract between the buyer and seller, detailing what is being sold, the price, and any other relevant conditions that must be met before the sale is finalized.

What are the primary components of this agreement?

The primary components include the names of the buyer and seller, property description, purchase price, deposit amount, closing date, contingencies, and any included appliances or fixtures. Each of these elements ensures all parties understand their responsibilities and expectations in the transaction.

Why is a Real Estate Purchase Agreement important?

This agreement protects both the buyer and seller by documenting the specifics of the transaction. It helps prevent misunderstandings. Furthermore, if disputes arise, it can serve as critical evidence in legal proceedings.

What are contingencies in a Real Estate Purchase Agreement?

Contingencies are specific conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and appraisal conditions. If a contingency is not satisfied, the buyer or seller may have the right to cancel the agreement without penalty.

Can the Real Estate Purchase Agreement be modified?

Yes, the agreement can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign off on the updates to ensure all terms are clear and enforceable.

What happens after the agreement is signed?

After the agreement is signed, the closing process begins. This process includes completing any contingencies, conducting a title search, and securing financing. The closing date is typically outlined in the agreement and is when the property officially changes hands.

Is it advisable to use an attorney when drafting a Real Estate Purchase Agreement?

While it is not legally required, it is often advisable to consult an attorney when drafting or reviewing a Real Estate Purchase Agreement. An attorney can help ensure that the agreement is legally sound, that it complies with local laws, and that your best interests are represented.

What if either party breaches the Real Estate Purchase Agreement?

If either party breaches the agreement, the other party may have legal recourse. Remedies can include seeking damages, enforcing the agreement, or pursuing specific performance, which is a court order forcing the breaching party to adhere to the terms of the contract.

How do I know if the Real Estate Purchase Agreement is complete?

A complete Real Estate Purchase Agreement should include all necessary components, be signed by both parties, and contain any relevant disclosures. A thorough review, ideally with legal counsel, will ensure that all elements are included and correctly filled out.