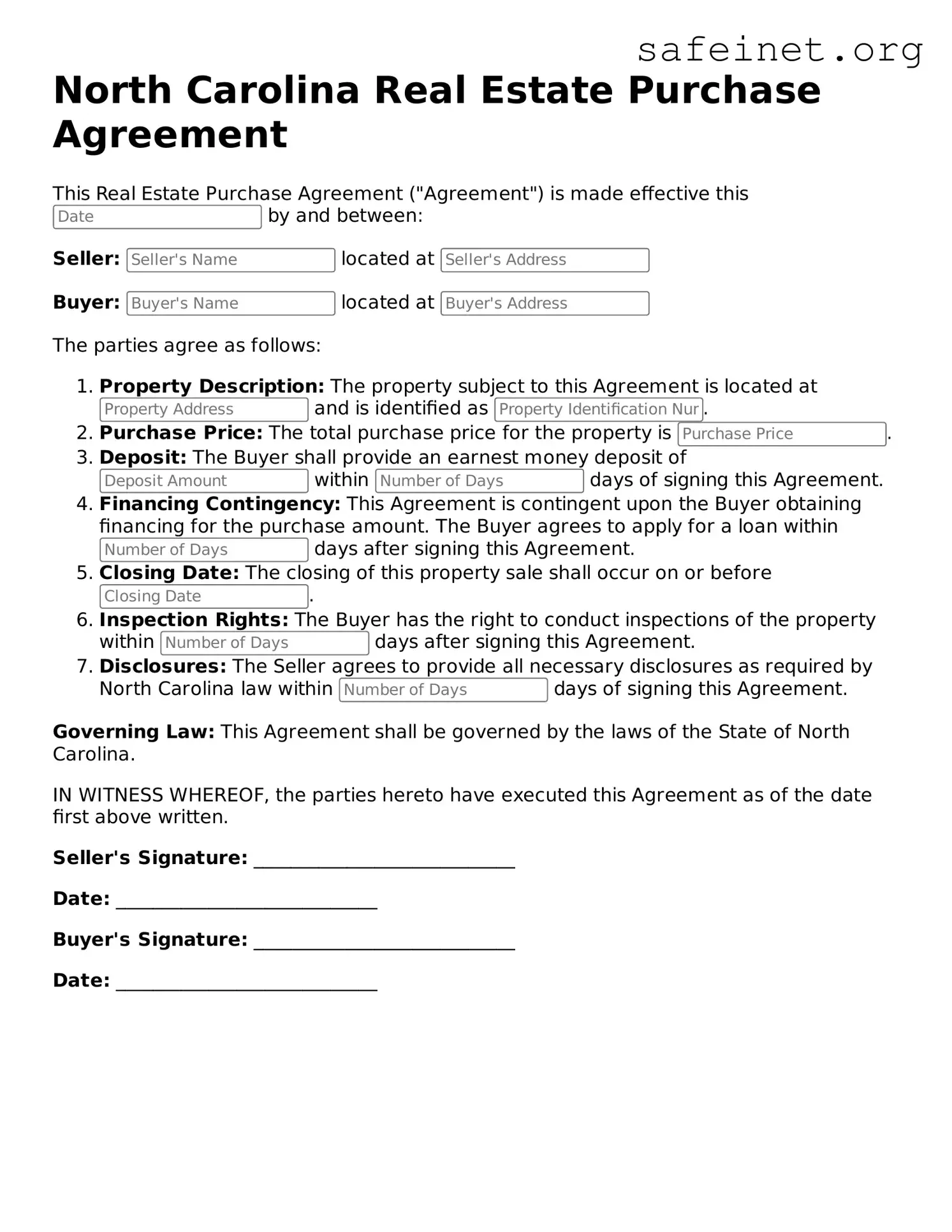

Valid Real Estate Purchase Agreement Template for the State of North Carolina

The North Carolina Real Estate Purchase Agreement is a crucial document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This legally binding agreement helps protect the interests of both parties by detailing everything from the purchase price to important contingencies. To begin your journey in real estate transactions, make sure to fill out the form by clicking the button below.