What is a Michigan RV Bill of Sale?

A Michigan RV Bill of Sale is a legal document used to transfer ownership of a recreational vehicle (RV) from one party to another within the state of Michigan. This form contains essential information about the RV, the buyer, and the seller, ensuring a clear record of the transaction.

Why do I need a Bill of Sale for my RV?

The Bill of Sale serves as proof of the transaction, protecting both the buyer and the seller. For the buyer, it provides evidence of ownership, which is crucial when registering the RV with the state or obtaining insurance. For the seller, it documents that they no longer have ownership of the vehicle, which can prevent future liability issues.

What information should be included in the RV Bill of Sale?

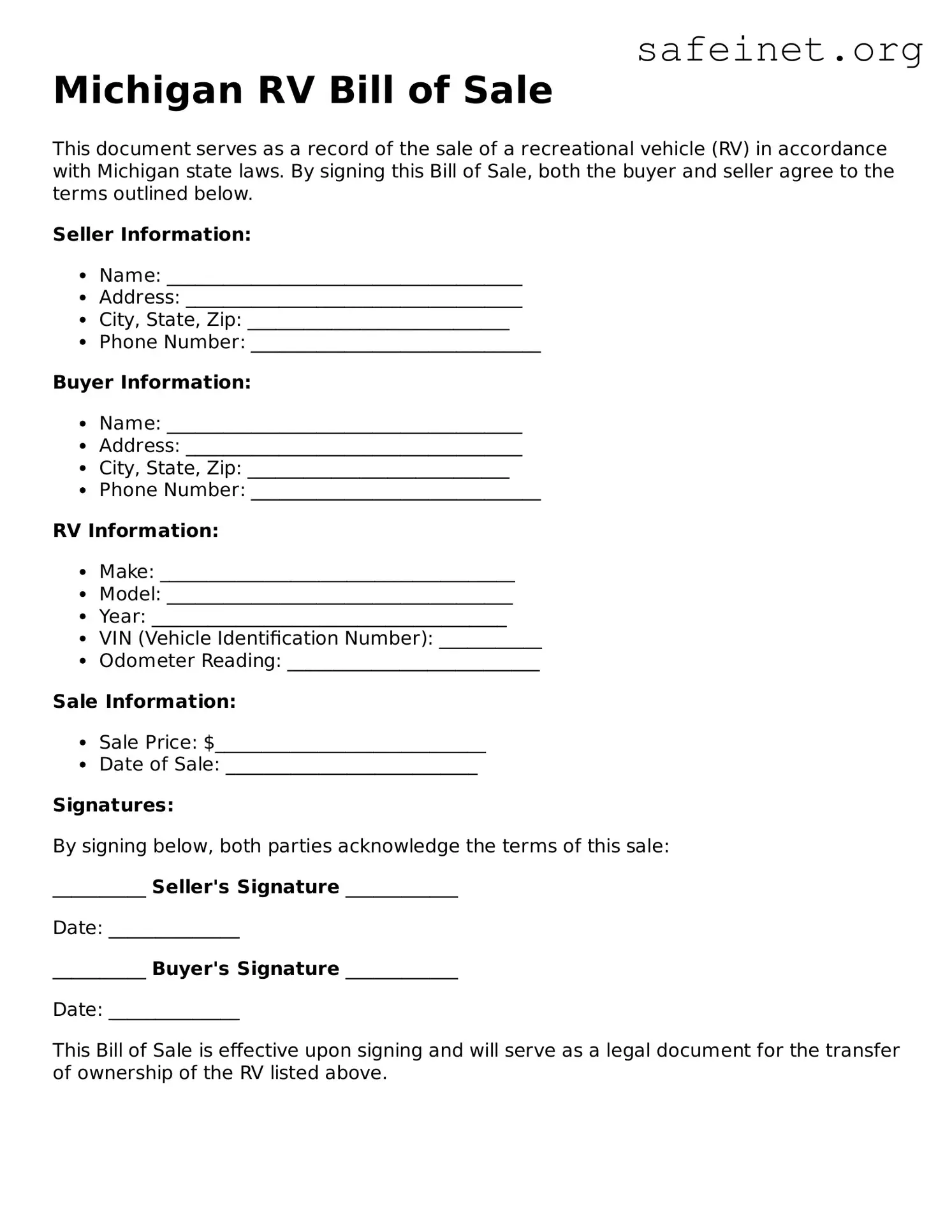

The RV Bill of Sale should include the following details: the names and addresses of both the buyer and seller, the vehicle identification number (VIN), the make and model of the RV, the sale price, and the date of the transaction. Additionally, both parties should sign the document to validate it.

Do I need to have my RV Bill of Sale notarized?

While notarization is not generally required for a Michigan RV Bill of Sale, having the document notarized adds an extra layer of verification. This can help prevent disputes in case either party challenges the sale in the future.

Is a Bill of Sale the same as a title?

No, a Bill of Sale is not the same as a title. The title is an official document issued by the state that proves ownership of the RV. The Bill of Sale functions as a receipt for the transaction. After the sale, the buyer will need to complete the title transfer process to officially register the RV in their name.

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it can complicate the ownership verification process. However, you can create a new Bill of Sale using the same details as the original, and both parties can sign it again. Always keep a copy of this important document for your records.

Can I create my own RV Bill of Sale?

Yes, you can create your own RV Bill of Sale. However, it must include all the necessary information and meet any state requirements to be valid. Many online templates are available to guide you through the process, ensuring you include all essential details.

Does the RV Bill of Sale have an impact on sales tax?

Yes, the sale price listed on the Bill of Sale is often used by the state to determine whether sales tax is owed on the transaction. The buyer may need to present the Bill of Sale when registering the RV, as it serves as proof of the sale amount.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should retain a signed copy for their records. The buyer should then proceed with the title transfer and registration of the RV. It is also recommended that the seller keep a record of the sale for future reference.