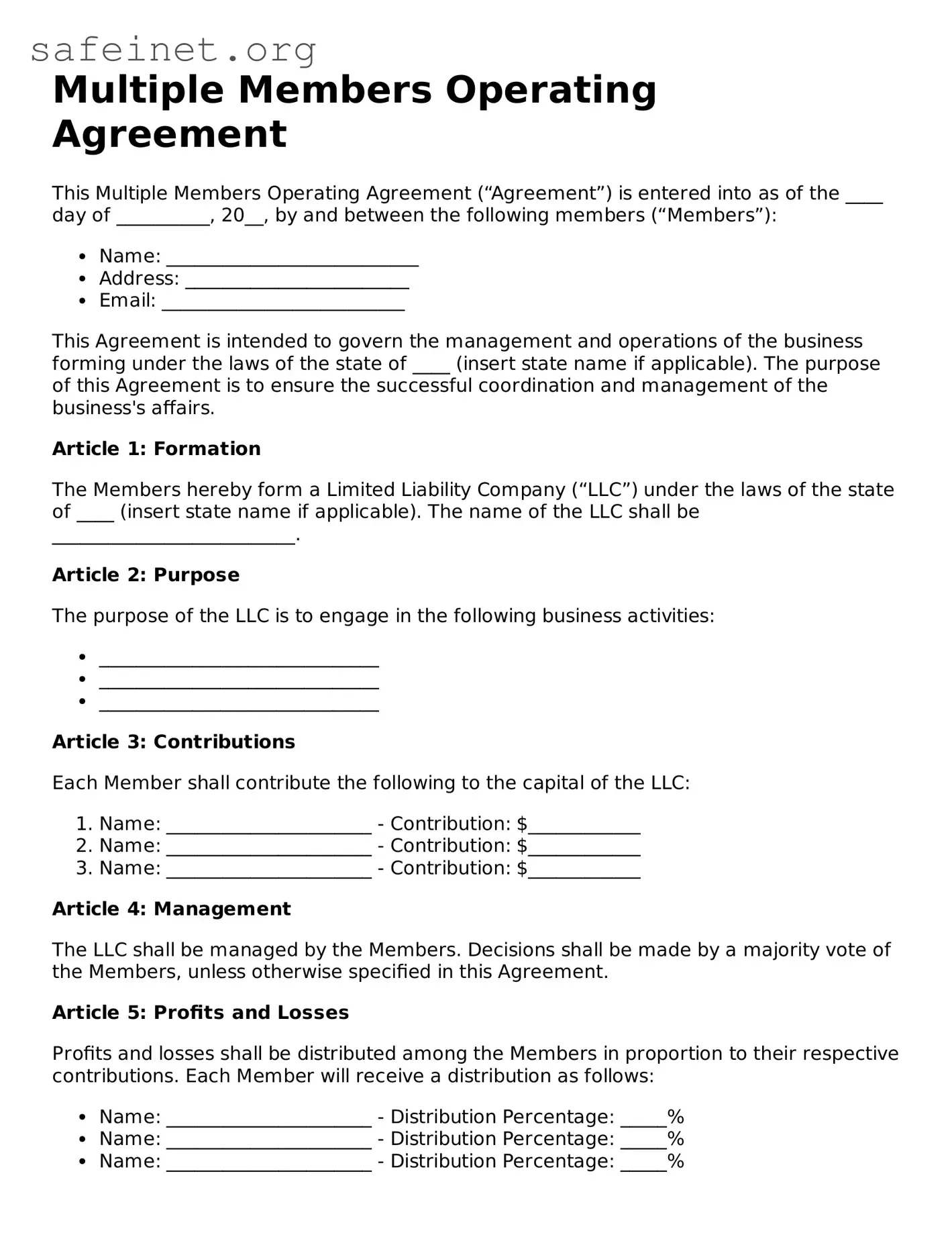

Multiple Members Operating Agreement

This Multiple Members Operating Agreement (“Agreement”) is entered into as of the ____ day of __________, 20__, by and between the following members (“Members”):

- Name: ___________________________

- Address: ________________________

- Email: __________________________

This Agreement is intended to govern the management and operations of the business forming under the laws of the state of ____ (insert state name if applicable). The purpose of this Agreement is to ensure the successful coordination and management of the business's affairs.

Article 1: Formation

The Members hereby form a Limited Liability Company (“LLC”) under the laws of the state of ____ (insert state name if applicable). The name of the LLC shall be __________________________.

Article 2: Purpose

The purpose of the LLC is to engage in the following business activities:

- ______________________________

- ______________________________

- ______________________________

Article 3: Contributions

Each Member shall contribute the following to the capital of the LLC:

- Name: ______________________ - Contribution: $____________

- Name: ______________________ - Contribution: $____________

- Name: ______________________ - Contribution: $____________

Article 4: Management

The LLC shall be managed by the Members. Decisions shall be made by a majority vote of the Members, unless otherwise specified in this Agreement.

Article 5: Profits and Losses

Profits and losses shall be distributed among the Members in proportion to their respective contributions. Each Member will receive a distribution as follows:

- Name: ______________________ - Distribution Percentage: _____%

- Name: ______________________ - Distribution Percentage: _____%

- Name: ______________________ - Distribution Percentage: _____%

Article 6: Records

The LLC shall maintain complete and accurate records of its operations and financial affairs. Each Member shall have the right to inspect such records at any reasonable time.

Article 7: Amendments

This Agreement may be amended only in writing, with the consent of all Members.

Article 8: Governing Law

This Agreement shall be governed by the laws of the state of ____ (insert state name if applicable).

IN WITNESS WHEREOF, the Members have executed this Agreement as of the date first written above.

___________________________________________

Member Name: ___________________________

___________________________________________

Member Name: ___________________________

___________________________________________

Member Name: ___________________________