What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that grants one individual the authority to act on behalf of another in relation to real estate transactions. This includes the ability to buy, sell, mortgage, or manage property. It enables the appointed agent, or attorney-in-fact, to make decisions regarding the property as if they were the owner.

Why would someone need a Real Estate Power of Attorney?

Individuals often require a Real Estate Power of Attorney when they are unable to manage their property due to factors such as illness, absence, or other personal circumstances. This document ensures that property decisions can continue to be made efficiently and effectively, even when the property owner is not physically present or capable of making those decisions.

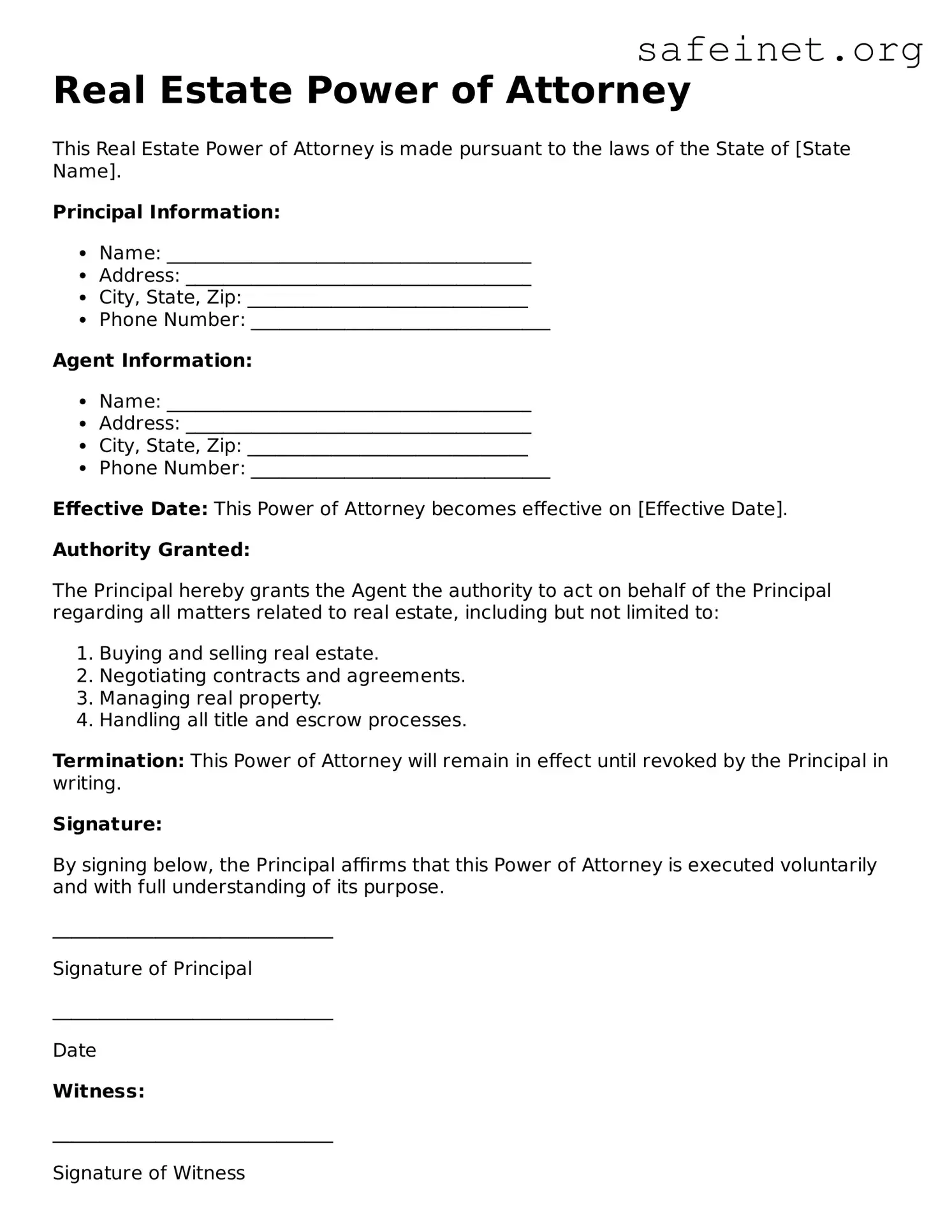

How is a Real Estate Power of Attorney executed?

Executing a Real Estate Power of Attorney typically involves several steps. The document must be drafted clearly, specifying the powers granted to the agent. The property owner must then sign the form, preferably in the presence of a notary public. In some states, witnesses may also be required to validate the document. Once signed and notarized, the document is effective immediately or upon the occurrence of a specified event, depending on the owner's wishes.

Can a Real Estate Power of Attorney be revoked?

Yes, a Real Estate Power of Attorney can be revoked at any time by the property owner, as long as they are mentally competent. The revocation must be documented in writing and should be communicated to the appointed agent and any parties relying on the original document. It is advisable to notify financial institutions and relevant third parties to avoid any confusion.

Is a Real Estate Power of Attorney valid in all states?

While a Real Estate Power of Attorney is generally recognized across the United States, each state has its own laws governing these documents. Variations can occur in terms of execution requirements, the scope of authority granted, and the acceptable form of notarization. It is essential to consult state-specific laws to ensure compliance and validity.

Can the agent appointed in a Real Estate Power of Attorney make any decisions?

The scope of decisions that the agent can make depends on the specific powers outlined in the Real Estate Power of Attorney document. The principal can limit the agent’s powers to specific transactions or grant broad authority. It is crucial that the language in the document is clear to avoid potential disputes regarding what actions the agent can or cannot take on behalf of the property owner.

What happens if the property owner becomes incapacitated?

In cases where the property owner becomes incapacitated and has designated a fiduciary through a Real Estate Power of Attorney, the agent can continue to act on their behalf without additional legal intervention. This arrangement provides a seamless way to handle property matters, assuming the Power of Attorney remains valid and has not been revoked. It is essential that the document includes provisions for such situations, ensuring the agent's authority persists.