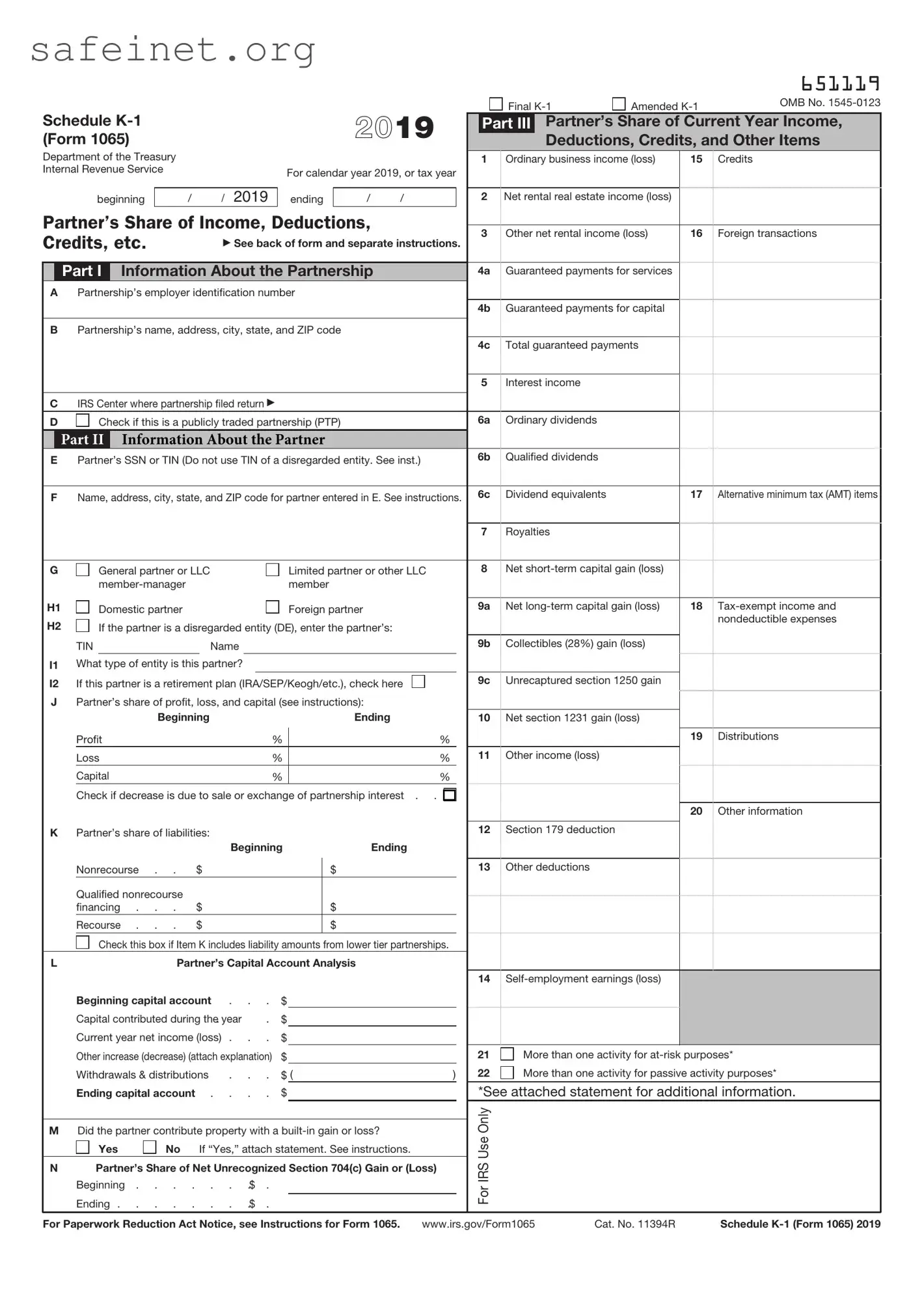

What is the IRS Schedule K-1 (Form 1065)?

The IRS Schedule K-1 (Form 1065) is a tax document used to report income, deductions, and credits from partnerships. It is issued to each partner by the partnership and details their share of the partnership's financial activity for the tax year. Each partner uses this information to report their portion of income on their individual tax returns.

Who needs to file a Schedule K-1 (Form 1065)?

Partnerships that operate in the United States must file Form 1065, which includes issuing a Schedule K-1 to each partner. Every partner, regardless of the amount of their stake or the income they receive, will need their K-1 to accurately report their share of the partnership's income on their tax returns.

How do I use the information on my Schedule K-1?

Once you receive your Schedule K-1, carefully review it for accuracy. The form provides details on your share of the partnership’s income, losses, deductions, and credits. You will report this information on your personal tax return, typically on Schedule E of Form 1040. It's vital to ensure that the amounts match your records.

What should I do if my Schedule K-1 is incorrect?

If you notice any errors or discrepancies on your Schedule K-1, contact the partnership immediately. Partnerships have an obligation to issue corrected K-1 forms if mistakes are found. Make sure to keep records of any communication about corrections for your reference.

Are there any deadlines associated with the Schedule K-1 (Form 1065)?

The partnership must file Form 1065, including the Schedule K-1s, by the 15th day of the third month after the end of the partnership's tax year. For partnerships on a calendar year basis, this would typically be March 15. Partners should expect to receive their K-1 copies around this time, though delays can occur.

What happens if I don’t receive my Schedule K-1 in time?

If you haven’t received your Schedule K-1 by the tax filing deadline, you should still file your tax return as accurately as you can, using any relevant financial statements. You may consider filing for an extension or consulting a tax professional for guidance. If the K-1 arrives after you've filed, you may need to amend your tax return to report any additional income or deductions.

Can I e-file my tax return with a Schedule K-1?

Yes, you can e-file your tax return if you have a Schedule K-1. Most tax software programs support the input of K-1 data. However, you should be sure to enter all information accurately to avoid any potential issues with the IRS.

What if my partnership operated at a loss?

If your partnership operated at a loss, this loss will also be reported on your Schedule K-1. As a partner, you can often use these losses to offset other income on your personal tax return. Keep in mind, however, that there are limitations on how much of a loss you can deduct based on your investment and participation in the partnership.

Is there any difference between the Schedule K-1 for partnerships and for S corporations?

Yes, there are significant differences. While both forms report income, deductions, and credits to their respective shareholders or partners, the underlying tax structures are different. S corporations use Schedule K-1 (Form 1120S), which is specific to S corporations and has different reporting requirements and tax implications compared to the K-1 used by partnerships (Form 1065).