What is a Lady Bird Deed in Michigan?

A Lady Bird Deed, also known as an enhanced life estate deed, allows the property owner to maintain control over the property during their lifetime while designating a beneficiary to receive the property upon their passing. This type of deed is particularly advantageous because it avoids probate, which can be a lengthy and costly process.

Who can use a Lady Bird Deed in Michigan?

Any property owner in Michigan can utilize a Lady Bird Deed. This includes individuals who own residential real estate and wish to ensure a smooth transfer of property to their heirs without the complications of probate. It is particularly beneficial for individuals looking to maintain their property rights and avoid potential complications associated with traditional wills.

What are the main benefits of using a Lady Bird Deed?

The benefits include avoiding probate, retaining control of the property during your lifetime, and the ability to sell or mortgage the property without needing the consent of the beneficiaries. Additionally, since the property is not subject to probate, it may provide privacy for the owner's estate, as probate proceedings are public.

Are there any limitations to a Lady Bird Deed?

While a Lady Bird Deed offers many advantages, it does have some limitations. For instance, it cannot be used for certain types of property, such as commercial real estate or property subject to a life estate. Furthermore, if the property owner needs to qualify for government benefits, such as Medicaid, the deed may affect eligibility. Consulting with a knowledgeable professional is advisable.

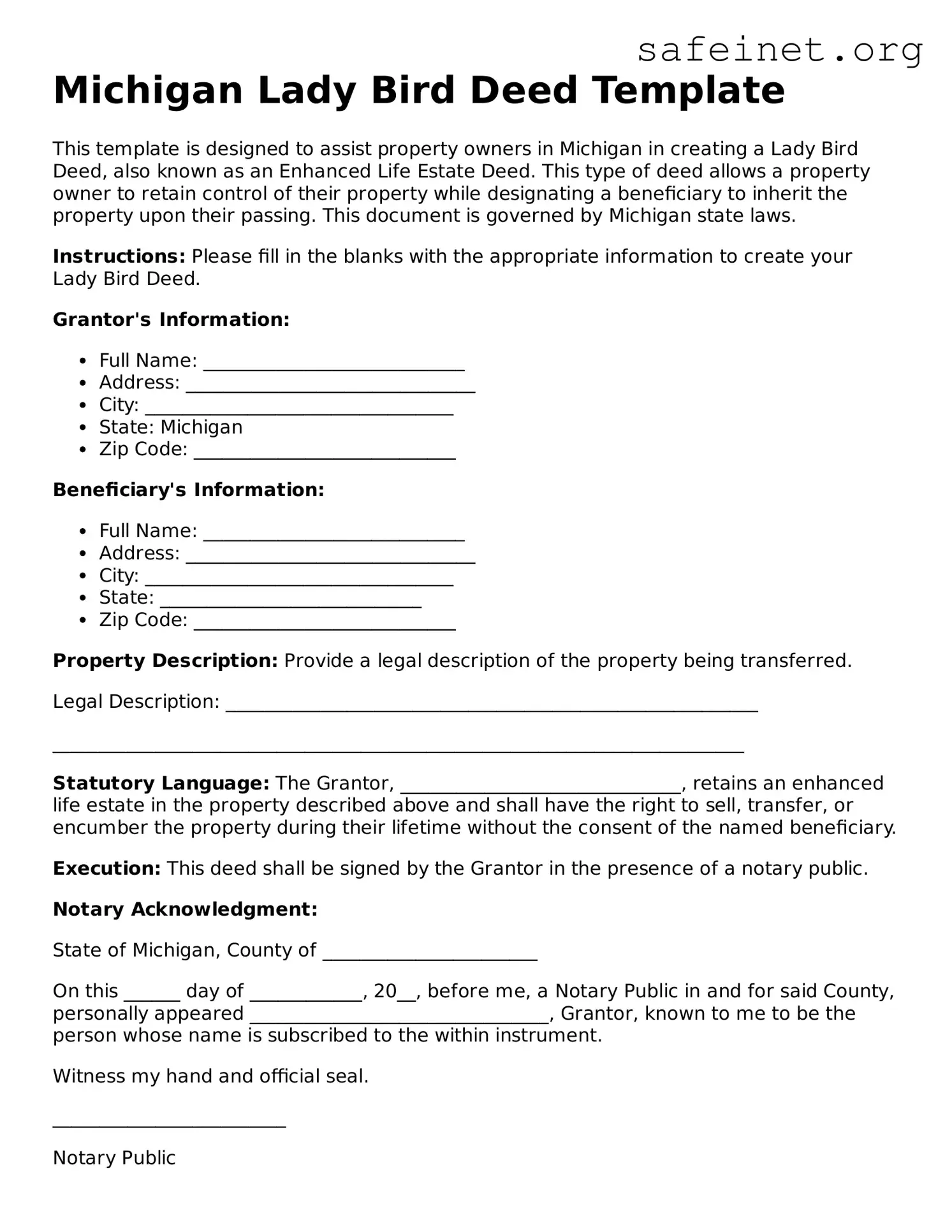

How is a Lady Bird Deed executed in Michigan?

To execute a Lady Bird Deed, the property owner must draft the deed and sign it in front of a notary public. After signing, the deed must be recorded with the local county register of deeds. This step is critical; failing to record the deed could prevent the desired transfer of property upon the owner’s death.

Can I change or revoke a Lady Bird Deed after it is created?

Yes, the property owner retains the right to change or revoke the Lady Bird Deed at any time during their lifetime. This flexibility is one of the attractive features of this deed type. If the owner decides to make changes, a new deed must be executed and recorded, which should be done with the same attention to detail as the original deed.

Is legal assistance necessary when creating a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, doing so is not recommended. It’s essential that the deed is properly drafted, signed, and recorded to ensure that it is valid and provides the intended benefits. Seeking guidance from an estate planning attorney can help avoid potential pitfalls and ensure compliance with Michigan laws.

What happens if I do not create a Lady Bird Deed?

If a property owner does not create a Lady Bird Deed and instead passes their property through a will or intestate succession, the property will go through probate. This process can lead to delays, legal fees, and potential disputes among heirs. Creating a Lady Bird Deed can simplify the transfer of property and help protect the owner’s wishes.