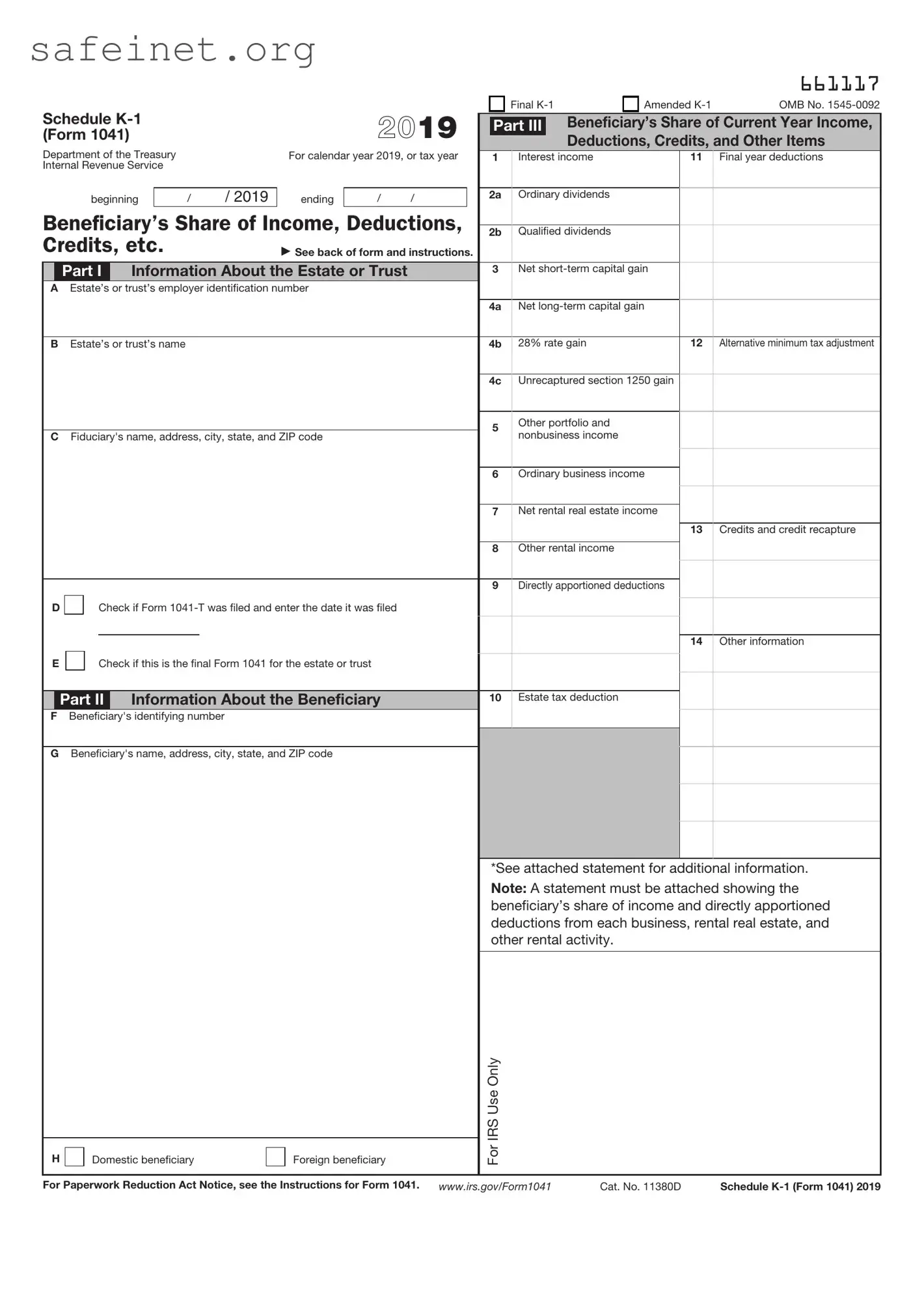

What is the IRS Schedule K-1 (Form 1041)?

The IRS Schedule K-1 (Form 1041) is a tax document used by estates and trusts to report income, deductions, and credits to beneficiaries. Each beneficiary receives a K-1 form that details their share of the estate's or trust's taxable income and other relevant tax information. This form is essential for beneficiaries to accurately report their income on their personal tax returns.

Who needs to file the Schedule K-1 (Form 1041)?

The fiduciary of an estate or trust must file the Schedule K-1 (Form 1041) for each beneficiary receiving distributions. The form provides the IRS with information about the beneficiary’s portion of the estate's or trust's income, ensuring that beneficiaries report their share on their tax returns.

When is the Schedule K-1 (Form 1041) due?

The completed Schedule K-1 (Form 1041) is due to beneficiaries when the fiduciary files the Form 1041 for the estate or trust. Typically, Form 1041 must be filed by the 15th day of the fourth month following the end of the tax year, which aligns with the due date for the K-1 forms.

How do beneficiaries report income from Schedule K-1 (Form 1041)?

Beneficiaries report the income, deductions, and credits listed on the Schedule K-1 (Form 1041) on their personal tax returns, usually on IRS Form 1040. Specific line items on the K-1 correspond to certain parts of the 1040 form, assisting beneficiaries in properly claiming their share of the estate's or trust's income.

What types of income are reported on Schedule K-1 (Form 1041)?

Common types of income reported on Schedule K-1 (Form 1041) include interest income, dividends, capital gains, and ordinary income. Each type is distinguished to help beneficiaries understand how it affects their overall tax liability. Different types of income may also be subject to varying tax rates.

What should I do if I believe the K-1 information is incorrect?

If you believe the information on your Schedule K-1 (Form 1041) is incorrect, contact the fiduciary or the person responsible for filing the estate or trust's taxes. It is crucial to address any discrepancies promptly, as incorrect information may lead to errors on your tax return.

What if I do not receive a Schedule K-1 (Form 1041) but should have?

If you believe you should receive a Schedule K-1 (Form 1041) but do not receive it, reach out to the fiduciary or trustee for clarification. Beneficiaries have a right to receive this document to accurately report their income and ensure compliance with tax laws.

Are there any special tax implications for receiving income through Schedule K-1 (Form 1041)?

Yes, beneficiaries may have special tax implications for income received via Schedule K-1 (Form 1041). This income may affect your overall taxable income and potentially push you into a higher tax bracket. It’s important to consult with a tax professional to understand the full impact and any strategies for tax planning.

Can I e-file my tax return if I receive a Schedule K-1 (Form 1041)?

Yes, you can e-file your tax return while including the income reported on your Schedule K-1 (Form 1041). Most e-filing software accommodates K-1 forms, making it easier for beneficiaries to accurately report their income. Just ensure the figures from the K-1 are correctly entered into the appropriate fields during the e-filing process.