What is a Letter of Intent to Purchase Commercial Real Estate?

A Letter of Intent (LOI) to Purchase Commercial Real Estate is a preliminary agreement between a buyer and seller. It outlines the basic terms and conditions under which the buyer intends to purchase the property. The LOI is not a legally binding contract, but it serves as a formal expression of interest that can help streamline negotiations and set the stage for a more detailed purchase agreement later on.

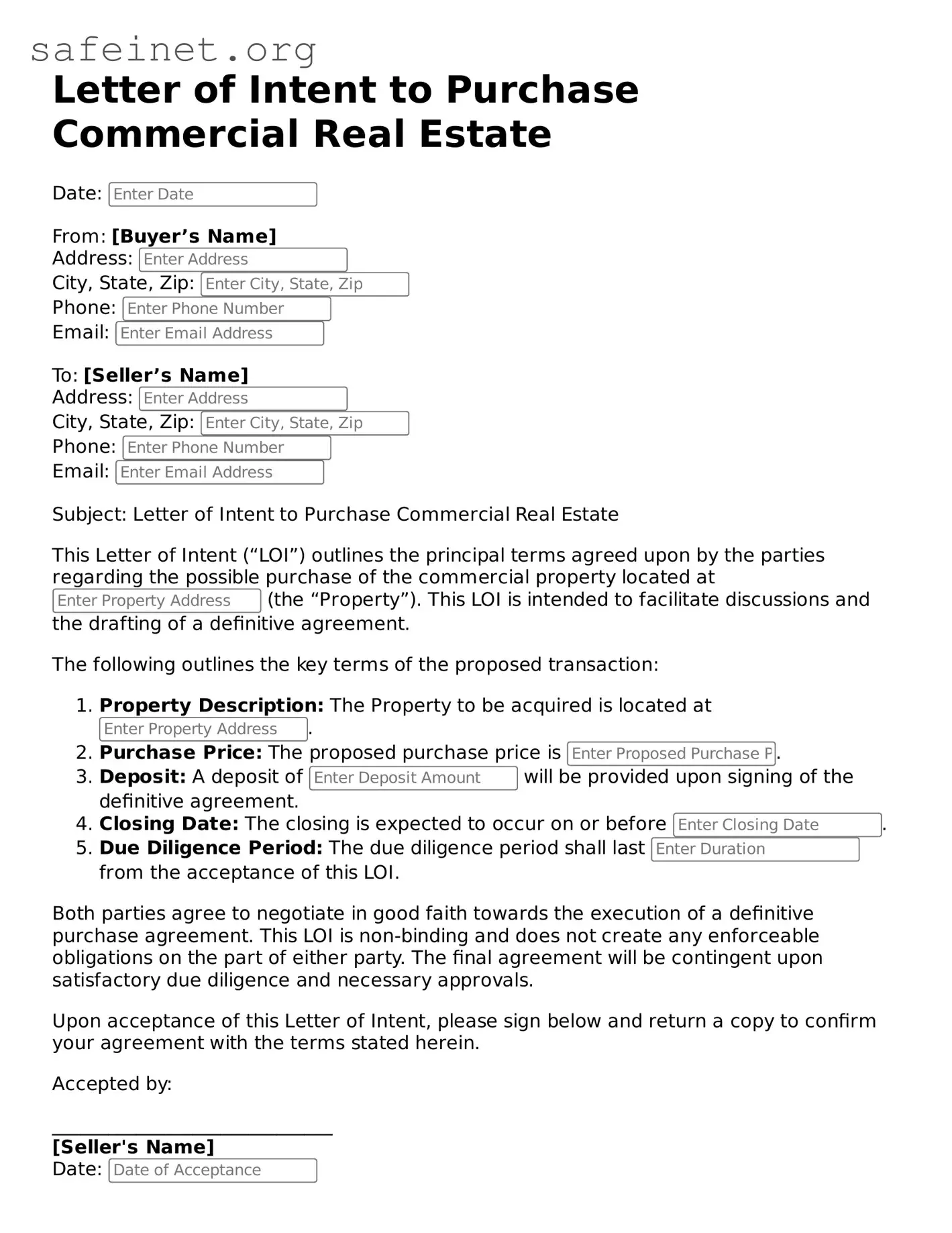

What information should be included in the LOI?

An effective LOI typically includes several key elements. These include the names and contact information of the parties involved, a description of the property, the proposed purchase price, and any contingencies or conditions that must be met for the sale to proceed. The duration of the offer and any confidentiality clauses may also be incorporated. Including these details helps clarify expectations for both parties.

Is the Letter of Intent legally binding?

The LOI itself is generally not considered a legally binding contract, although certain sections may be enforceable, such as confidentiality agreements or provisions relating to exclusivity. It is important to clarify which aspects of the LOI are binding versus non-binding to avoid misunderstandings. Legal advice should be sought to navigate these complexities.

How does a Letter of Intent benefit both buyers and sellers?

The LOI provides clarity and sets the stage for negotiations. For buyers, it demonstrates serious intent without committing to a full contract yet. Sellers can gauge the buyer's interest and commitment level, while also setting parameters around the negotiation process. Ultimately, it cultivates a more efficient and organized approach to moving forward with the transaction.

Can the Letter of Intent be modified once submitted?

Yes, the LOI can often be modified after its initial submission. Both parties can agree on changes to terms, conditions, or other relevant details. Keeping open lines of communication is essential in this process, as it helps ensure that all parties are on the same page and willing to work together to reach a mutual agreement.

What happens after the Letter of Intent is signed?

Upon signing the LOI, both parties typically move towards negotiating a more detailed Purchase and Sale Agreement (PSA). This formal agreement will cover all the terms in greater detail, including payment structures, property disclosures, and closing procedures. Due diligence is often initiated at this point, allowing the buyer to conduct inspections and review any necessary documentation related to the property.

Should I involve a lawyer when drafting a Letter of Intent?

While it is not strictly necessary to involve a lawyer when drafting an LOI, it is highly advisable. A legal professional can provide valuable insights to ensure that the document effectively represents the interests of the parties involved. Furthermore, a lawyer can help identify potentially binding elements and advise on potential liabilities, making the process smoother and more secure.

How does market conditions affect the terms of the LOI?

Market conditions significantly impact the terms outlined in the LOI. In a seller’s market, where demand exceeds supply, sellers may be less willing to negotiate on price or terms. Conversely, in a buyer’s market, buyers may have greater leverage to negotiate favorable terms. Understanding the current market dynamics can guide both parties in framing the LOI's terms appropriately.