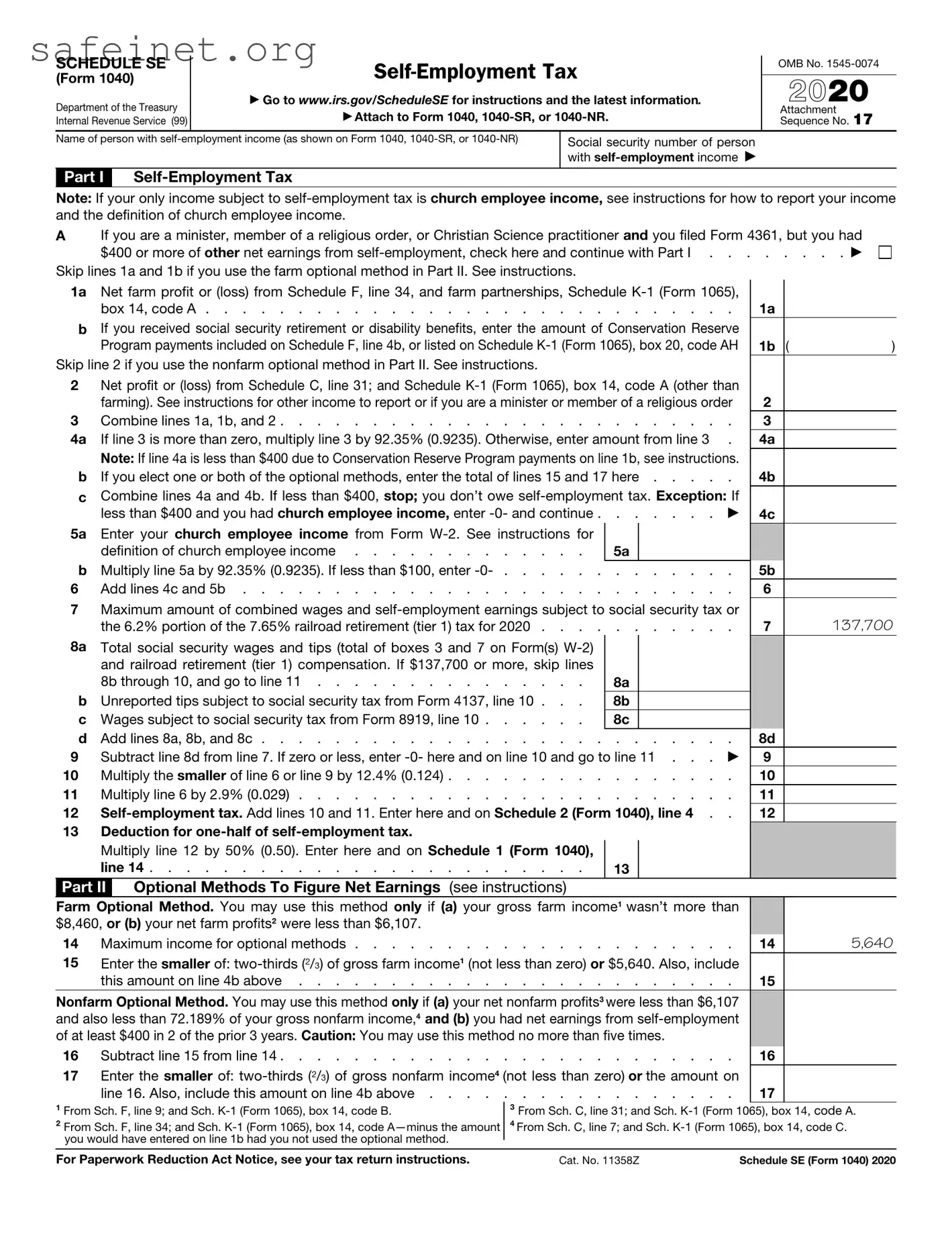

What is the IRS Schedule SE form?

The IRS Schedule SE (Self-Employment Tax) form is used by individuals to calculate and report self-employment tax. This tax primarily consists of Social Security and Medicare taxes for self-employed individuals. It is important for freelancers, independent contractors, and business owners who earn income outside of traditional employment to file this form to ensure compliance with tax obligations.

Who needs to file Schedule SE?

Taxpayers who earned $400 or more in net self-employment income must file Schedule SE. This includes individuals who operate a business as a sole proprietor, freelancers, and those receiving income from partnerships or LLCs that are treated as partnerships for tax purposes. Even if self-employed individuals do not owe any income tax, they still need to file to pay the self-employment tax.

How do I calculate self-employment tax?

To calculate self-employment tax, total your net earnings from self-employment. This figure is then multiplied by the self-employment tax rate, which is currently 15.3%. This rate consists of 12.4% for Social Security and 2.9% for Medicare. A portion of this tax may be deducted when calculating taxable income, making the effective tax burden slightly lower.

What if my net earnings are less than $400?

If your net earnings from self-employment are below $400, you are not required to file Schedule SE or pay self-employment tax. However, if you had any income from self-employment, you might still want to report that income on your tax return, particularly if you wish to qualify for certain tax credits or benefits.

Can I deduct any expenses when calculating self-employment income?

Yes, self-employed individuals can deduct business-related expenses when calculating their net income. This includes costs for supplies, travel, equipment, and other necessary expenses incurred while operating the business. Accurate record-keeping is essential to substantiate these deductions during tax filing.

What are the deadlines for filing Schedule SE?

Schedule SE is typically due on the same date as your federal income tax return. For most taxpayers, this means the form is due on April 15. If you file for an extension, you must submit Schedule SE by the extended deadline, which is usually October 15. Be mindful of these dates to avoid penalties.

Where do I submit the Schedule SE form?

Schedule SE is submitted along with your Form 1040 when filing your tax return. If you are electronic filing, most tax software will automatically include Schedule SE with your submission. For paper filers, attach Schedule SE to your Form 1040 and mail it to the address provided in the instructions.

Is there a limit on how much self-employment tax I can pay?

While there is no overall limit on self-employment tax, there is a cap on the amount of income subject to the Social Security portion of the tax. For 2023, this cap is $160,200. Income above this threshold will not be subject to the 12.4% Social Security tax, though the 2.9% Medicare tax applies to all self-employment income, with an additional 0.9% Medicare tax for higher earners.