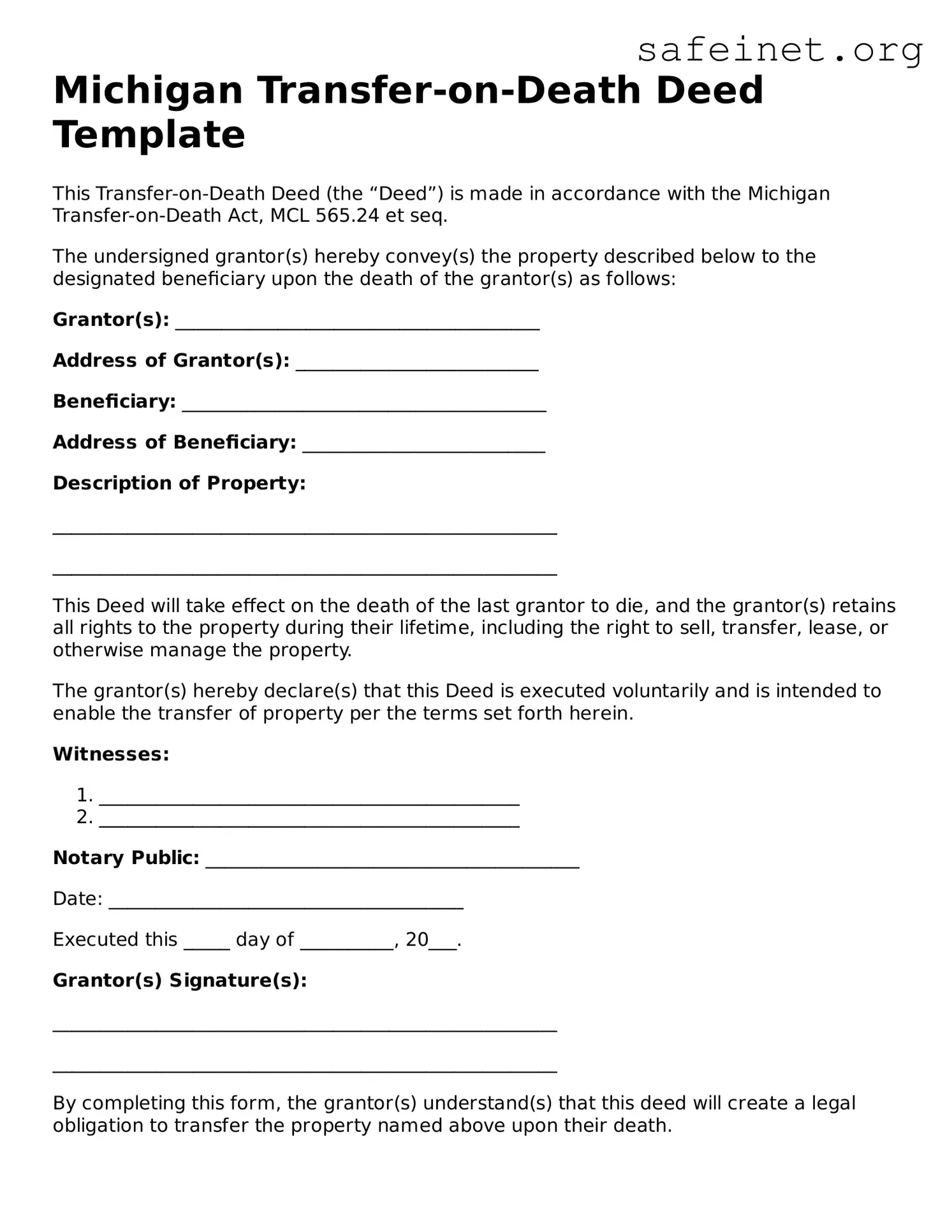

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed (the “Deed”) is made in accordance with the Michigan Transfer-on-Death Act, MCL 565.24 et seq.

The undersigned grantor(s) hereby convey(s) the property described below to the designated beneficiary upon the death of the grantor(s) as follows:

Grantor(s): _______________________________________

Address of Grantor(s): __________________________

Beneficiary: _______________________________________

Address of Beneficiary: __________________________

Description of Property:

______________________________________________________

______________________________________________________

This Deed will take effect on the death of the last grantor to die, and the grantor(s) retains all rights to the property during their lifetime, including the right to sell, transfer, lease, or otherwise manage the property.

The grantor(s) hereby declare(s) that this Deed is executed voluntarily and is intended to enable the transfer of property per the terms set forth herein.

Witnesses:

- _____________________________________________

- _____________________________________________

Notary Public: ________________________________________

Date: ______________________________________

Executed this _____ day of __________, 20___.

Grantor(s) Signature(s):

______________________________________________________

______________________________________________________

By completing this form, the grantor(s) understand(s) that this deed will create a legal obligation to transfer the property named above upon their death.