What is a Power of Attorney in Michigan?

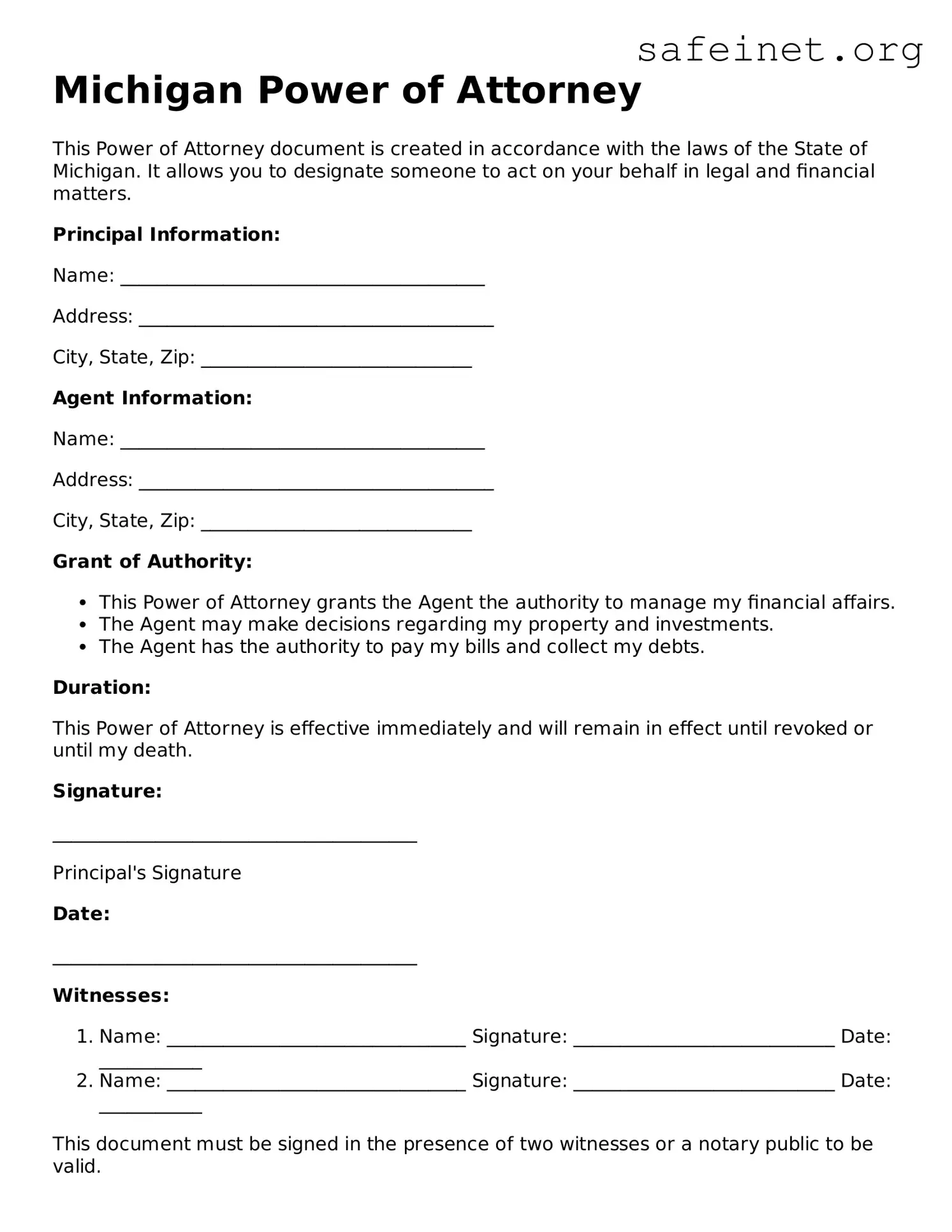

A Power of Attorney (POA) in Michigan is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. These decisions can cover financial matters, medical care, or other specified areas, depending on how the document is structured.

Why should I consider creating a Power of Attorney?

Having a Power of Attorney in place provides peace of mind. It ensures that someone you trust can manage your affairs if you become unable to do so due to illness, injury, or other circumstances. This can help avoid family conflicts and eliminate delays that may arise while waiting for a court to appoint a guardian.

What types of Power of Attorney are available in Michigan?

In Michigan, you can choose from several types of Power of Attorney. A durable Power of Attorney remains effective even if the principal becomes incapacitated. A medical Power of Attorney grants authority specifically for healthcare decisions. There is also a limited Power of Attorney, which grants specific powers for a particular task or period.

Do I need an attorney to create a Power of Attorney in Michigan?

While it’s not legally required to have an attorney draft a Power of Attorney, consulting one is often advisable. An attorney can provide guidance tailored to your specific situation, ensuring that the document meets legal standards and accurately reflects your wishes.

How do I revoke a Power of Attorney in Michigan?

To revoke a Power of Attorney in Michigan, you must create a written document stating your intent to revoke it. This document should be signed and dated. It’s also recommended to inform your former agent and any institutions or individuals who had a copy of the original Power of Attorney of the revocation.

When does a Power of Attorney become effective?

A Power of Attorney can be set to become effective immediately upon signing, or it can be made effective only upon the principal becoming incapacitated. If you choose the latter option, it’s essential to clearly state the conditions that determine when the POA takes effect.

What should I consider when choosing an agent for my Power of Attorney?

When selecting an agent, consider trustworthiness, decision-making skills, and familiarity with your values and preferences. The agent will have significant authority, so choose someone who will act in your best interest and communicate openly with your family and healthcare providers.