What is the purpose of the North Carolina Articles of Incorporation form?

The North Carolina Articles of Incorporation form is a legal document used to establish a corporation in the state. This form provides basic information about the new corporation, such as its name, purpose, duration, and the number of shares it is authorized to issue. By filing this document, you formally create a separate legal entity, which can take on debt, enter contracts, and conduct business in its own name.

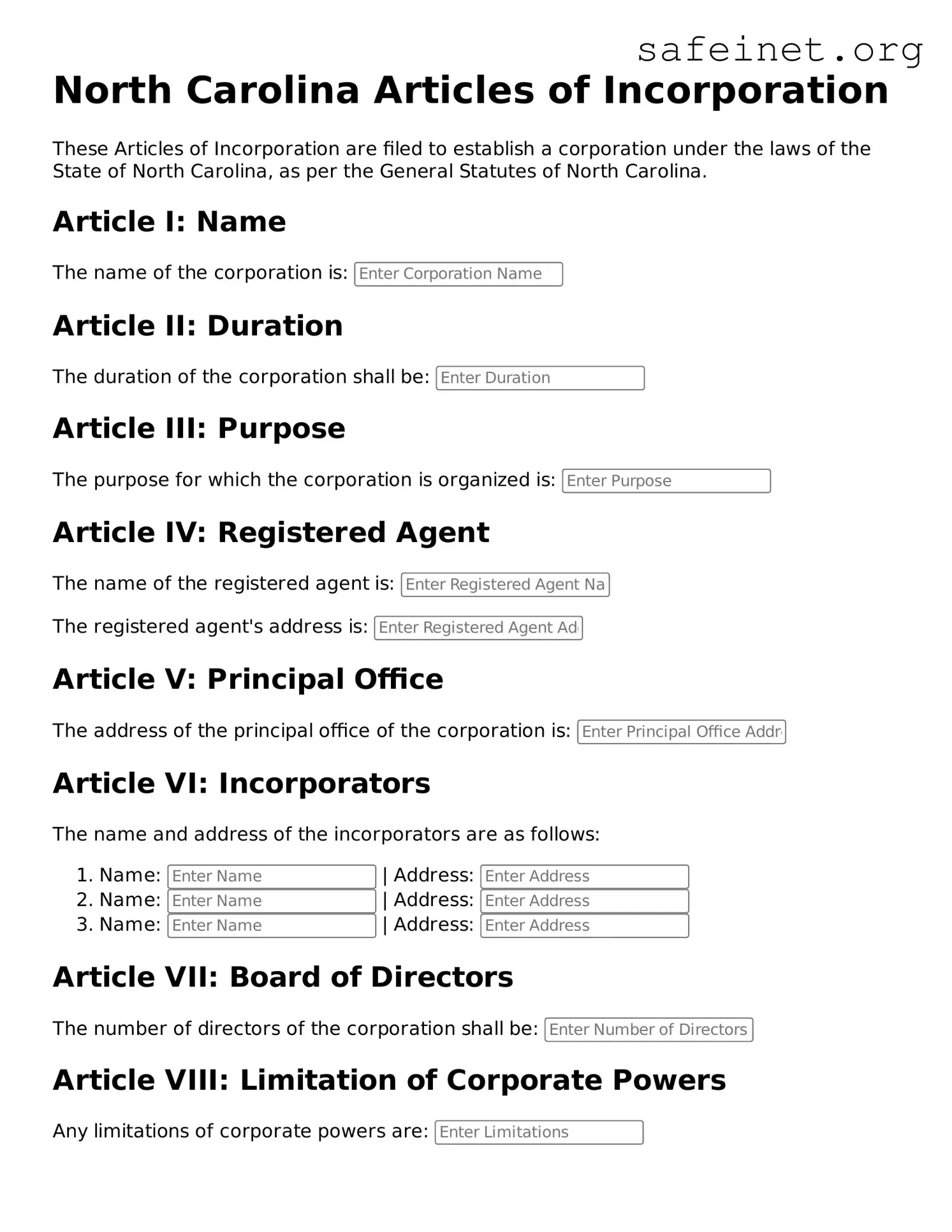

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, specific details must be included. This typically involves the proposed corporation name, the principal office address, the name and address of the registered agent, the purpose of the corporation, the duration if not perpetual, and the number of shares the corporation is authorized to issue. Additionally, the names and addresses of the incorporators are required. It’s essential that all information is accurate to avoid delays in processing.

How do I file the Articles of Incorporation in North Carolina?

Filing the Articles of Incorporation in North Carolina can be done online or through mail. If you choose to file online, you need to visit the North Carolina Secretary of State's website, create an account, and follow the prompts to complete the form. If filing by mail, print the completed form and send it to the appropriate address, along with the filing fee. Ensure that you have submitted all required information to prevent any issues with your application.

What is the filing fee for the Articles of Incorporation in North Carolina?

The filing fee for the North Carolina Articles of Incorporation is currently set at $125. This fee is subject to change, so it is advisable to confirm the amount on the North Carolina Secretary of State's website before submitting your application. Keep in mind that additional costs may arise if you opt for expedited processing or other services.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if filed online, you may receive confirmation within a few business days. If mailed, processing may take several weeks. Factors such as the current workload of the Secretary of State's office and completeness of the application can impact how long it takes to finalize your corporation's formation. It is recommended to plan accordingly and allow sufficient time for processing.

Can I amend the Articles of Incorporation after they have been filed?

Yes, amendments to the Articles of Incorporation can be made after filing. If changes are necessary, such as altering the corporation's name or modifying the purpose, you must submit an amendment form to the Secretary of State. This will require additional information and a filing fee. Timely updates ensure that your corporation remains compliant with state regulations.

Are there ongoing requirements after filing the Articles of Incorporation?

Yes, after filing the Articles of Incorporation, there are ongoing requirements you must adhere to. Corporations must file annual reports, maintain accurate records, and follow state regulations regarding taxes and corporate governance. Failure to meet these obligations can lead to penalties or loss of good standing. Staying informed about these requirements is vital for maintaining your corporation’s legal status.