What is a Payroll Check form?

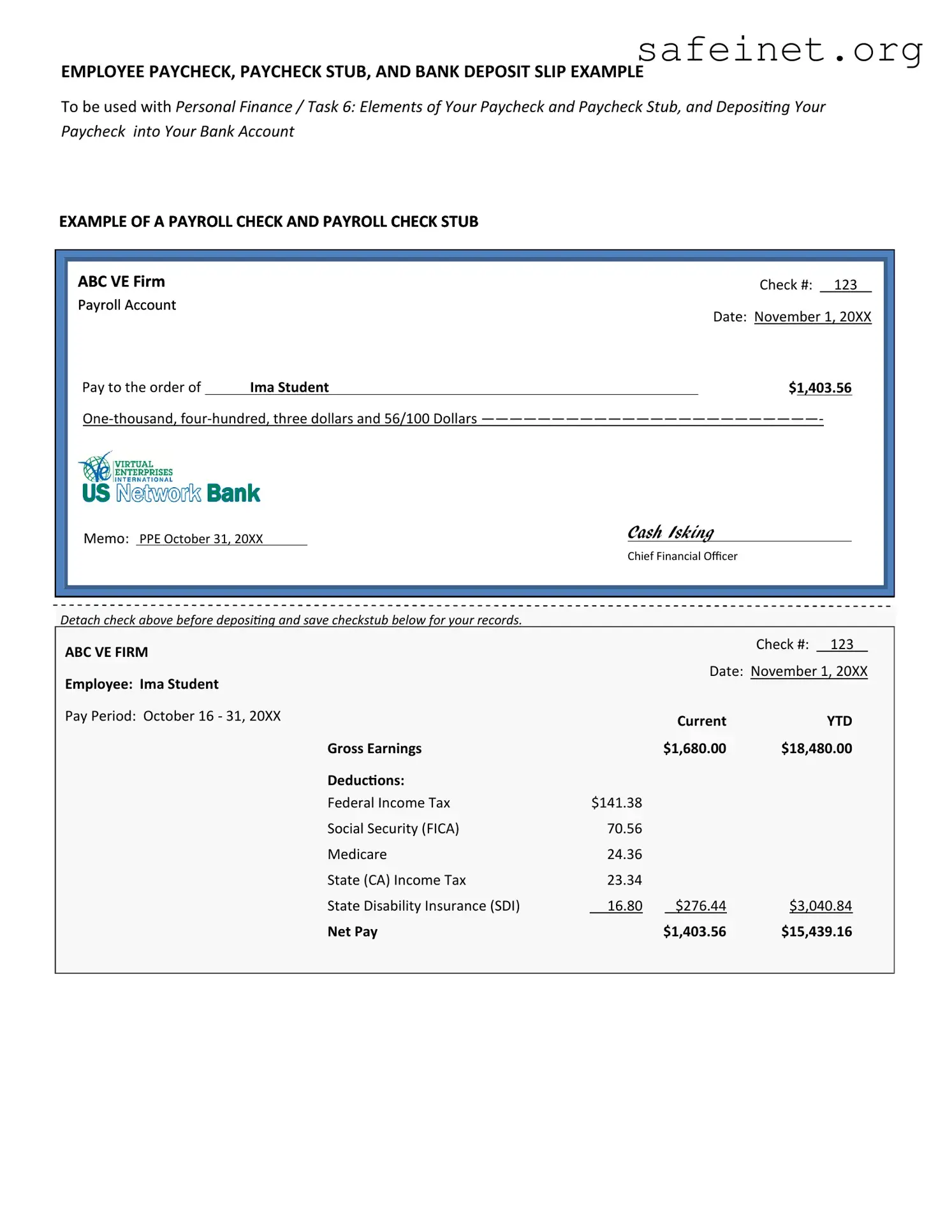

A Payroll Check form is a document used by employers to pay their employees for work performed during a specific pay period. It typically includes information such as the employee's name, hours worked, pay rate, and the total amount to be paid.

Who needs to fill out the Payroll Check form?

Typically, the Payroll Check form is completed by the payroll department or designated HR personnel. However, employees may need to provide certain information, like their hours worked, to ensure accurate payment.

When should the Payroll Check form be submitted?

The completed Payroll Check form should be submitted according to your company's payroll schedule. This is usually at the end of each pay period, but you should check with your employer for specific deadlines.

What information is required on the Payroll Check form?

The form generally requires details such as employee name, employee ID, period covered, hours worked, pay rate, deductions, and any additional bonuses or other payments. Accurate information ensures employees are paid correctly.

What if I notice an error on my Payroll Check form?

If you find an error, contact your payroll department immediately. It's important to address issues as soon as possible to prevent delays in payment. You may need to provide further documentation to correct the error.

Can the Payroll Check form be submitted electronically?

Many companies now allow electronic submissions of the Payroll Check form. Check your employer’s policy or system for guidance on how to submit forms digitally, if available. This can save time and improve efficiency.

What happens if I don’t submit my Payroll Check form on time?

Failing to submit the form on time may result in delayed payment. Each employer has specific policies on late submissions, so it's vital to understand those to avoid any issues with your paycheck.

Can I make changes to the Payroll Check form after submission?

Changes may be possible, but it depends on your employer's policies. If you need to make a correction after submitting the form, contact your payroll department to find out what steps you need to take to amend the information.

What should I do if I don't receive my Payroll Check?

If you do not receive your check, first check with your bank to see if it has been deposited. If not, contact your employer's payroll department to investigate the issue. Be prepared to provide information about the missing payment.

Are there any tax implications associated with the Payroll Check form?

Yes, the Payroll Check form typically includes tax deductions for federal, state, and local taxes. Additionally, contributions for Social Security and Medicare may also be deducted. Understanding these deductions is crucial for managing personal finances effectively.