What is a Durable Power of Attorney in North Carolina?

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This type of power of attorney remains valid even if the principal becomes incapacitated. It is often used for financial matters, healthcare decisions, or both, ensuring that someone trusted can manage affairs when the principal cannot do so themselves.

What are the key benefits of having a Durable Power of Attorney?

There are several benefits to establishing a Durable Power of Attorney. It provides peace of mind, knowing that someone you trust will be in charge of important decisions when you are unable to act. This document can help avoid family disputes about who should make decisions on your behalf. It may also prevent the need for court intervention, which can be time-consuming and costly. Furthermore, it allows you to choose your agent, providing more control over who will represent your interests.

Who can be an agent in a Durable Power of Attorney?

In North Carolina, any competent adult can serve as an agent. This includes family members, friends, or professionals, such as an attorney or financial advisor. It is important to choose someone you trust, as this agent will have significant authority over your financial and health-related decisions. It may also be advisable to have a backup agent in case the primary agent is unable or unwilling to fulfill their duties.

Do I need a lawyer to create a Durable Power of Attorney?

No, hiring a lawyer is not a requirement for creating a Durable Power of Attorney in North Carolina. However, legal assistance can be beneficial, especially if your situation is complex. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. They can also provide guidance on selecting your agent and discussing the powers you wish to grant.

What powers can I grant my agent?

The Durable Power of Attorney can grant a wide range of powers, which can include managing bank accounts, making investment decisions, paying bills, filing tax returns, and even making healthcare decisions if specified. The principal has the option to limit the powers granted or to include specific tasks. Clarity in what powers are given can help avoid confusion and potential misuse of authority.

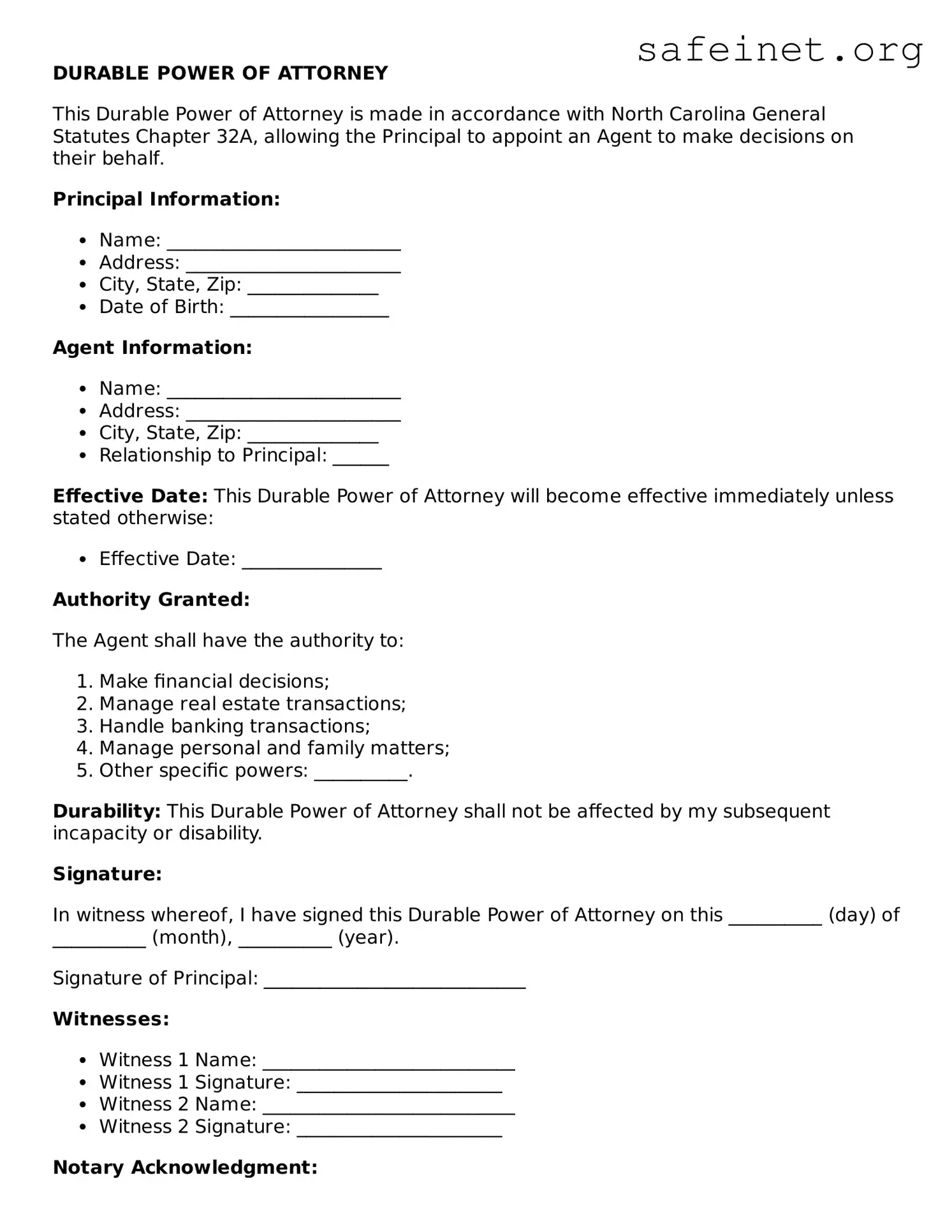

Is there a need for witnesses or notarization?

Yes, in North Carolina, the Durable Power of Attorney must be signed by the principal and must include either a notary public’s acknowledgment or the signatures of two witnesses. The witnesses must be competent adults and should not be named as agents in the document. Notarization is often preferred as it can help confirm the identity of the principal and the voluntary nature of the signing.

How can I revoke a Durable Power of Attorney?

Revoking a Durable Power of Attorney is a straightforward process. The principal can do so at any time, provided they are still of sound mind. To revoke the document, the principal should communicate their intent to their agent and must create a written notice of revocation. This notice should ideally be signed and dated. It is also advisable to provide copies of the revocation notice to any institutions or individuals who had relied on the previous Durable Power of Attorney.

What happens if I do not have a Durable Power of Attorney?

If an individual does not have a Durable Power of Attorney in place and becomes incapacitated, a court may appoint a guardian to manage their affairs. This process can be lengthy and costly, often resulting in decisions being made by individuals who may not have a personal understanding of the incapacitated person’s wishes. Establishing a Durable Power of Attorney helps ensure that someone you trust makes decisions on your behalf without the need for court intervention.