What is a Letter of Intent to Purchase Business?

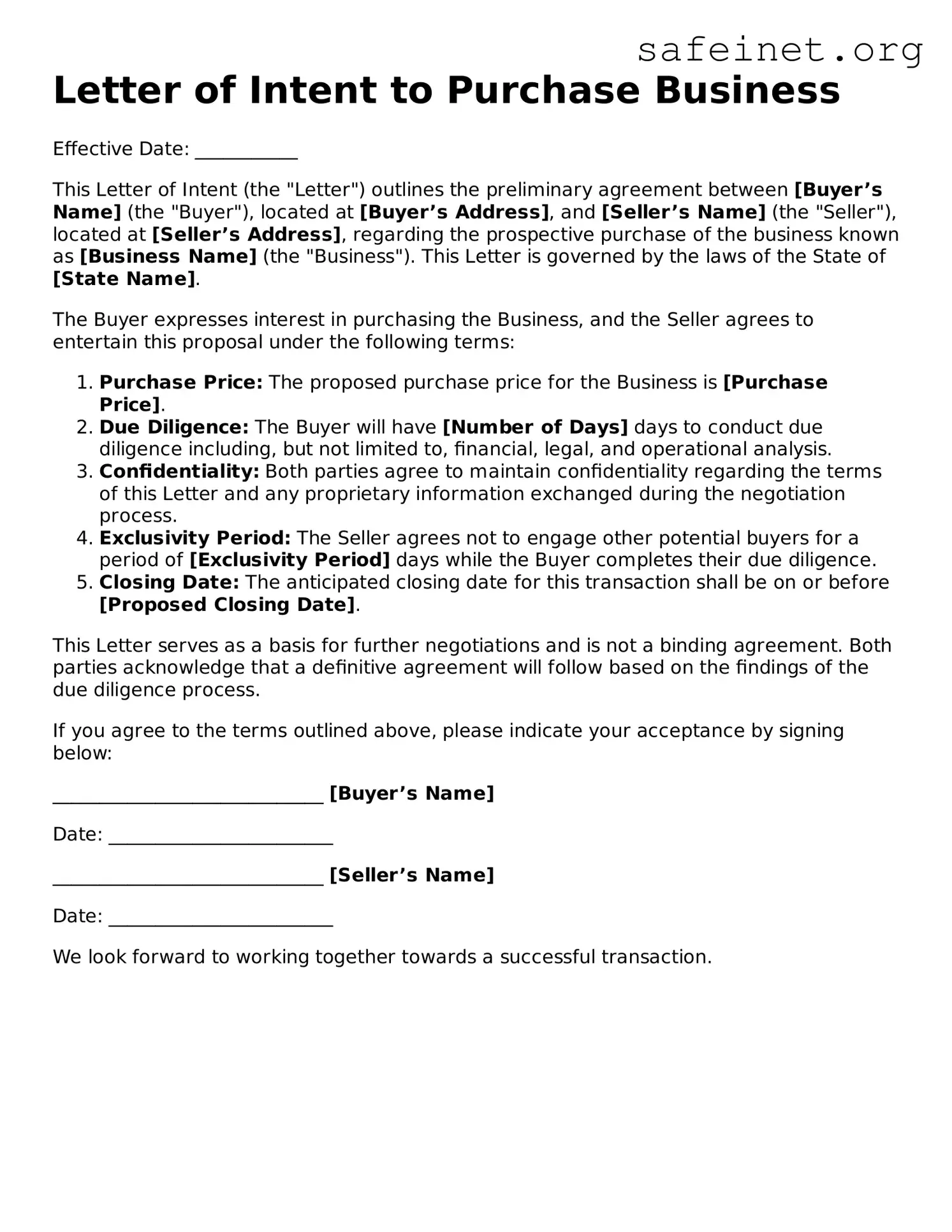

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller, indicating the buyer's intention to purchase the business. It typically includes important details such as the purchase price, terms of the sale, and any contingencies that may apply. This letter is not legally binding but serves as a roadmap for the negotiation process.

Why is a Letter of Intent important?

Creating a Letter of Intent is important as it helps to clarify the key terms and conditions of the proposed sale. This document sets the stage for due diligence, financing arrangements, and other transactional aspects. By outlining mutual understanding, both parties can avoid potential misunderstandings later in the negotiation process.

Is a Letter of Intent legally binding?

In general, a Letter of Intent is not legally binding, except for specific provisions that the parties explicitly state to be binding, such as confidentiality or exclusivity terms. It primarily serves as a guide for negotiations and does not create a legal obligation for either party to complete the transaction.

What should be included in a Letter of Intent?

A typical Letter of Intent includes several key components. These often encompass identification of the parties involved, the proposed purchase price, a description of the business assets to be acquired, timelines for due diligence and closing, as well as contingencies for financing and necessary approvals. Including these details can help ensure clarity for both sides.

Who typically prepares the Letter of Intent?

Generally, either party can draft the Letter of Intent, but it's commonly prepared by the buyer's legal or financial advisor. The buyer often has a clearer understanding of the terms they seek. However, both parties should review the document to ensure it accurately conveys their intentions before proceeding.

Can the Letter of Intent be modified?

Yes, the Letter of Intent can be modified if both parties agree to changes in the terms or conditions. This may occur as negotiations progress or as new information arises during the due diligence process. It is important to document any modifications to maintain clarity and prevent disputes.

What happens after the Letter of Intent is signed?

After the Letter of Intent is signed, the next steps typically involve conducting thorough due diligence and finalizing the terms of the sale. This includes financial assessments, verification of assets and liabilities, and obtaining any necessary approvals. Once due diligence is satisfactory, both parties can proceed to draft and sign a formal purchase agreement.

Do I need a lawyer to create a Letter of Intent?

While it is not strictly necessary to have a lawyer to create a Letter of Intent, consulting with legal counsel is advisable. A lawyer can provide guidance on the specific language and terms to include and help ensure that the document reflects the intentions of both parties, as well as provides proper legal protections when needed.