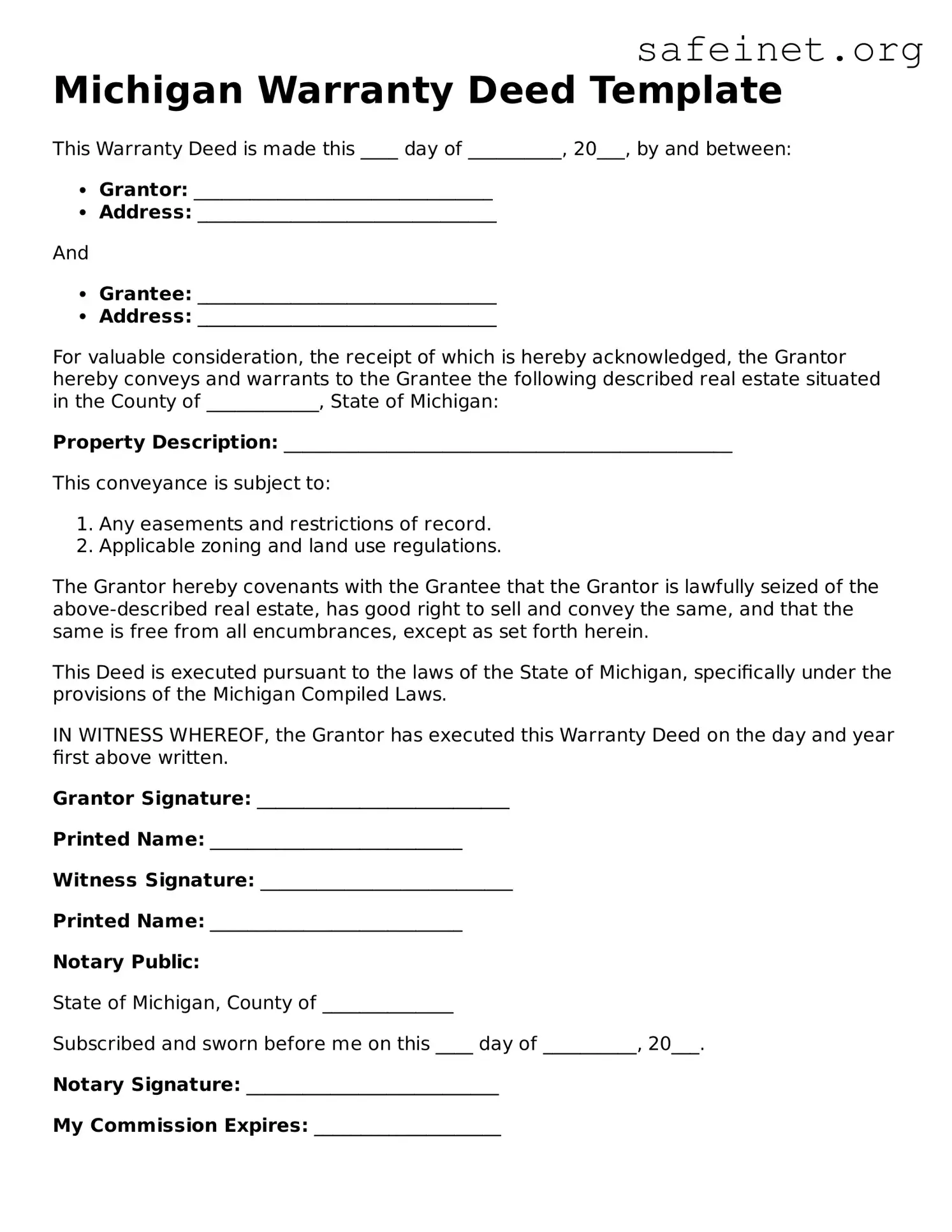

Michigan Warranty Deed Template

This Warranty Deed is made this ____ day of __________, 20___, by and between:

- Grantor: ________________________________

- Address: ________________________________

And

- Grantee: ________________________________

- Address: ________________________________

For valuable consideration, the receipt of which is hereby acknowledged, the Grantor hereby conveys and warrants to the Grantee the following described real estate situated in the County of ____________, State of Michigan:

Property Description: ________________________________________________

This conveyance is subject to:

- Any easements and restrictions of record.

- Applicable zoning and land use regulations.

The Grantor hereby covenants with the Grantee that the Grantor is lawfully seized of the above-described real estate, has good right to sell and convey the same, and that the same is free from all encumbrances, except as set forth herein.

This Deed is executed pursuant to the laws of the State of Michigan, specifically under the provisions of the Michigan Compiled Laws.

IN WITNESS WHEREOF, the Grantor has executed this Warranty Deed on the day and year first above written.

Grantor Signature: ___________________________

Printed Name: ___________________________

Witness Signature: ___________________________

Printed Name: ___________________________

Notary Public:

State of Michigan, County of ______________

Subscribed and sworn before me on this ____ day of __________, 20___.

Notary Signature: ___________________________

My Commission Expires: ____________________