What is a prenuptial agreement?

A prenuptial agreement, often called a prenup, is a legal document that couples create before getting married. It outlines how assets will be divided in the event of a divorce or separation. Many people think of prenups as negative or unromantic, but they can actually provide clarity and security for both partners.

Why should we consider having a prenuptial agreement?

Having a prenup can help protect individual assets, clarify financial responsibilities during marriage, and prevent future disputes. It's particularly useful for those who have significant assets or debts, or for individuals entering a second marriage. It promotes transparency and communication about finances before tying the knot.

What can be included in a prenuptial agreement?

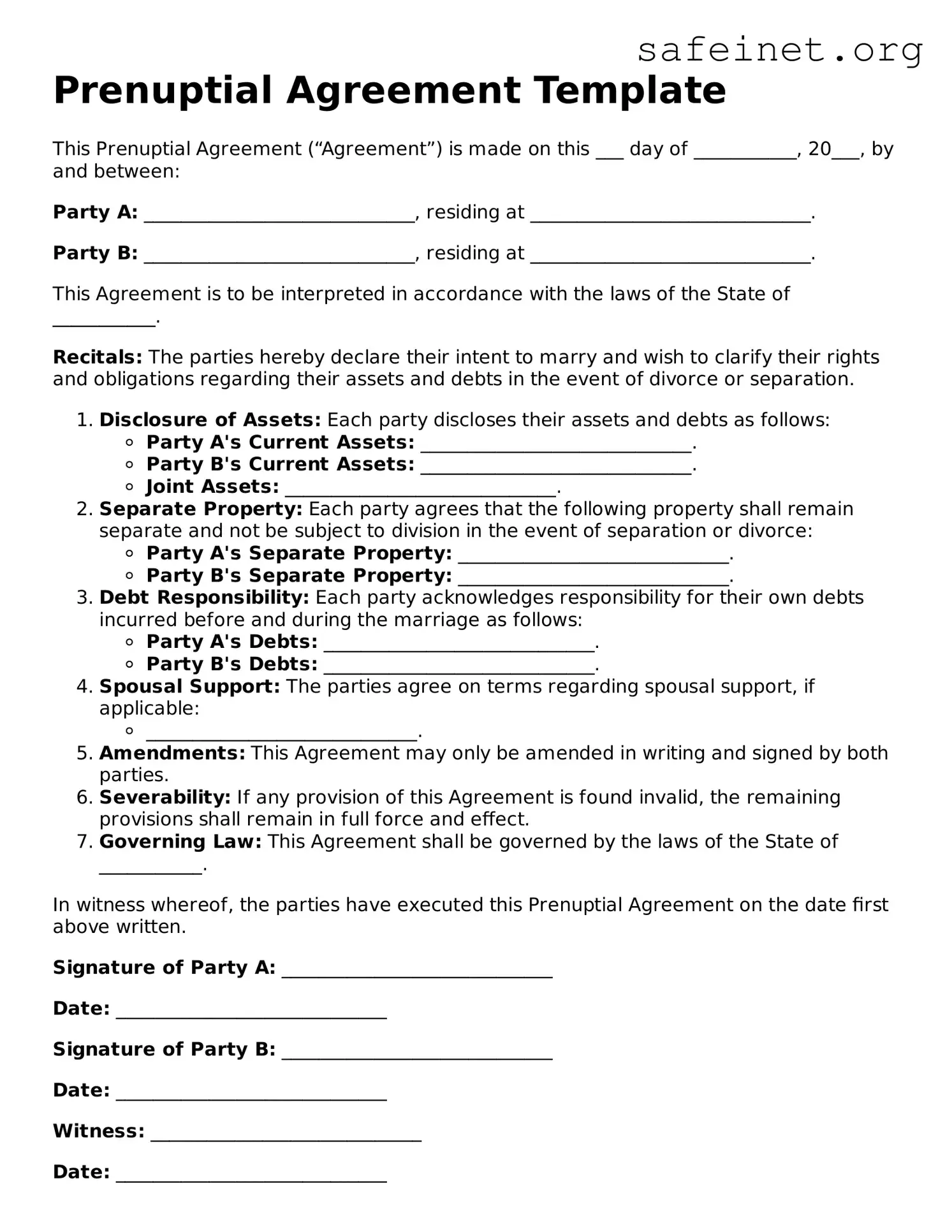

You can include a wide range of topics in a prenup. Common items include division of property, debt responsibilities, and spousal support. Some couples also outline how joint finances will be managed during the marriage. However, not everything can be included—most importantly, you cannot determine child custody or child support terms in a prenup since those are determined based on the child's best interest at the time of separation.

How do we create a prenuptial agreement?

Creating a prenup typically involves both partners and their respective legal advisors. It starts with open discussions about your financial situation, followed by drafting the agreement. It's crucial that both parties fully disclose their financial circumstances to ensure transparency. Once drafted, both partners need to sign the agreement. It's often best to do this well ahead of the wedding to avoid any claims of coercion.

Are prenuptial agreements legally binding?

Yes, when properly created, prenuptial agreements are generally enforceable in court. To be considered valid, the prenup must follow specific legal requirements, such as being in writing and signed voluntarily by both parties. Courts will review the agreement to ensure it is fair and that both parties had an opportunity to seek independent legal counsel.

Can we modify a prenuptial agreement once we are married?

Absolutely! If circumstances change—for example, a significant increase in income or having children—you can modify your prenup. Both parties must agree to the changes, and it’s best to document the modifications in writing and have them signed again. This ensures everything remains clear and legally binding.

What happens if we get divorced and don’t have a prenup?

If a couple divorces without a prenup, state laws will dictate how assets and debts are divided. This can often lead to disputes and a lengthy divorce process. Without a clear agreement in place, decisions about alimony, property division, and other financial matters may become contentious. It’s generally a good idea to consider a prenup to avoid these potential complications.