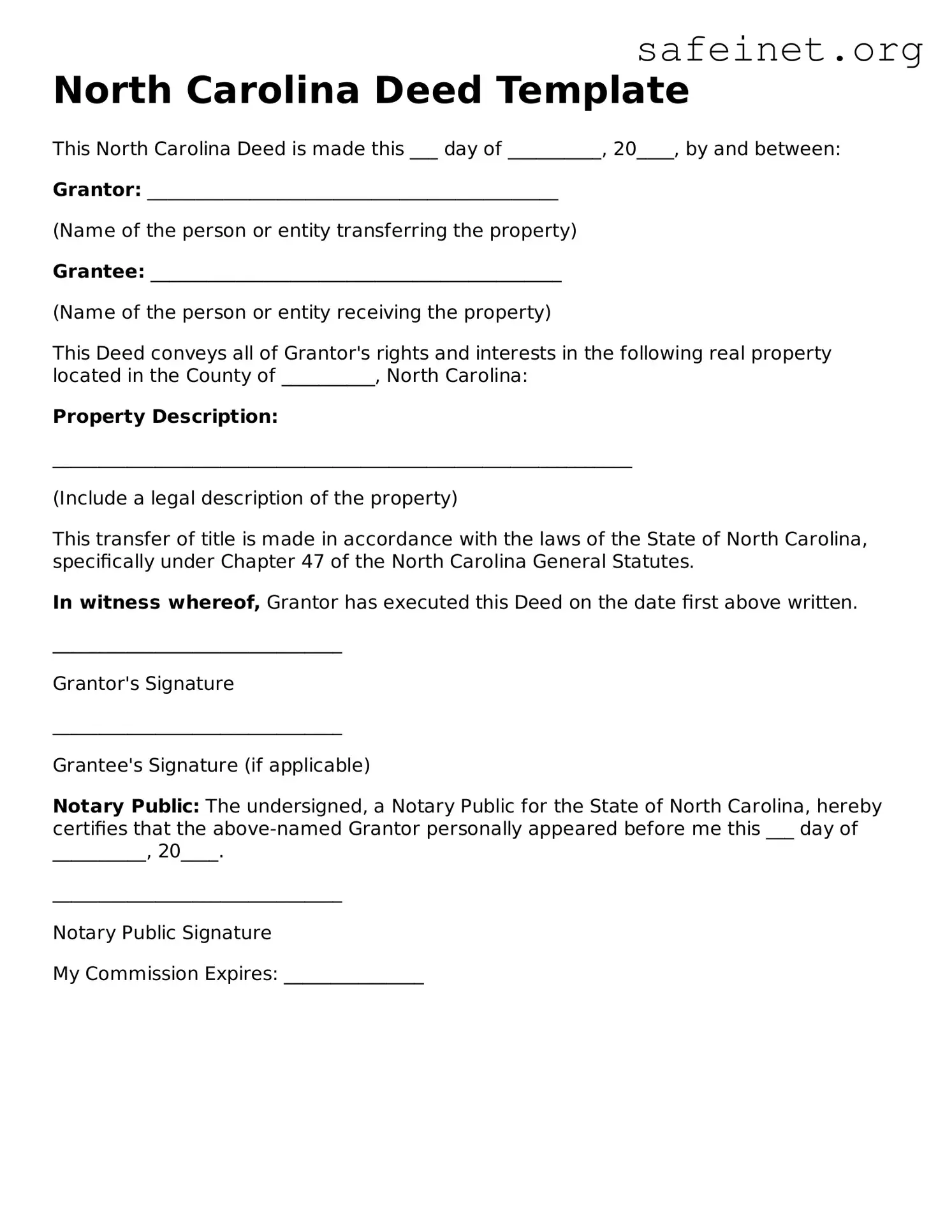

North Carolina Deed Template

This North Carolina Deed is made this ___ day of __________, 20____, by and between:

Grantor: ____________________________________________

(Name of the person or entity transferring the property)

Grantee: ____________________________________________

(Name of the person or entity receiving the property)

This Deed conveys all of Grantor's rights and interests in the following real property located in the County of __________, North Carolina:

Property Description:

______________________________________________________________

(Include a legal description of the property)

This transfer of title is made in accordance with the laws of the State of North Carolina, specifically under Chapter 47 of the North Carolina General Statutes.

In witness whereof, Grantor has executed this Deed on the date first above written.

_______________________________

Grantor's Signature

_______________________________

Grantee's Signature (if applicable)

Notary Public: The undersigned, a Notary Public for the State of North Carolina, hereby certifies that the above-named Grantor personally appeared before me this ___ day of __________, 20____.

_______________________________

Notary Public Signature

My Commission Expires: _______________