What is a Promissory Note?

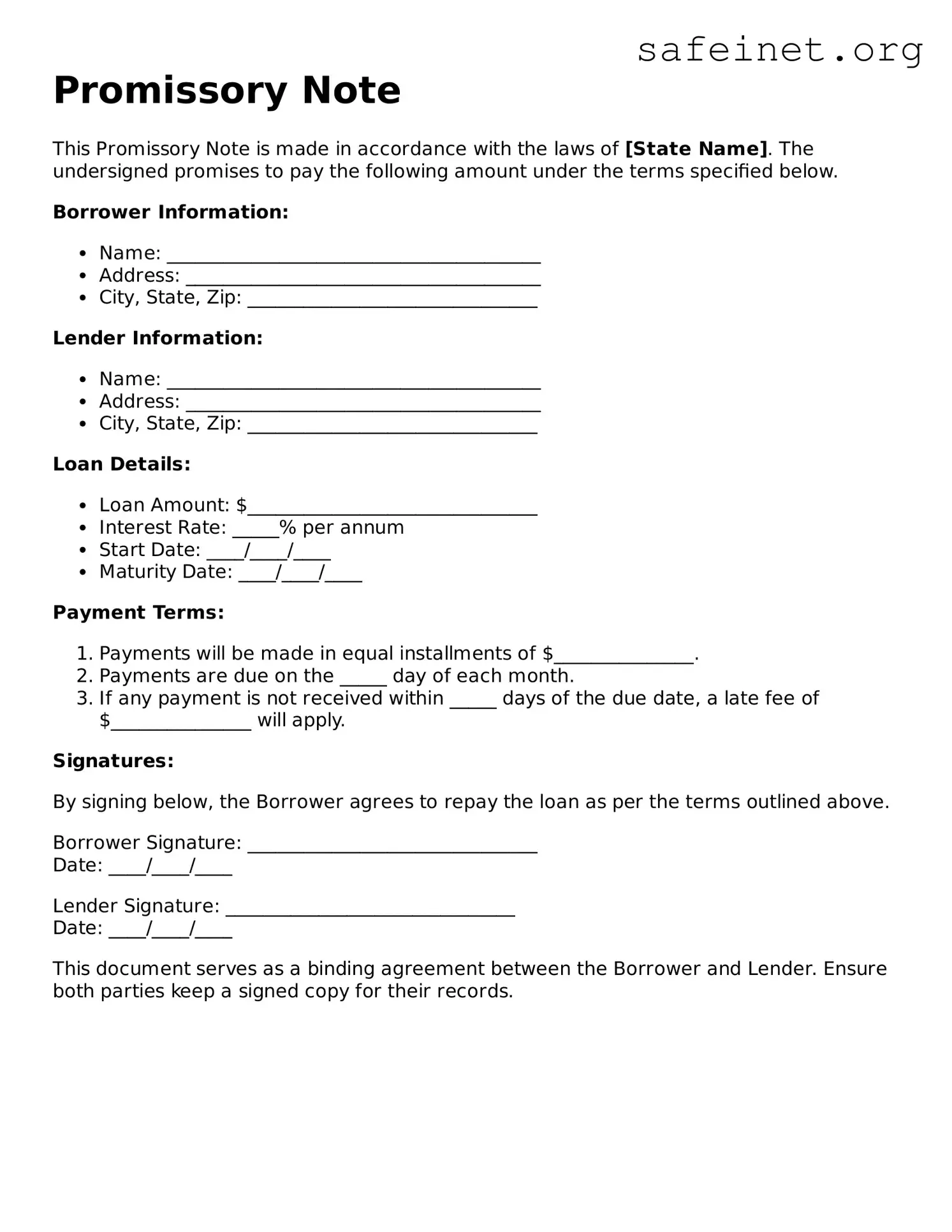

A Promissory Note is a written promise to pay a specific amount of money to a designated person or entity by a specified date. It outlines the terms of the loan and creates a legal obligation for the borrower to repay the lender. Generally, it includes details such as the loan amount, interest rate, repayment schedule, and any conditions attached to the loan.

Who uses a Promissory Note?

Individuals and businesses may use Promissory Notes for various purposes. For example, a person may borrow money from a friend or family member and use a Promissory Note to formalize the loan agreement. Similarly, businesses often utilize these notes to secure financing from investors or banks.

What should be included in a Promissory Note?

Key elements of a Promissory Note include the names of the borrower and lender, the principal amount of the loan, the interest rate, repayment terms, maturity date, and any specific conditions. It may also require signatures from both parties to validate the agreement.

Is a Promissory Note legally enforceable?

Yes, a Promissory Note is generally considered a legally enforceable document. The lender can take legal action against the borrower if they fail to repay the loan according to the agreed-upon terms. However, the enforceability may depend on specific state laws and the clarity of the terms outlined in the note.

Can a Promissory Note be transferred?

Yes, a Promissory Note can often be transferred from one party to another. This process, known as assignment, allows the original lender to transfer their rights to receive payments to someone else. The borrower should be informed of this transfer to avoid confusion about whom to make payments to.

What happens if a borrower defaults on a Promissory Note?

If a borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They can pursue a legal remedy, which may involve filing a lawsuit to recover the owed amount. Alternatively, the lender could negotiate a new repayment plan with the borrower to help them catch up on payments.

Do I need a lawyer to create a Promissory Note?

While it is not strictly necessary to hire a lawyer for creating a Promissory Note, it can be beneficial, particularly for larger or more complex loans. Legal advice can help ensure the document complies with applicable laws and that all necessary terms are included to protect both parties' interests.

How do I enforce a Promissory Note?

To enforce a Promissory Note, the lender typically needs to have a copy of the signed agreement and documentation of the borrower’s default. If amicable efforts to collect the debt fail, the lender might file a lawsuit in civil court to seek repayment. It is advisable to consult legal counsel when considering this option.

Can a Promissory Note include additional terms?

Yes, Promissory Notes can include additional terms beyond basic repayment plans. This might include late fees, prepayment conditions, and collateral requirements. It’s important that any additional terms are clearly stated in the document to avoid misunderstandings later on.

Where can I find a template for a Promissory Note?

Many reputable online legal resource websites offer templates for Promissory Notes. These templates can often be customized to meet individual needs. It is crucial to choose a template that complies with your state's laws and to consider having a legal professional review it before use.