What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person, known as the principal, to authorize someone else, called the agent or attorney-in-fact, to make decisions on their behalf. This authority can cover a variety of matters, including financial and healthcare decisions, and can be limited to specific tasks or be broad in scope. It's a powerful tool for managing your affairs when you’re unable to do so yourself, whether due to illness, absence, or other circumstances.

Who can be appointed as an agent in a Power of Attorney?

Typically, any competent adult can serve as an agent in a Power of Attorney. Many people choose trusted family members, friends, or financial professionals. The key is that the individual you appoint should be someone you trust completely since they will have the authority to make significant decisions on your behalf. It’s essential to select an agent who understands your wishes and values, ensuring your interests are well-represented.

Are there different types of Power of Attorney?

Yes, there are several types of Power of Attorney, each serving different purposes. A General Power of Attorney grants broad powers to the agent to act on behalf of the principal in a wide range of matters. A Specific or Limited Power of Attorney restricts the agent’s authority to particular transactions or situations. Additionally, there’s a Durable Power of Attorney, which remains effective even if the principal becomes incapacitated, and a Springing Power of Attorney, which only becomes effective under certain conditions. Understanding the differences can help you choose the right type for your needs.

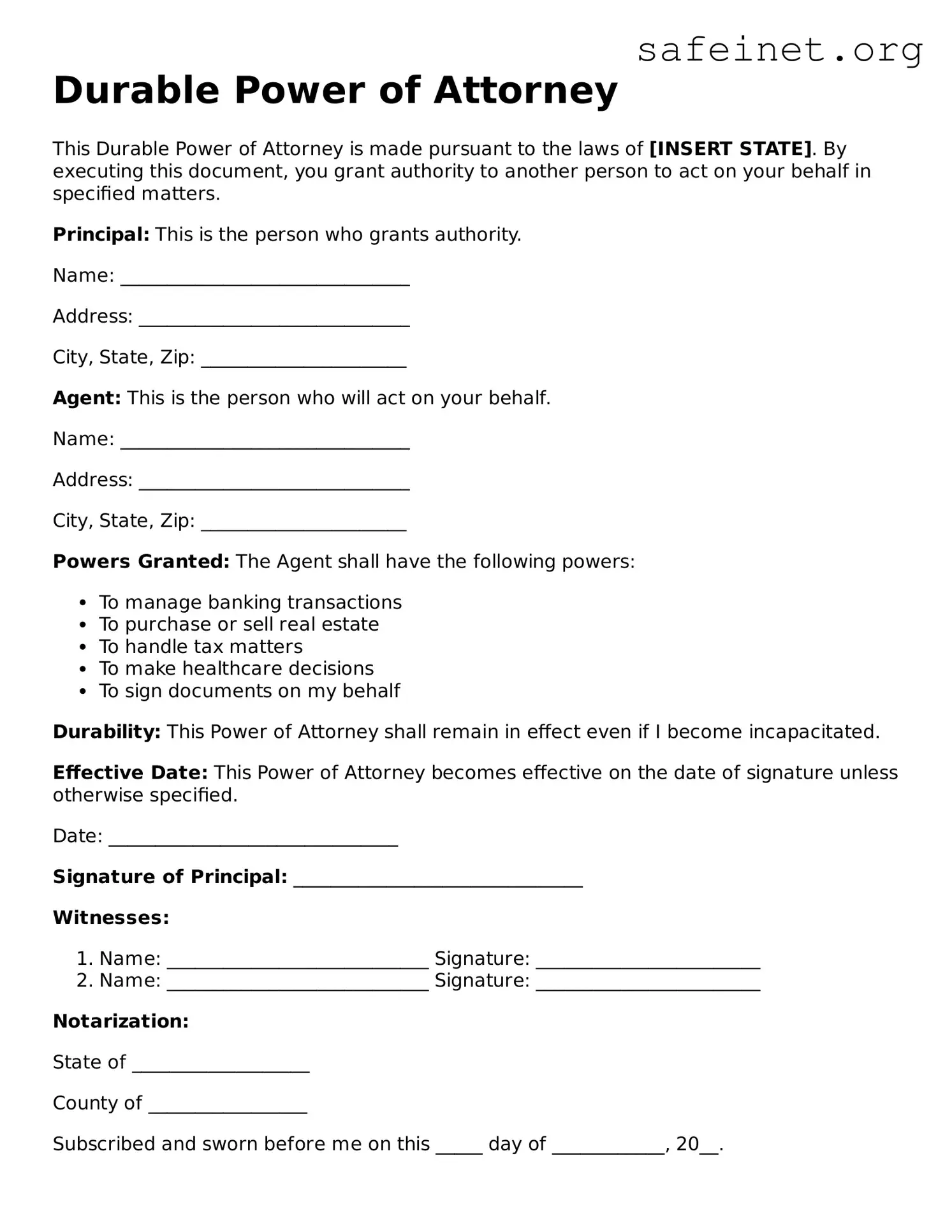

How do I create a Power of Attorney?

Creating a Power of Attorney typically involves drafting the document, clearly stating who the principal is, who the agent is, and what powers are being granted. Many templates are available online, or you might consider consulting with a legal professional to ensure your document meets state-specific requirements. After drafting, the document usually needs to be signed and, in some states, notarized and witnessed to be valid. Proper execution of the document is crucial for it to be legally recognized.

Can I revoke a Power of Attorney?

Yes, a Power of Attorney can be revoked at any time as long as the principal is still mentally competent. To revoke, the principal must create a written revocation document and ensure that it’s delivered to the agent and any institutions that were relying on the original Power of Attorney. It’s also wise to destroy any copies of the original document to avoid confusion. Keeping track of these changes is vital to ensure that your wishes are clearly understood.

What happens if I don't have a Power of Attorney?

If you do not have a Power of Attorney and become unable to make decisions for yourself, the court may have to appoint a guardian or conservator to manage your affairs. This can be a lengthy and costly process, and the appointed individual might not be someone you would have chosen. Establishing a Power of Attorney ahead of time allows you to have control over who makes decisions for you, avoiding the complications and uncertainties that can arise without one.

Is there a cost associated with setting up a Power of Attorney?

The cost of setting up a Power of Attorney can vary. If you opt to draft the document yourself using online resources, the cost may be minimal, involving only filing fees or notarization charges. Alternatively, engaging a lawyer to assist in drafting the document can be more expensive, potentially ranging from $100 to several hundred dollars based on complexity. Investing in a clear and well-drafted Power of Attorney can save you and your loved ones time and stress in the long run.