What is a Last Will and Testament in Michigan?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be managed after their death. In Michigan, this document allows individuals to specify beneficiaries for their property, designate guardians for minor children, and appoint an executor to oversee the distribution of their estate. Having a will can provide clarity and direction during a difficult time for loved ones.

Who can create a Last Will and Testament in Michigan?

In Michigan, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. The person making the will, known as the testator, must understand the implications of their decisions and be free from undue influence. This ensures that the will reflects their true wishes regarding the distribution of their estate.

Do I need to hire a lawyer to create a will in Michigan?

No, it is not mandatory to hire a lawyer to create a will in Michigan. Many people choose to use online resources or templates available for that purpose. However, consulting a lawyer can provide valuable guidance and ensure that the will complies with legal requirements, particularly for more complicated estates or specific wishes.

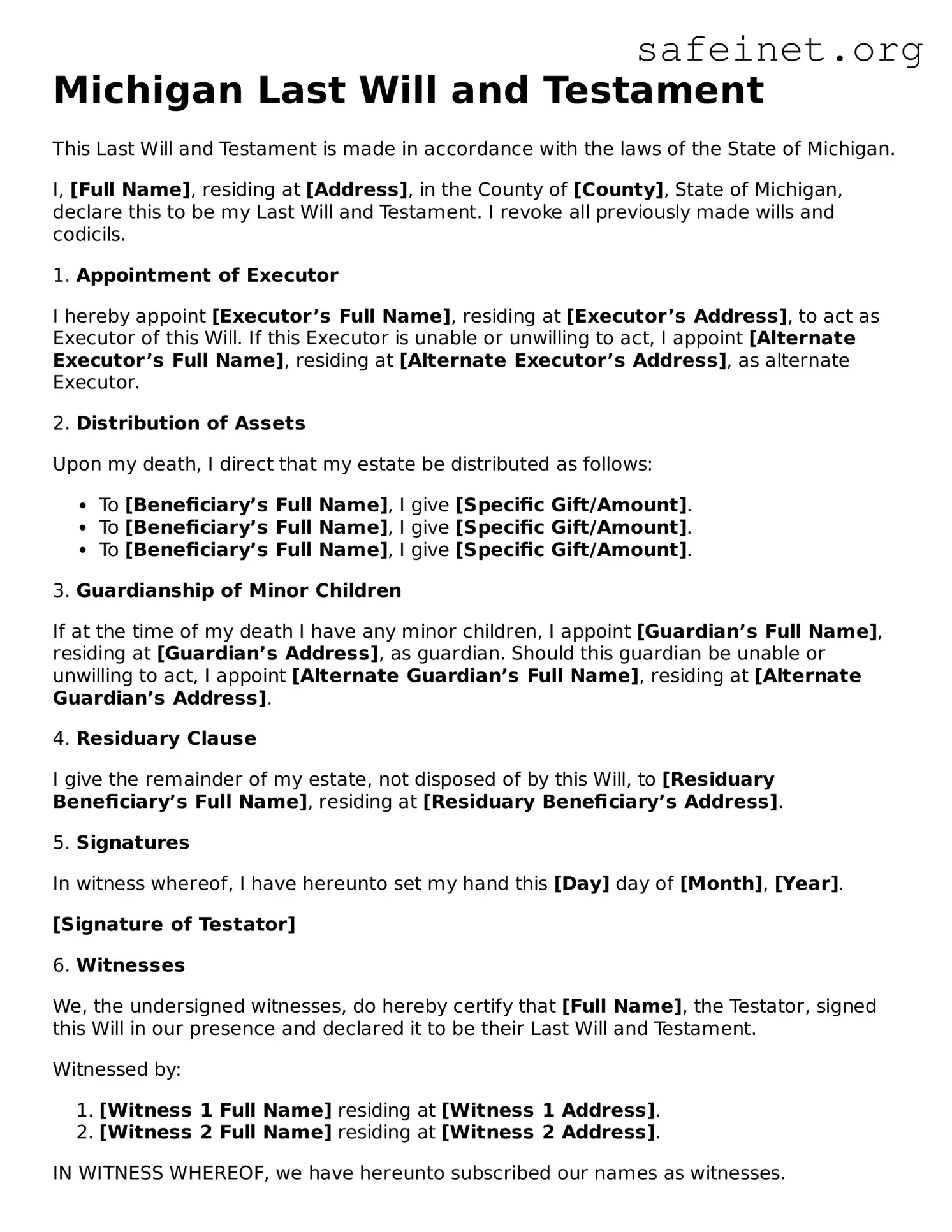

What are the legal requirements for a will in Michigan?

In Michigan, a will must be in writing and signed by the testator in the presence of at least two witnesses. These witnesses must also sign the will to affirm they witnessed the signing. Michigan allows handwritten, typed, or printed wills, but it’s essential that the will is clear and properly executed to be valid.

What happens if I die without a will in Michigan?

If you die without a will in Michigan, your estate will be distributed according to Michigan’s intestacy laws. This means that your assets will be distributed to your relatives in a specific order, which may not align with your wishes. Creating a will prevents this automatic distribution and allows you to make your own choices regarding your estate.

Can I change my Last Will and Testament once it’s created?

Yes, you can change your Last Will and Testament at any time while you are of sound mind. This process is known as making a codicil, which is an amendment to the original will. If significant changes are made, it may be advisable to create a new will altogether to avoid confusion. It’s important to follow legal procedures to ensure that any changes made are valid.

How should I store my Last Will and Testament?

You should store your will in a safe but accessible location. Many people choose to keep it in a fireproof safe at home or in a safety deposit box at a bank. It's essential to inform your executor and trusted family members of its location. This ensures that, after your death, your loved ones can easily find and execute your wishes as outlined in the will.

Can I write a will in Michigan if I am not a resident?

Yes, non-residents can write a will in Michigan, but it must still comply with Michigan laws to be valid. If you have property in Michigan or wish to designate beneficiaries who reside in the state, it may be beneficial to specifically reference Michigan laws in your will. Consulting with a local attorney can help ensure validity and clarity.

What happens to my debts after I pass away?

When a person passes away, their debts do not disappear. The debts will need to be settled before any assets are distributed to beneficiaries. In Michigan, an estate representative is responsible for paying off the deceased's legitimate debts using the estate's assets. Remaining assets can then be distributed according to the wishes specified in the will.