What is a Mobile Home Purchase Agreement?

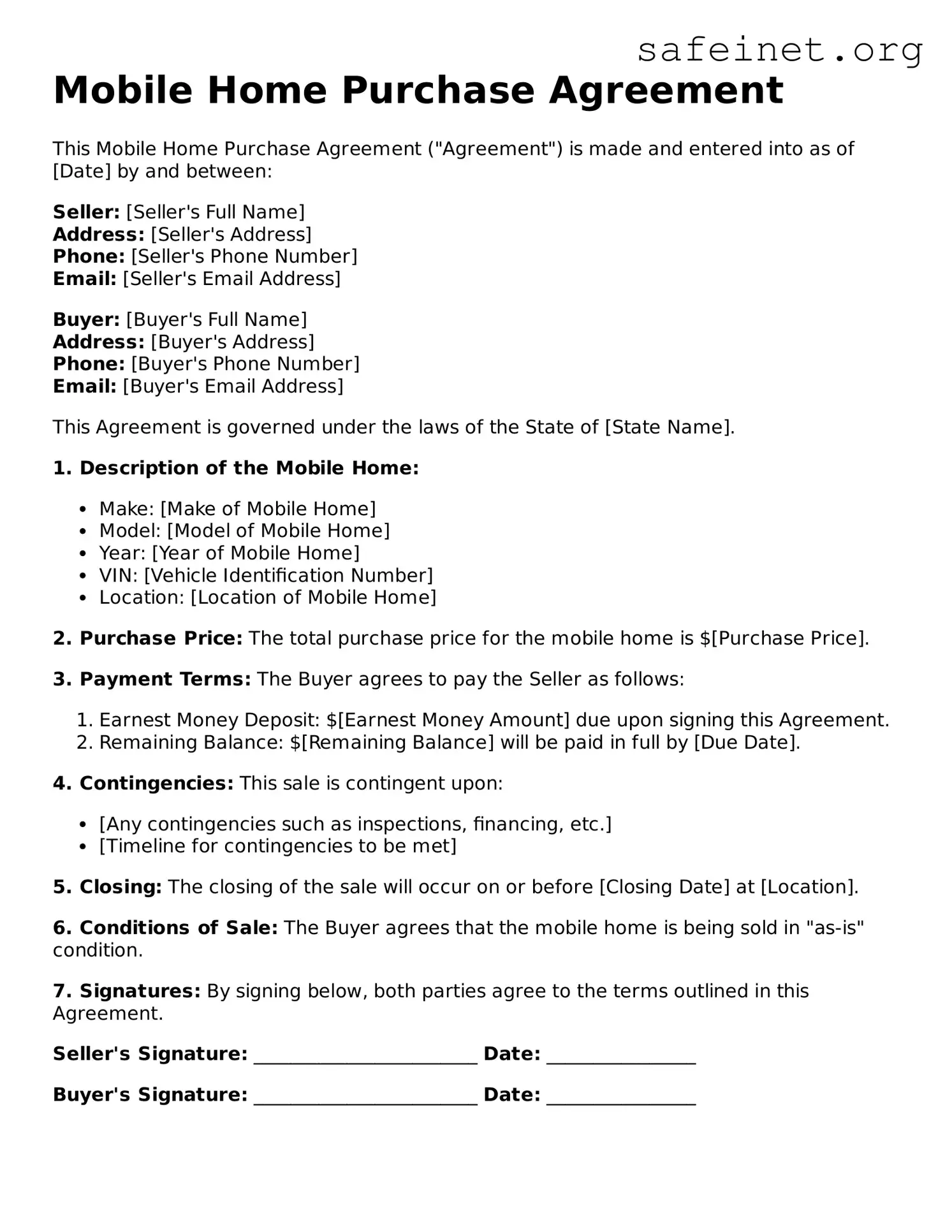

A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a mobile home. This agreement serves to protect both the buyer and the seller by clearly defining the expectations of each party throughout the transaction process.

What should be included in the agreement?

Typically, a Mobile Home Purchase Agreement should include details such as the purchase price, a description of the mobile home, the sale date, and any contingencies (like financing). Additionally, it may outline the responsibilities for closing costs, inspection clauses, and warranties regarding the condition of the home.

Is a Mobile Home Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to adhere to the terms outlined in the agreement. Failure to do so may result in legal consequences or the potential for a lawsuit.

Can the terms of the agreement be negotiated?

Absolutely! The Mobile Home Purchase Agreement is a negotiable document. Prior to signing, buyers and sellers can discuss and agree on different terms, such as price, payment methods, and timelines. It is important for both parties to come to a mutual agreement to prevent disputes later on.

What happens if one party wants to back out after signing?

If one party wishes to back out after signing the agreement, the consequences depend on the terms of the contract and the applicable laws. Some agreements may contain a clause that allows one or both parties to withdraw under certain circumstances, while others may impose penalties for breaking the contract. It's advisable to consult legal counsel in such situations.

Do I need a lawyer to draft or review the agreement?

While it is not mandatory to have a lawyer for drafting or reviewing a Mobile Home Purchase Agreement, it is strongly recommended. A lawyer can help ensure that the document meets legal standards and adequately protects your interests. They can also clarify any complex terms or conditions that may arise.

How can I ensure a smooth transaction when using a Mobile Home Purchase Agreement?

To facilitate a smooth transaction, make sure to communicate openly with the other party. Be clear about expectations, timelines, and any conditions that may affect the sale. Additionally, taking the time to read through the agreement carefully and seeking legal advice can help prevent issues from arising during the purchasing process.