What is an LLC Share Purchase Agreement?

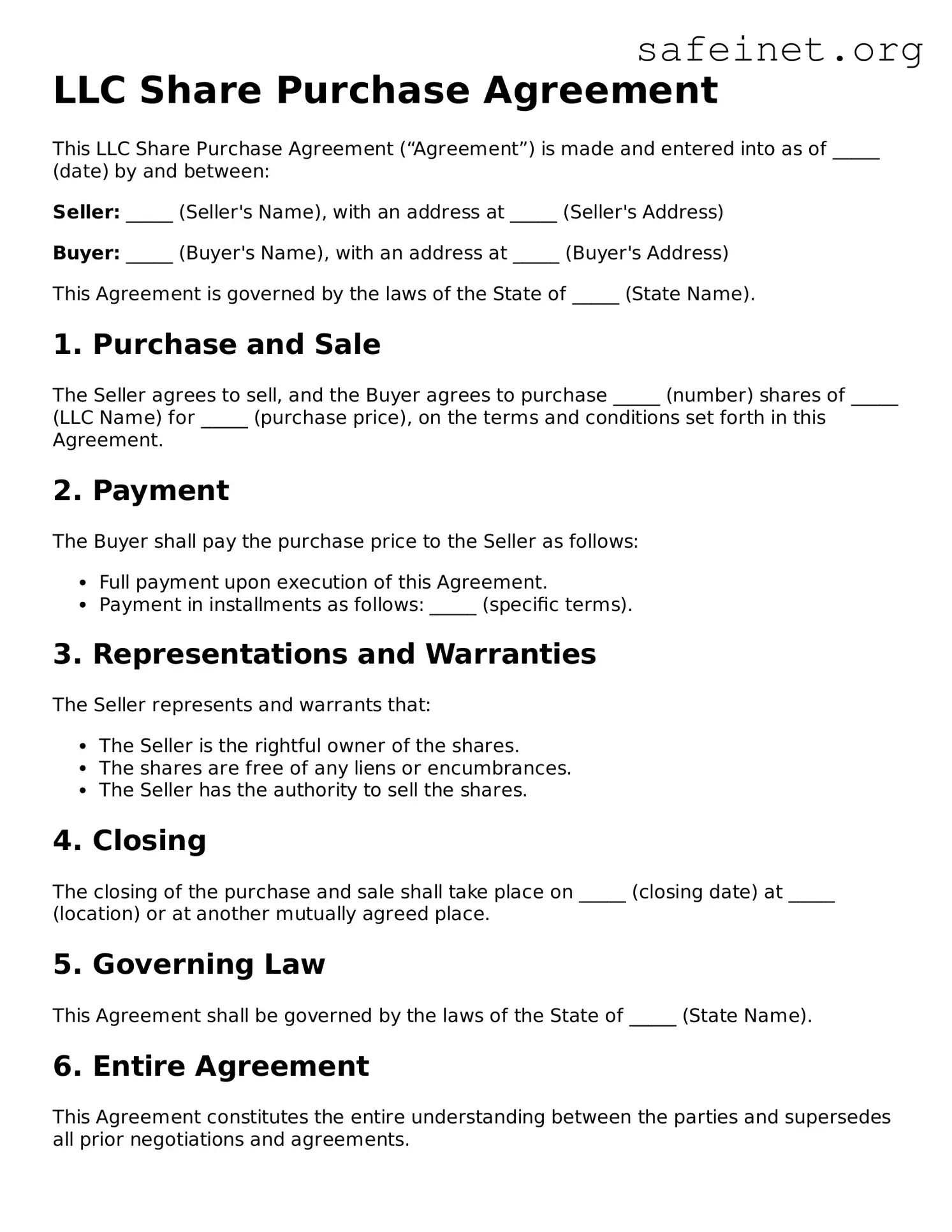

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which an individual or entity can purchase shares from a Limited Liability Company (LLC). This agreement serves as a safeguard for both the buyer and the seller, ensuring that all aspects of the transaction are clearly defined and agreed upon.

Why do I need an LLC Share Purchase Agreement?

This agreement is essential for protecting everyone's interests involved in the transaction. It details the price, payment methods, and any warranties related to the LLC shares. Having a formal agreement reduces misunderstandings and legal disputes in the future.

What should be included in an LLC Share Purchase Agreement?

Key components typically include the names of the buyer and seller, a description of the shares being sold, the purchase price, payment terms, representations and warranties of the seller, and any conditions that must be met before the sale is finalized. Additionally, closing procedures and governing law should be outlined.

Is an LLC Share Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both parties are obligated to comply with the terms outlined in the document. Failing to adhere to the agreement can result in legal consequences.

Can I use a template for the LLC Share Purchase Agreement?

While using a template can save time, it is important to ensure that it is tailored to your specific situation and complies with state laws. Each LLC may have unique factors that need to be considered, so it's wise to consult a legal expert when drafting the agreement.

What are the common pitfalls when drafting this agreement?

Common pitfalls include vague language, failing to specify payment terms, and not addressing post-sale responsibilities. Skipping details can lead to confusion and disputes down the line. Ensuring clarity in the terms is crucial for both parties.

How long does the process take from agreement to closing?

The timeline can vary based on several factors, including the efficiency of both parties, the complexity of the transaction, and any due diligence required. Generally, once terms are agreed upon, it may take a few days to several weeks to finalize everything and complete the sale.

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party has the right to seek legal remedies. This could include suing for damages or enforcing specific performance of the agreement, depending on the circumstances and the terms laid out in the document.

Can the agreement be amended after signing?

Yes, amendments can be made after the agreement is signed, but both parties must agree to the changes and document them in writing. This ensures that any modifications are legally binding and recognized by both sides.

Should I consult a lawyer before signing an LLC Share Purchase Agreement?

Consulting a legal expert is highly recommended, especially if you are unfamiliar with the process. A lawyer can help ensure that the agreement is comprehensive, complies with applicable laws, and protects your interests throughout the transaction.