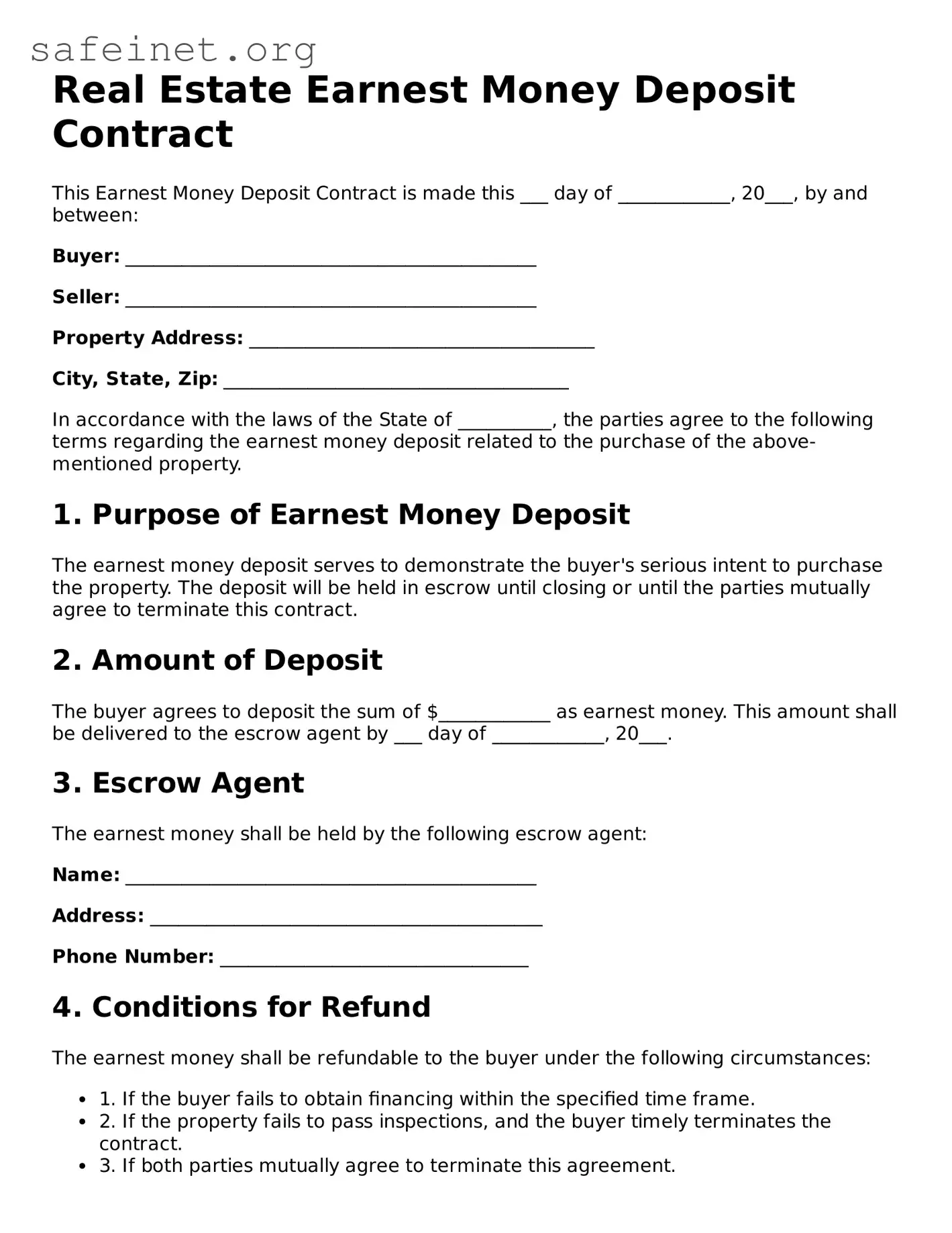

Real Estate Earnest Money Deposit Contract

This Earnest Money Deposit Contract is made this ___ day of ____________, 20___, by and between:

Buyer: ____________________________________________

Seller: ____________________________________________

Property Address: _____________________________________

City, State, Zip: _____________________________________

In accordance with the laws of the State of __________, the parties agree to the following terms regarding the earnest money deposit related to the purchase of the above-mentioned property.

1. Purpose of Earnest Money Deposit

The earnest money deposit serves to demonstrate the buyer's serious intent to purchase the property. The deposit will be held in escrow until closing or until the parties mutually agree to terminate this contract.

2. Amount of Deposit

The buyer agrees to deposit the sum of $____________ as earnest money. This amount shall be delivered to the escrow agent by ___ day of ____________, 20___.

3. Escrow Agent

The earnest money shall be held by the following escrow agent:

Name: ____________________________________________

Address: __________________________________________

Phone Number: _________________________________

4. Conditions for Refund

The earnest money shall be refundable to the buyer under the following circumstances:

- 1. If the buyer fails to obtain financing within the specified time frame.

- 2. If the property fails to pass inspections, and the buyer timely terminates the contract.

- 3. If both parties mutually agree to terminate this agreement.

5. Non-Refundable Deposit

In the event that the buyer does not fulfill the terms of this contract, the earnest money may be forfeited to the seller as liquidated damages.

6. Signatures

In witness whereof, the parties hereto have executed this Earnest Money Deposit Contract as of the date first above written.

Buyer Signature: __________________________ Date: _____________

Seller Signature: __________________________ Date: _____________

This contract represents the entire agreement concerning the earnest money deposit and supersedes any prior negotiations or agreements.

By signing, the parties acknowledge that they have read and understood the terms of this contract and agree to abide by its provisions.