What is a Lease-to-Own Agreement?

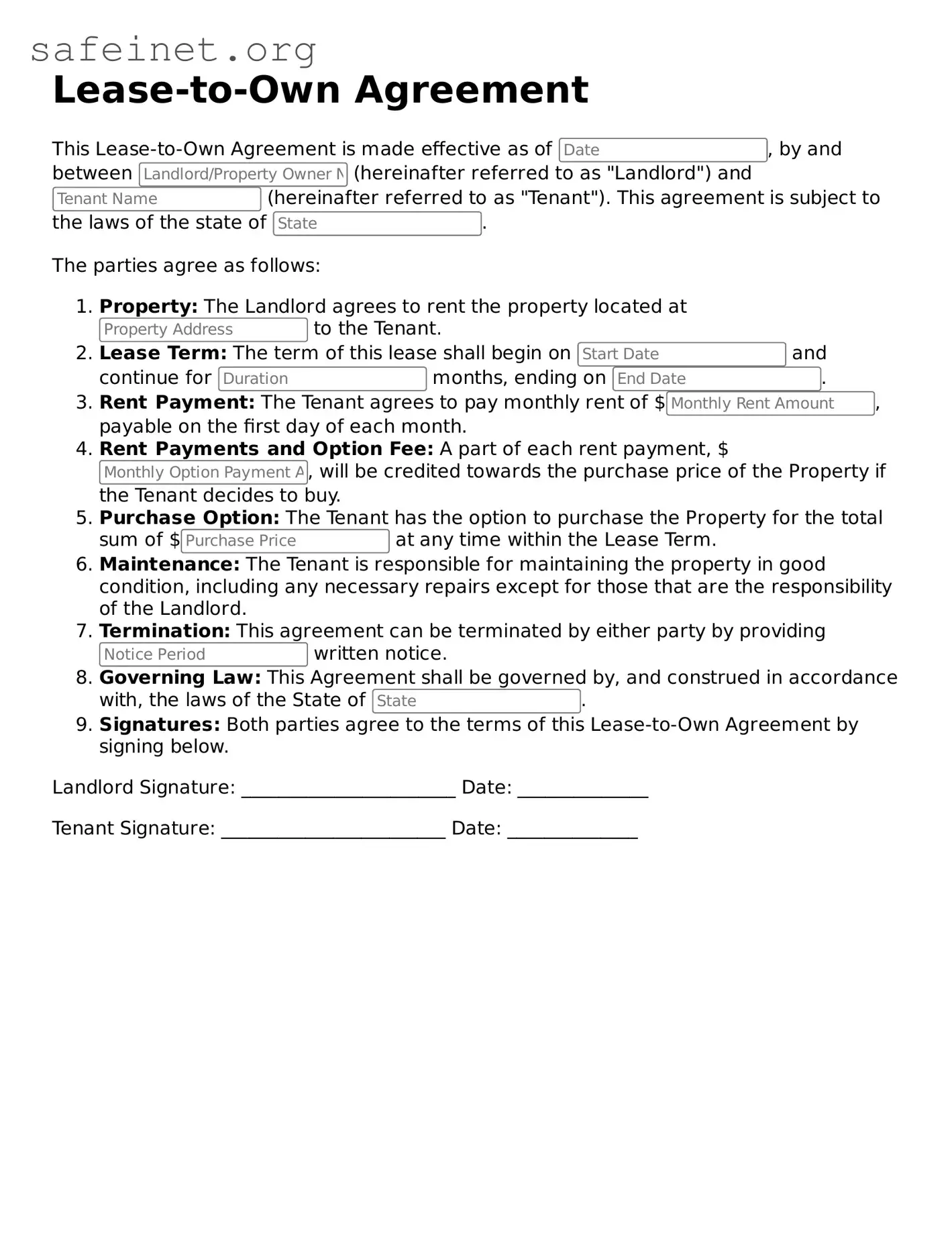

A Lease-to-Own Agreement is a contract that allows a tenant to rent a property for a specific period with the option to purchase it later. During the lease term, a portion of the rent paid can be credited toward the purchase price if the tenant decides to buy the property. This agreement can be beneficial for those who want to eventually own a home but may not currently have the means for a full down payment.

How does the Lease-to-Own process work?

The process typically starts with signing a lease agreement that outlines the terms of the rental. The agreement will specify how long the tenant will rent the property, how much rent will be paid, and how much of that rent will go toward the future purchase. By the end of the rental period, the tenant can choose to buy the property at a predetermined price. If they choose not to buy, they may lose the rent credits accumulated.

What are the benefits of entering into a Lease-to-Own Agreement?

This type of agreement offers flexibility. It gives the tenant the chance to live in the property and save for a down payment while locking in the purchase price. It can be a good option for those who need time to repair their credit or accumulate funds. Additionally, it allows tenants to assess whether they truly want to buy the property before making a commitment.

What should I look for in a Lease-to-Own Agreement?

It’s crucial to review the terms carefully. Look for details on the price at which you can purchase the property and how the rent credits are calculated. Ensure that all responsibilities, such as maintenance and repairs, are clearly outlined. Consider how long you have to make the purchase and any consequences if you decide not to buy. Consulting a legal professional can help clarify complex terms.

Are there any risks associated with a Lease-to-Own Agreement?

Yes, there are potential risks to consider. If the tenant decides not to purchase the property, they may lose any rent credits. Market conditions may also change, potentially making the agreed purchase price higher than the market value. Additionally, some leases may contain terms that could lead to eviction if the rent is not paid on time, which adds a layer of risk.

Can I negotiate the terms of a Lease-to-Own Agreement?

Definitely, negotiating is a common part of the process. Both parties can discuss terms like purchase price, lease duration, and the amount credited toward the purchase. It’s important that both parties feel comfortable and agree on the terms before signing the contract. Always make sure that any negotiated changes are documented in the final agreement to avoid confusion later.