What is a Lady Bird Deed?

A Lady Bird Deed is a specific type of property deed that allows a property owner to retain control over their property during their lifetime while automatically transferring it to designated beneficiaries upon their passing. This form of deed provides a way to bypass probate, simplifying the transfer process after death.

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner does not lose any rights to the property during their lifetime. They can sell, mortgage, or change the beneficiaries listed on the deed. Upon the owner's death, the property automatically passes to the beneficiaries without going through probate court, making the transition smoother and often faster.

What are the benefits of using a Lady Bird Deed?

The primary benefits include avoiding probate, maintaining control over the property, and possibly protecting the property from creditors. It can also have tax advantages, as the property may receive a step-up in basis, which can minimize capital gains tax for the beneficiaries.

Who can use a Lady Bird Deed?

Any property owner can potentially use a Lady Bird Deed. It is particularly beneficial for individuals seeking to pass their home to family members without the complexities associated with probate. However, the rules can vary by state, so checking local laws is essential.

Are there any limitations to a Lady Bird Deed?

While powerful, a Lady Bird Deed isn't without limitations. It may not be recognized in every state, and there can be challenges if the property owner has outstanding debts. Additionally, it cannot be used for all types of property, such as certain commercial properties.

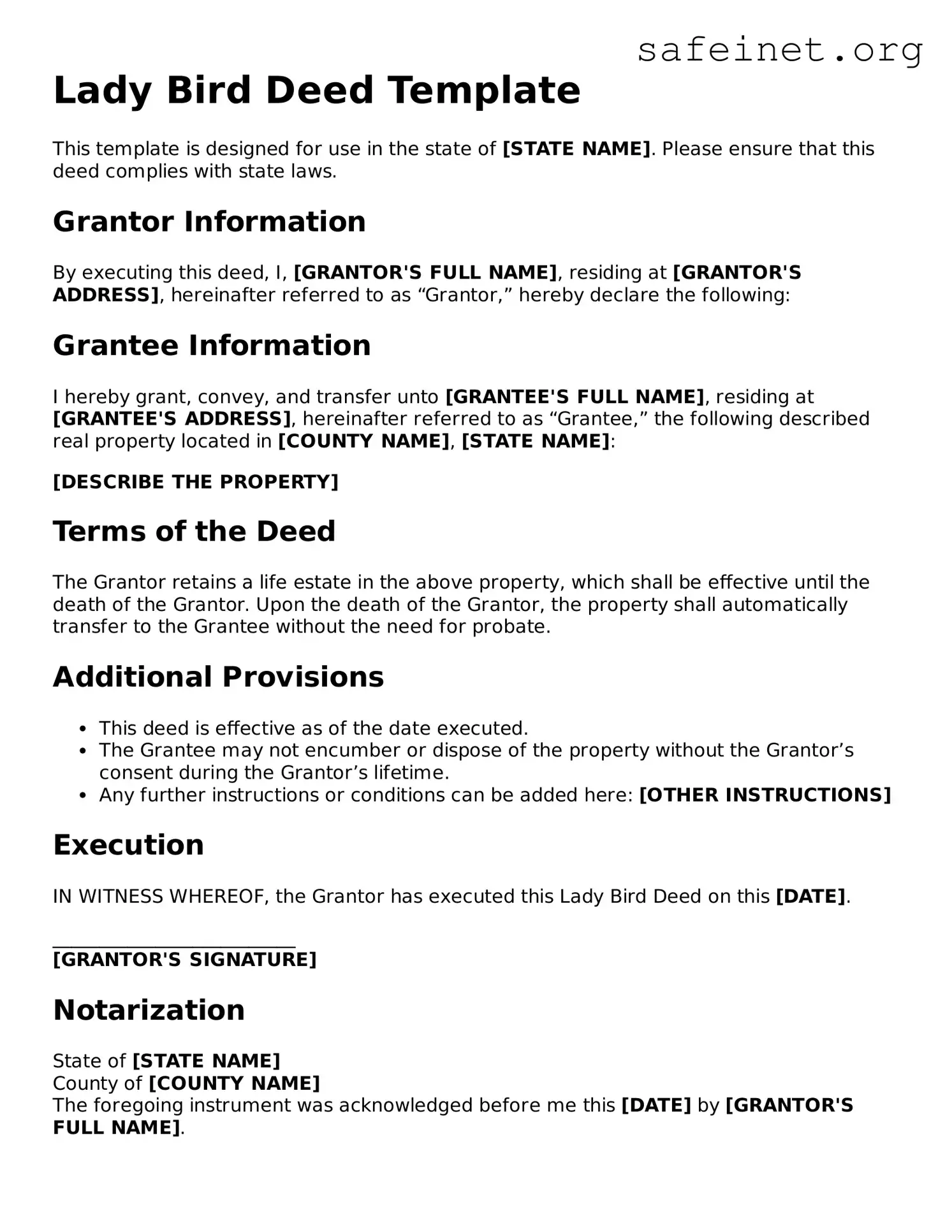

How do you create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves drafting the deed with specific language that outlines the retained rights of the owner and the beneficiaries. It must be signed, notarized, and recorded in the appropriate county office. Consulting with a legal expert is often advisable to ensure compliance with state laws.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked or changed. The property owner retains the right to alter the deed at any time during their life. This might include changing beneficiaries or even converting the deed into a traditional life estate deed if circumstances change.

How does a Lady Bird Deed affect Medicaid eligibility?

A Lady Bird Deed can help shield the property from being counted as an asset for Medicaid eligibility. By transferring the property after death rather than during life, it may help individuals qualify for Medicaid without liquidating assets. This is a complex area, so consultation with a Medicaid planning expert is recommended.

Is a Lady Bird Deed the same as a life estate deed?

No, they are not the same. A life estate deed grants the beneficiary rights to the property only after the owner’s death, while a Lady Bird Deed allows the original owner to retain control and sell or mortgage the property during their lifetime. The Lady Bird Deed offers more flexibility and rights to the owner.