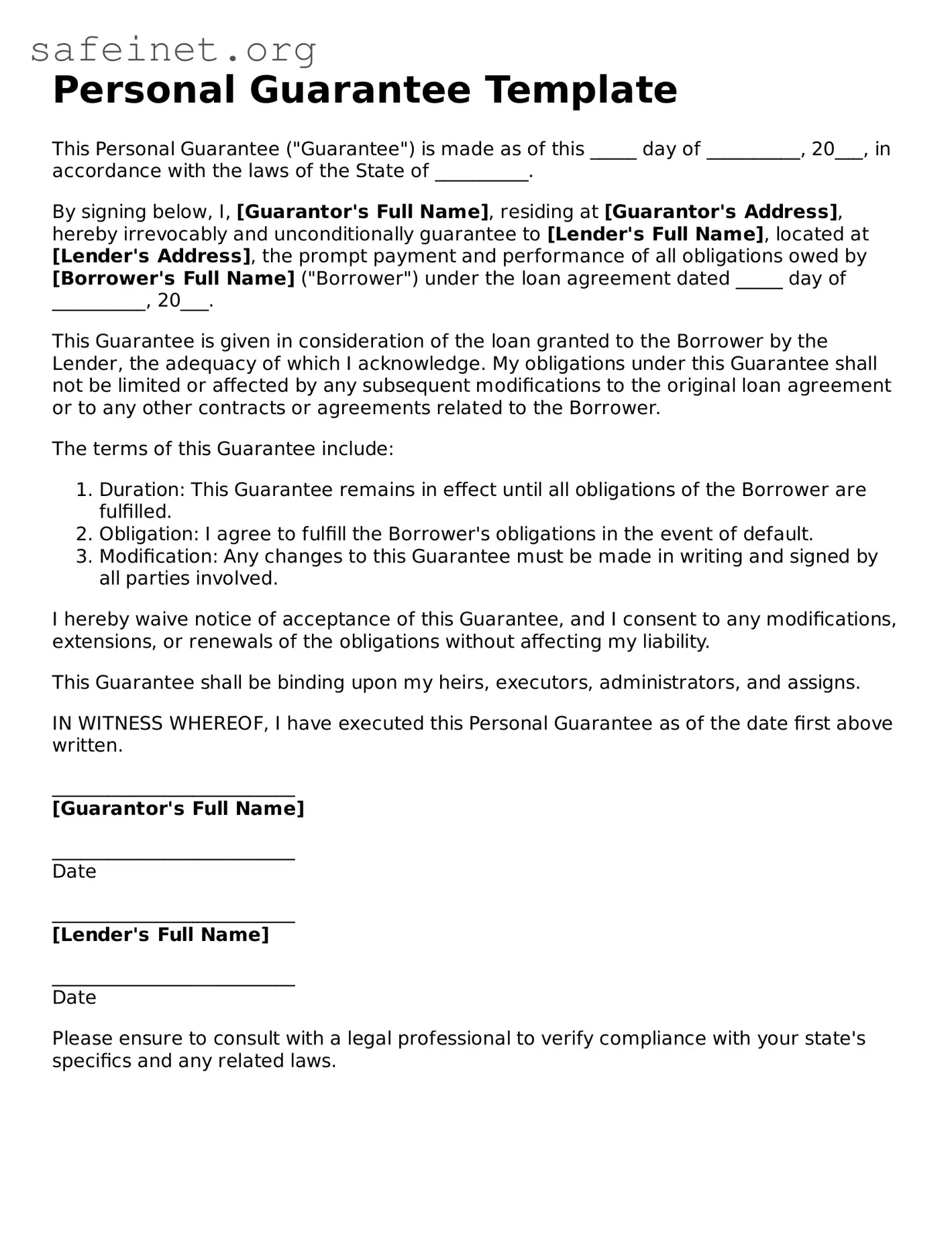

Personal Guarantee Template

This Personal Guarantee ("Guarantee") is made as of this _____ day of __________, 20___, in accordance with the laws of the State of __________.

By signing below, I, [Guarantor's Full Name], residing at [Guarantor's Address], hereby irrevocably and unconditionally guarantee to [Lender's Full Name], located at [Lender's Address], the prompt payment and performance of all obligations owed by [Borrower's Full Name] ("Borrower") under the loan agreement dated _____ day of __________, 20___.

This Guarantee is given in consideration of the loan granted to the Borrower by the Lender, the adequacy of which I acknowledge. My obligations under this Guarantee shall not be limited or affected by any subsequent modifications to the original loan agreement or to any other contracts or agreements related to the Borrower.

The terms of this Guarantee include:

- Duration: This Guarantee remains in effect until all obligations of the Borrower are fulfilled.

- Obligation: I agree to fulfill the Borrower's obligations in the event of default.

- Modification: Any changes to this Guarantee must be made in writing and signed by all parties involved.

I hereby waive notice of acceptance of this Guarantee, and I consent to any modifications, extensions, or renewals of the obligations without affecting my liability.

This Guarantee shall be binding upon my heirs, executors, administrators, and assigns.

IN WITNESS WHEREOF, I have executed this Personal Guarantee as of the date first above written.

__________________________

[Guarantor's Full Name]

__________________________

Date

__________________________

[Lender's Full Name]

__________________________

Date

Please ensure to consult with a legal professional to verify compliance with your state's specifics and any related laws.