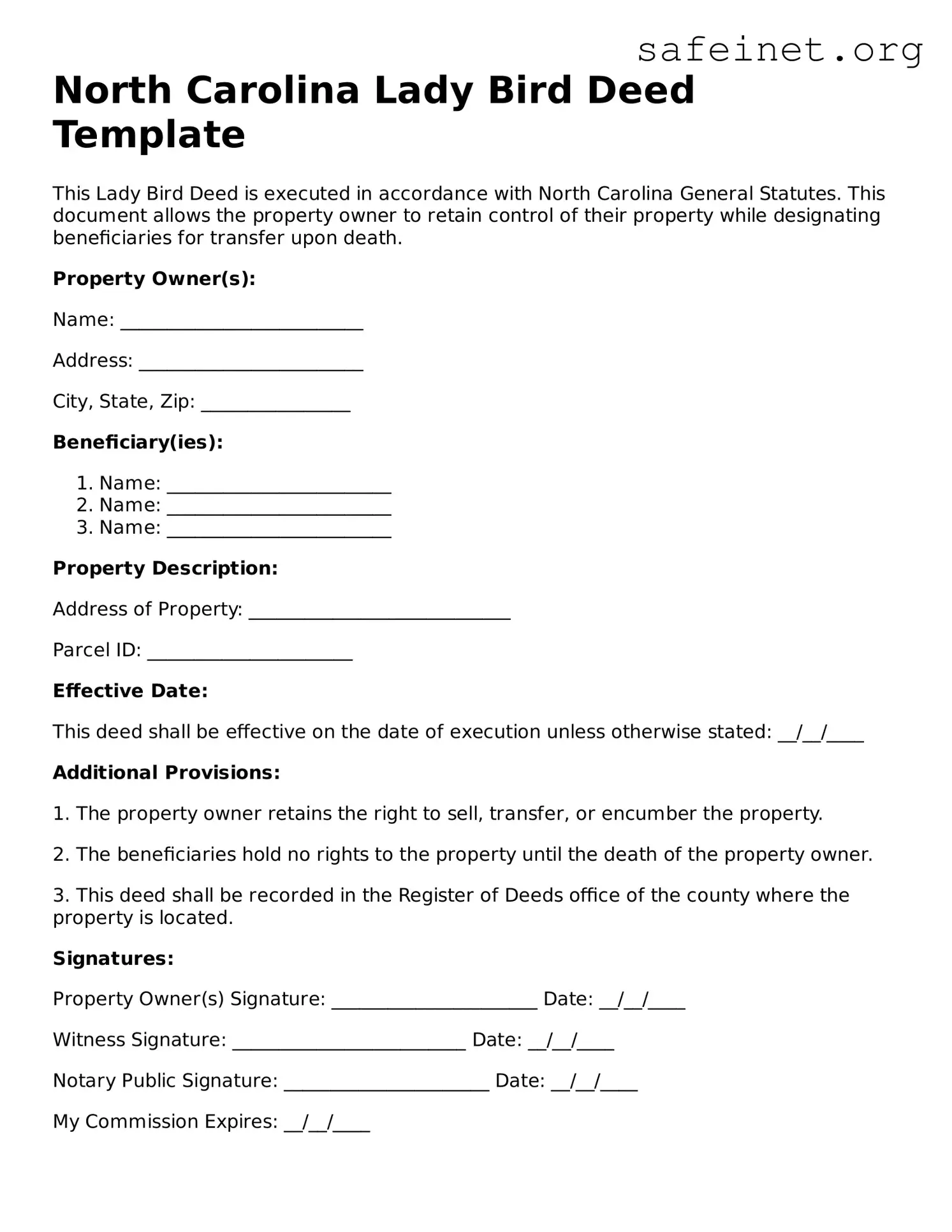

North Carolina Lady Bird Deed Template

This Lady Bird Deed is executed in accordance with North Carolina General Statutes. This document allows the property owner to retain control of their property while designating beneficiaries for transfer upon death.

Property Owner(s):

Name: __________________________

Address: ________________________

City, State, Zip: ________________

Beneficiary(ies):

- Name: ________________________

- Name: ________________________

- Name: ________________________

Property Description:

Address of Property: ____________________________

Parcel ID: ______________________

Effective Date:

This deed shall be effective on the date of execution unless otherwise stated: __/__/____

Additional Provisions:

1. The property owner retains the right to sell, transfer, or encumber the property.

2. The beneficiaries hold no rights to the property until the death of the property owner.

3. This deed shall be recorded in the Register of Deeds office of the county where the property is located.

Signatures:

Property Owner(s) Signature: ______________________ Date: __/__/____

Witness Signature: _________________________ Date: __/__/____

Notary Public Signature: ______________________ Date: __/__/____

My Commission Expires: __/__/____