What is the Michigan Real Estate Purchase Agreement form?

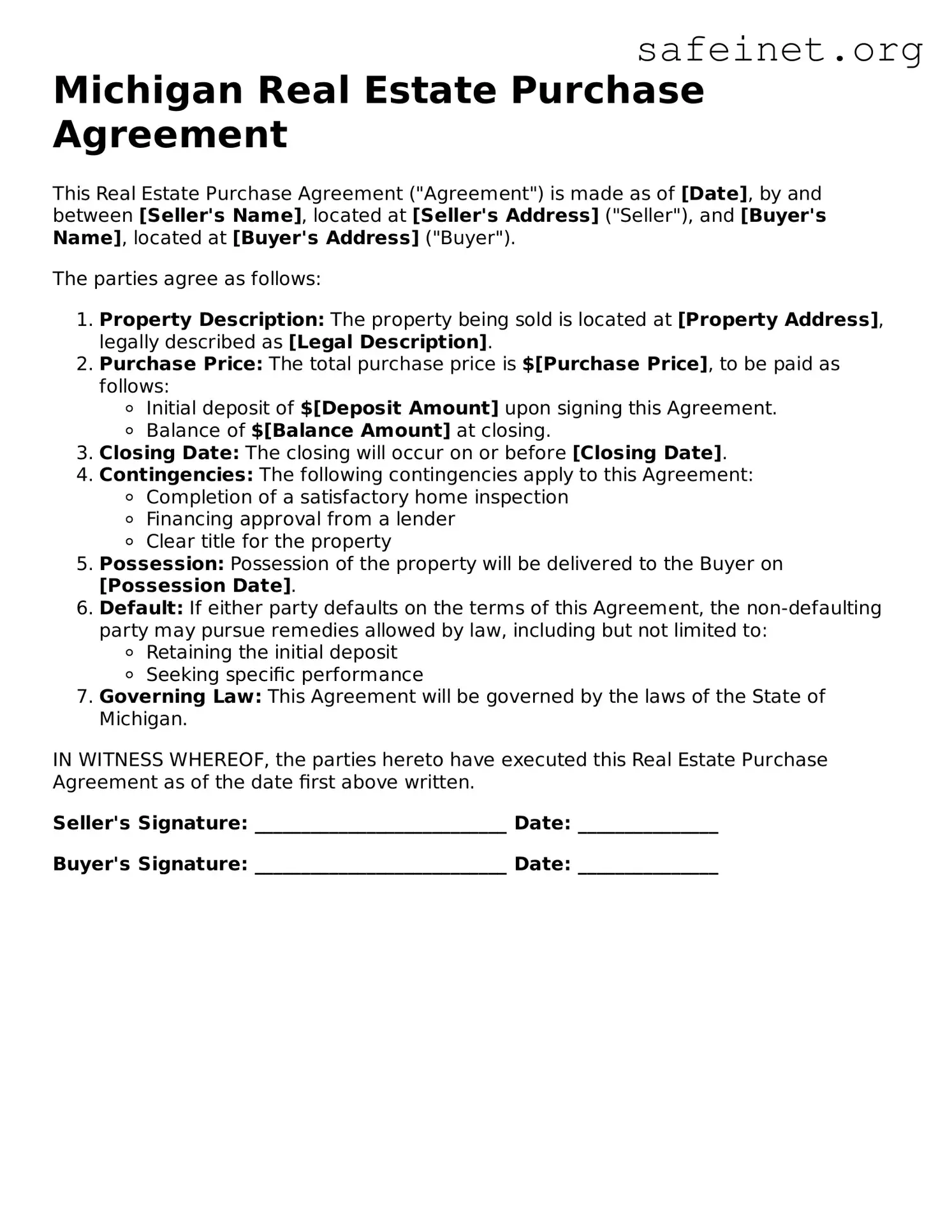

The Michigan Real Estate Purchase Agreement form is a legal document used in real estate transactions in Michigan. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes important details such as the sales price, closing date, and any contingencies that may affect the sale. It serves as a written record of the agreement between the parties involved and provides protection for both the buyer and the seller throughout the transaction process.

What key elements should be included in the agreement?

Several critical components must be present in a Michigan Real Estate Purchase Agreement. These elements include the full names of the buyer and seller, the property address, the offered purchase price, and the earnest money deposit amount. Additionally, it should specify contingencies, such as the buyer's ability to secure financing or complete a home inspection. Terms regarding possession, disclosures, and seller concessions should also be outlined to ensure clarity and mutual understanding between both parties.

Are there any common contingencies that buyers may include?

Yes, buyers often include various contingencies to protect their interests. Some common contingencies in the Michigan Real Estate Purchase Agreement include financing contingencies, which stipulate that the purchase is contingent upon obtaining a mortgage loan. Inspection contingencies allow buyers to conduct property inspections, ensuring they are aware of any potential issues before finalizing the sale. Additionally, buyers might include appraisal contingencies to confirm that the property's appraised value meets or exceeds the purchase price.

How does the closing process work after the agreement is signed?

Once both parties have signed the Michigan Real Estate Purchase Agreement, the closing process begins. The buyer typically hires a title company or attorney to handle the closing duties. A title search is conducted to ensure that the property title is clear of any liens or encumbrances. Before the closing date, the buyer should secure financing, complete inspections, and address any contingencies outlined in the agreement. On the closing day, all required documents are signed, funds are transferred, and ownership is officially transferred to the buyer.