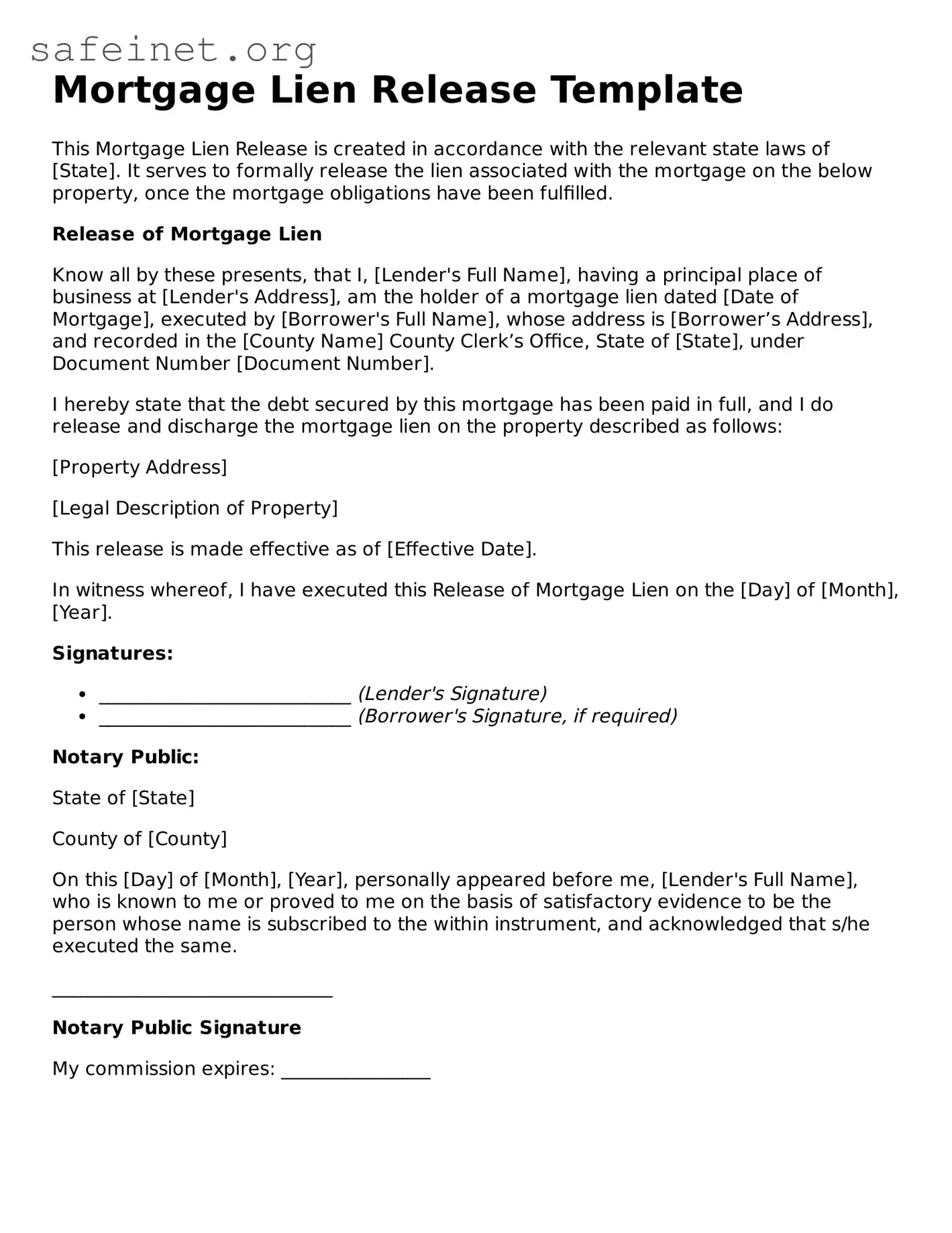

Mortgage Lien Release Template

This Mortgage Lien Release is created in accordance with the relevant state laws of [State]. It serves to formally release the lien associated with the mortgage on the below property, once the mortgage obligations have been fulfilled.

Release of Mortgage Lien

Know all by these presents, that I, [Lender's Full Name], having a principal place of business at [Lender's Address], am the holder of a mortgage lien dated [Date of Mortgage], executed by [Borrower's Full Name], whose address is [Borrower’s Address], and recorded in the [County Name] County Clerk’s Office, State of [State], under Document Number [Document Number].

I hereby state that the debt secured by this mortgage has been paid in full, and I do release and discharge the mortgage lien on the property described as follows:

[Property Address]

[Legal Description of Property]

This release is made effective as of [Effective Date].

In witness whereof, I have executed this Release of Mortgage Lien on the [Day] of [Month], [Year].

Signatures:

- ___________________________ (Lender's Signature)

- ___________________________ (Borrower's Signature, if required)

Notary Public:

State of [State]

County of [County]

On this [Day] of [Month], [Year], personally appeared before me, [Lender's Full Name], who is known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument, and acknowledged that s/he executed the same.

______________________________

Notary Public Signature

My commission expires: ________________