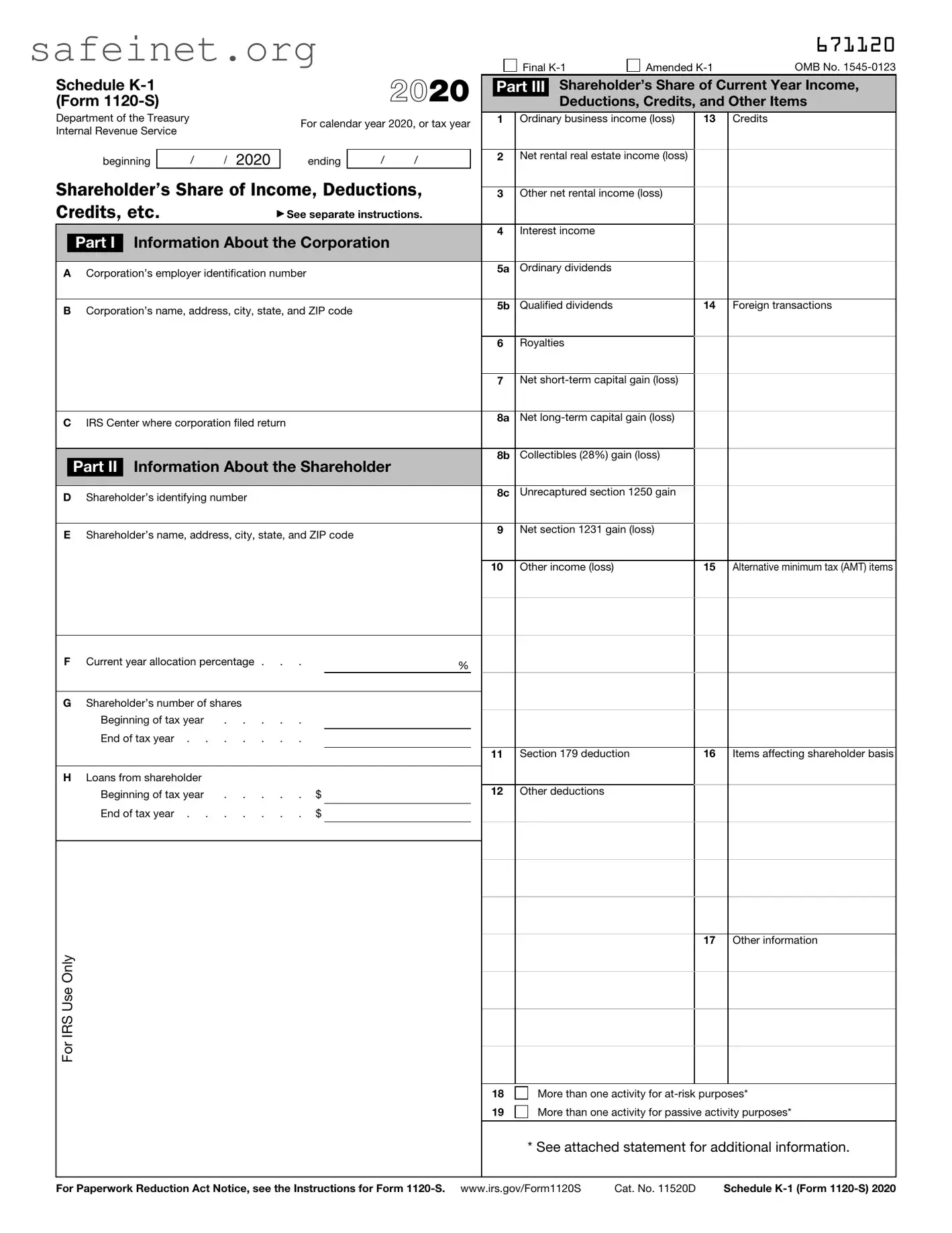

What is the IRS Schedule K-1 1120-S form?

The Schedule K-1 1120-S form is a tax document issued by S corporations to report each shareholder’s share of income, deductions, and credits. It serves as a pass-through entity, meaning that the corporation itself does not pay taxes at the corporate level; instead, shareholders report their share of the company's income on their personal tax returns.

Who needs to file Schedule K-1 1120-S?

Only S corporations are required to file Schedule K-1 1120-S. Each shareholder of the S corporation receives a K-1 that details their specific financial information. Shareholders must file this form with their individual tax returns.

When is the Schedule K-1 1120-S due?

The Schedule K-1 must be issued by the S corporation to its shareholders by March 15 of each year. This aligns with the deadline for the S corporation's return (Form 1120-S). Shareholders should ensure they receive their K-1 in a timely manner to meet their filing obligations.

How is the information on Schedule K-1 1120-S used?

Shareholders use the information reported on Schedule K-1 to complete their personal income tax returns. The income, deductions, and credits reported inform their overall tax liability and are included on Form 1040 and associated schedules.

Can I get my Schedule K-1 electronically?

Yes, many S corporations provide Schedule K-1 electronically. Shareholders may receive it via email or through a secure online portal. Ensure that you keep a copy for your records and for filing your taxes.

What should I do if I don’t receive my Schedule K-1?

If you haven’t received your K-1 by the filing deadline, you should contact the S corporation directly. Sometimes delays occur due to administrative issues. It is essential to resolve this promptly, as you may need the information to file your tax return accurately.

What happens if I receive an incorrect Schedule K-1?

If the information on your K-1 is incorrect, contact the S corporation for a corrected version. The corporation is responsible for providing accurate information, and you will need the revised K-1 to ensure correct reporting on your tax return.

Aren’t all S corporations required to file a Schedule K-1?

Yes, all S corporations must file a Schedule K-1 for each shareholder. This requirement applies regardless of whether the corporation had income, deductions, or credits. It ensures that all shareholders receive the necessary information for their tax filings.

What if I have multiple K-1 forms from different S corporations?

In the event you receive K-1 forms from multiple S corporations, it is important to report each one on your tax return. Each K-1 includes information specific to that corporation, and combining this information helps determine your overall tax situation.

Are there any penalties for not filing Schedule K-1?

Yes, failing to file or incorrectly filing a Schedule K-1 can result in penalties for both the S corporation and the shareholder. The IRS can impose fines for late filings, and shareholders may face issues during audits or when correcting their returns.