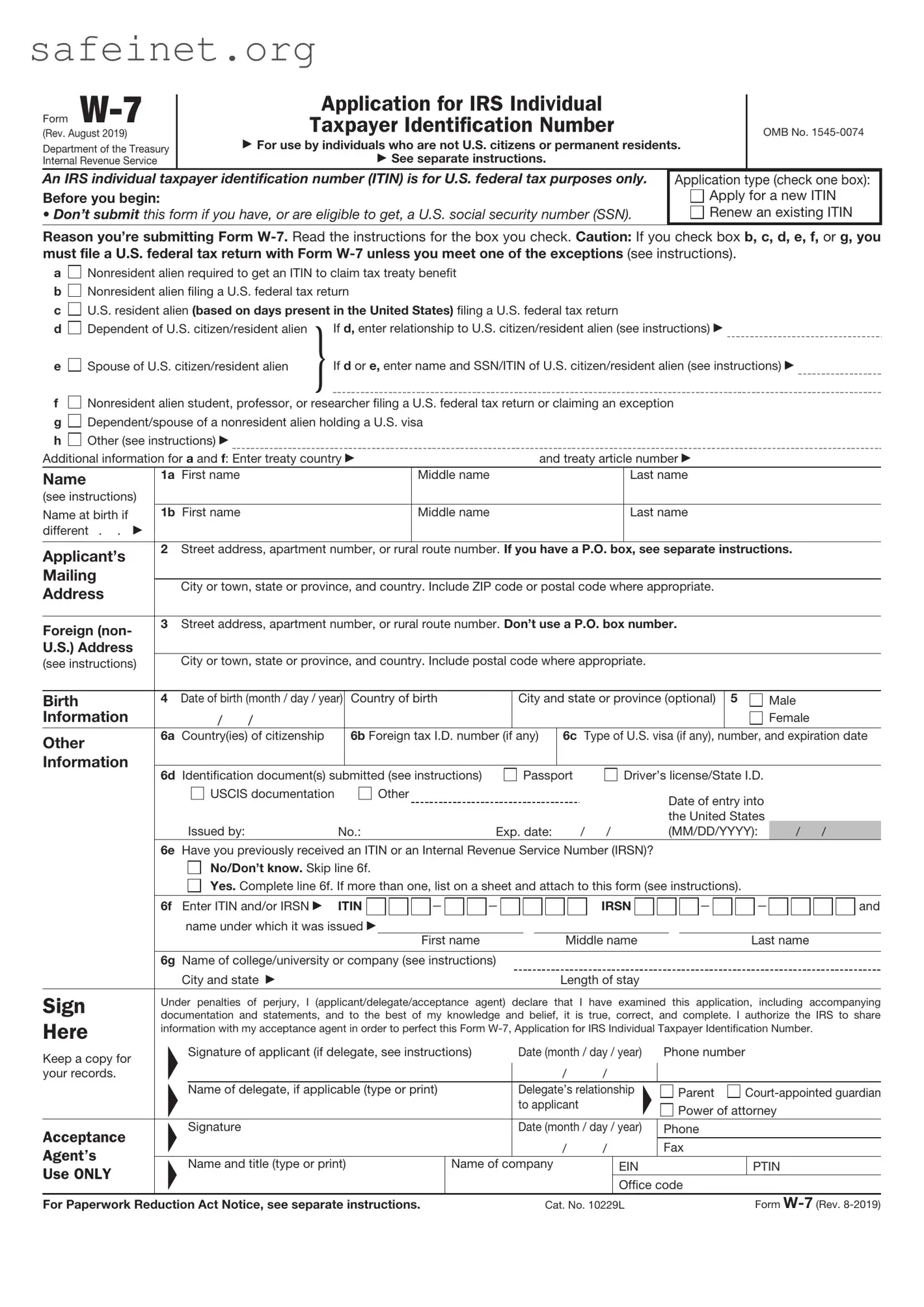

What is the IRS W-7 form?

The IRS W-7 form is an application used by individuals who are not U.S. citizens or residents and need an Individual Taxpayer Identification Number (ITIN). The ITIN is primarily for tax purposes, allowing those individuals to file their taxes and report income in the U.S. even if they are not eligible for a Social Security number.

Who needs to file a W-7 form?

Non-resident aliens who have U.S. tax obligations need to file a W-7. This includes foreign nationals who earn income from U.S. sources or need to claim a refund. Additionally, dependents or spouses of U.S. citizens or residents who are not eligible for a Social Security number also need to file a W-7.

How do I complete the W-7 form?

To complete the W-7 form, you need to provide personal information such as your name, address, and foreign tax identification number (if applicable). Be sure to select the reason for needing an ITIN, which can include tax reporting and claiming tax benefits. It's essential to fill out the entire form accurately to avoid delays.

What documents do I need to submit with the W-7 form?

You must submit original documents or certified copies that prove your identity and foreign status along with the W-7 form. Acceptable documents include a passport, national ID card, or birth certificate. It’s crucial to ensure that documents include your name and photograph if you’re using a passport.

Where do I send the W-7 form?

The completed W-7 form should be sent to the IRS. Depending on whether you are submitting it with a tax return or separately, the mailing address can differ. If submitted alongside a tax return, send it to the address specified for your particular form. For those submitting it by itself, refer to the IRS guidelines for the correct address.

How long does it take to receive my ITIN after filing the W-7?

Typically, it takes about 7 weeks to receive your ITIN after submitting the W-7 form and accompanying documentation. However, processing times can vary based on the volume of applications the IRS is handling. It's wise to apply as early as possible, especially during tax season.

Can I check the status of my W-7 application?

Yes, you can check the status of your W-7 application. You can contact the IRS directly by phone to inquire about your application status. Be prepared to provide details like your name, date of birth, and mailing address to assist the representative in locating your information.

What happens if my W-7 application is denied?

If your W-7 application is denied, you will receive a notice explaining the reason. Common reasons for denial include insufficient or incorrect documentation. You will have the opportunity to address the issues and reapply. It’s vital to read the denial notice carefully and follow any specific instructions provided.

Is there a fee to file the W-7 form?

There is no fee for filing the W-7 form itself. However, if you seek assistance from a tax professional to complete the form, there may be fees involved for their services. Always ensure you’re aware of any potential costs before engaging a professional.

Can I use an ITIN for purposes other than tax filing?

The ITIN is primarily for tax purposes; however, it can also be used in certain situations, such as opening a bank account or applying for loans with institutions that accept ITINs for identification. Keep in mind that improper use of ITIN can lead to complications, and it does not confer immigration status or eligibility for government benefits.