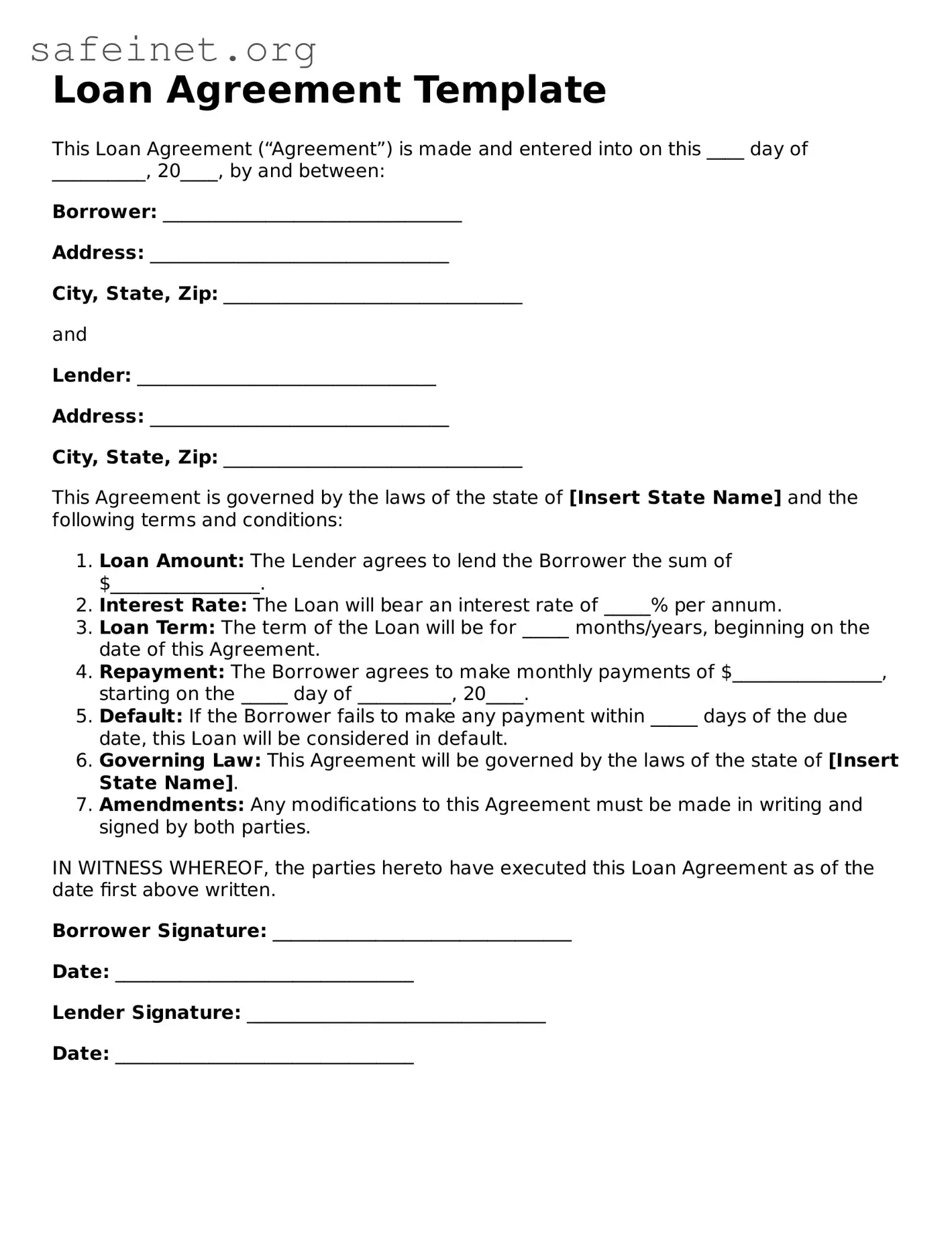

Loan Agreement Template

This Loan Agreement (“Agreement”) is made and entered into on this ____ day of __________, 20____, by and between:

Borrower: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

and

Lender: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

This Agreement is governed by the laws of the state of [Insert State Name] and the following terms and conditions:

- Loan Amount: The Lender agrees to lend the Borrower the sum of $________________.

- Interest Rate: The Loan will bear an interest rate of _____% per annum.

- Loan Term: The term of the Loan will be for _____ months/years, beginning on the date of this Agreement.

- Repayment: The Borrower agrees to make monthly payments of $________________, starting on the _____ day of __________, 20____.

- Default: If the Borrower fails to make any payment within _____ days of the due date, this Loan will be considered in default.

- Governing Law: This Agreement will be governed by the laws of the state of [Insert State Name].

- Amendments: Any modifications to this Agreement must be made in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first above written.

Borrower Signature: ________________________________

Date: ________________________________

Lender Signature: ________________________________

Date: ________________________________