What is a Power of Attorney in North Carolina?

A Power of Attorney is a legal document that allows you to appoint someone else to make decisions on your behalf. This person, known as the agent or attorney-in-fact, can handle various matters such as financial transactions or healthcare decisions, depending on how the document is set up. It's important to choose someone you trust, as they will have significant authority over your affairs when you're unable to manage them yourself.

Why do I need a Power of Attorney?

A Power of Attorney is essential for preparing for the unexpected. Illness, accidents, or other events could prevent you from making decisions about your health or finances. By having this document in place, you ensure that your wishes are honored even if you cannot express them. This can save your loved ones from unnecessary stress during difficult times.

Who can be my agent for a Power of Attorney?

In North Carolina, you can choose almost anyone as your agent, provided they are at least 18 years old and mentally competent. This could be a family member, friend, or even a professional advisor. However, keep in mind that it’s vital to select someone who understands your values and is willing to act in your best interest.

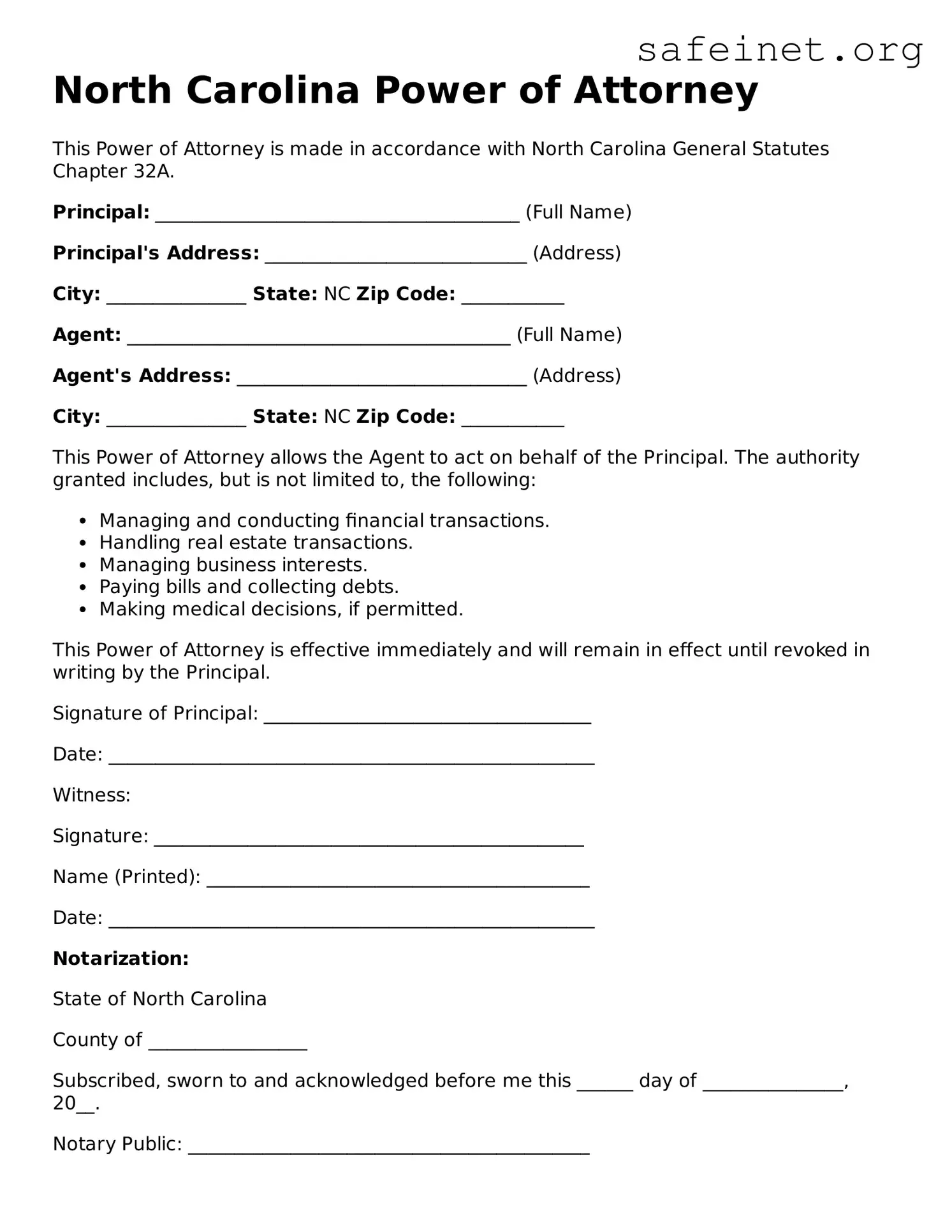

Does a Power of Attorney need to be notarized in North Carolina?

Yes, in North Carolina, a Power of Attorney must be signed in front of a notary public to be valid. This notarization is an important step, as it helps verify the identity of all parties involved and ensures the document is legal and binding. Additionally, if your Power of Attorney covers real estate transactions, it may also need to be recorded with your local register of deeds for additional protection.

Can I revoke my Power of Attorney at any time?

Absolutely! You have the right to revoke your Power of Attorney whenever you choose. To do this, you should create a written document stating that you are revoking your previous Power of Attorney. Make sure to notify your agent and any relevant institutions, such as banks or healthcare providers. Revoking the document ensures that your former agent no longer has the authority to act on your behalf.

Will my Power of Attorney still be valid if I become incapacitated?

Yes, in North Carolina, if you have set up a durable Power of Attorney, it will remain valid even if you become incapacitated. This type of Power of Attorney continues to be effective regardless of your mental or physical condition. It's crucial to indicate that your Power of Attorney is durable when you draft the document, so it serves its purpose during periods when you may need it most.

Do I need an attorney to create a Power of Attorney?

While it's not legally required to hire an attorney to create a Power of Attorney in North Carolina, it can be beneficial, especially if you have specific or complex needs. If your situation is straightforward, you can use available templates to create the document yourself. Just be sure that it meets all legal requirements and accurately reflects your wishes. Either way, understanding how this document works is key to ensuring that your intentions are carried out effectively.