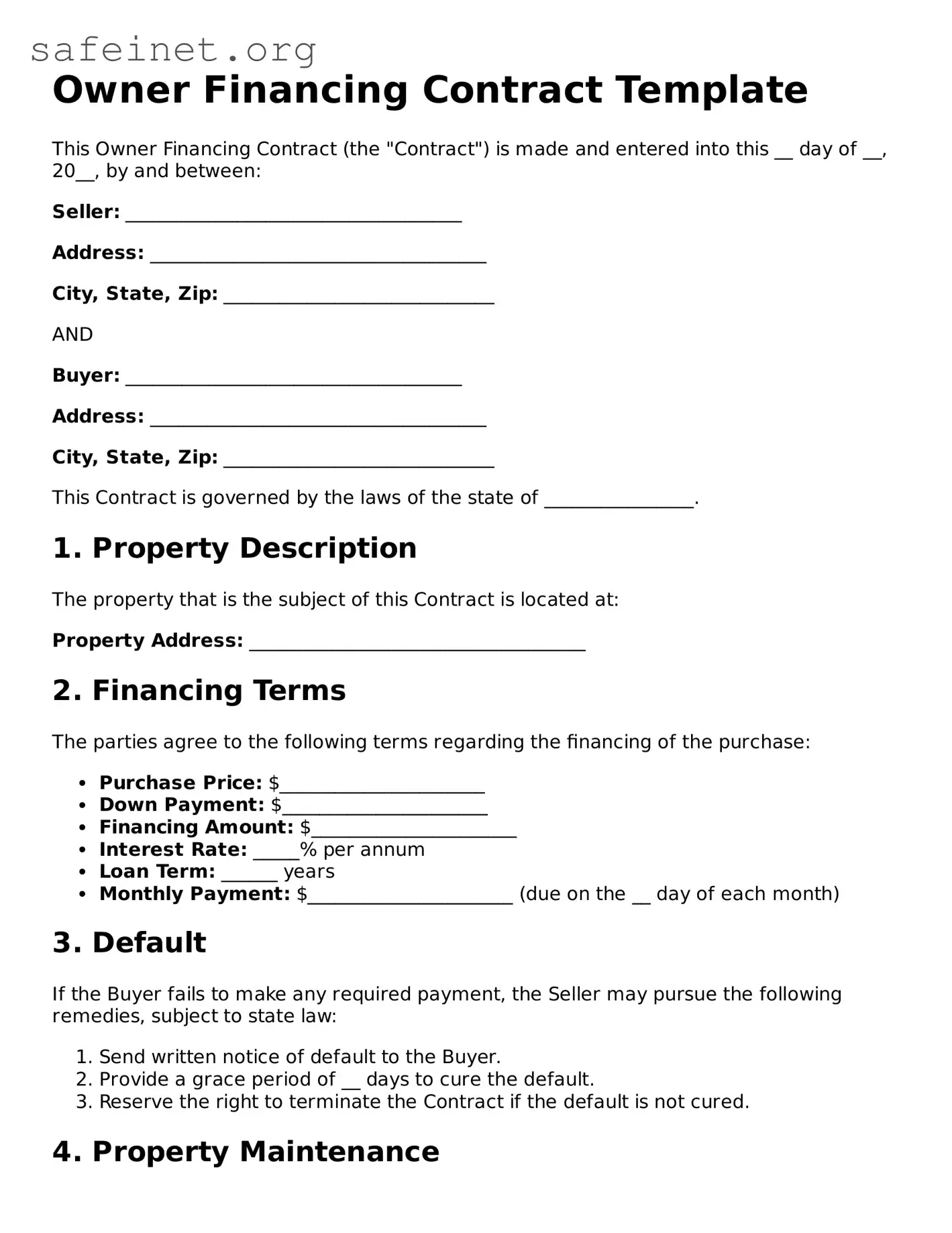

Owner Financing Contract Template

This Owner Financing Contract (the "Contract") is made and entered into this __ day of __, 20__, by and between:

Seller: ____________________________________

Address: ____________________________________

City, State, Zip: _____________________________

AND

Buyer: ____________________________________

Address: ____________________________________

City, State, Zip: _____________________________

This Contract is governed by the laws of the state of ________________.

1. Property Description

The property that is the subject of this Contract is located at:

Property Address: ____________________________________

2. Financing Terms

The parties agree to the following terms regarding the financing of the purchase:

- Purchase Price: $______________________

- Down Payment: $______________________

- Financing Amount: $______________________

- Interest Rate: _____% per annum

- Loan Term: ______ years

- Monthly Payment: $______________________ (due on the __ day of each month)

3. Default

If the Buyer fails to make any required payment, the Seller may pursue the following remedies, subject to state law:

- Send written notice of default to the Buyer.

- Provide a grace period of __ days to cure the default.

- Reserve the right to terminate the Contract if the default is not cured.

4. Property Maintenance

The Buyer agrees to maintain the property in good condition. This includes:

- Keeping the property clean and free of debris.

- Addressing necessary repairs in a timely manner.

- Complying with all local laws and regulations.

5. Governing Law

This Contract shall be governed by the laws of the State of ________________. Any disputes arising under this Contract shall be resolved in the appropriate courts of that state.

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract on the day and year first above written.

Seller Signature: _______________________________

Date: ______________________

Buyer Signature: _______________________________

Date: ______________________