The Schedule D of Form 1040 or 1040-SR is akin to a personal financial statement, which is often prepared to provide a snapshot of an individual’s financial position. Like Schedule D, a personal financial statement includes details about assets and liabilities, allowing individuals to gauge their financial health. Both documents require individuals to compile information about investments, reflecting gains and losses that may influence overall financial stability.

Investment income tax forms, such as the 1099-DIV, share similarities with Schedule D because they report specific types of income derived from investments. The 1099-DIV provides information about dividends and distributions, which directly ties into the capital gains and losses reported on Schedule D. This relationship helps taxpayers consolidate their investment income and assess their overall tax liability related to investments.

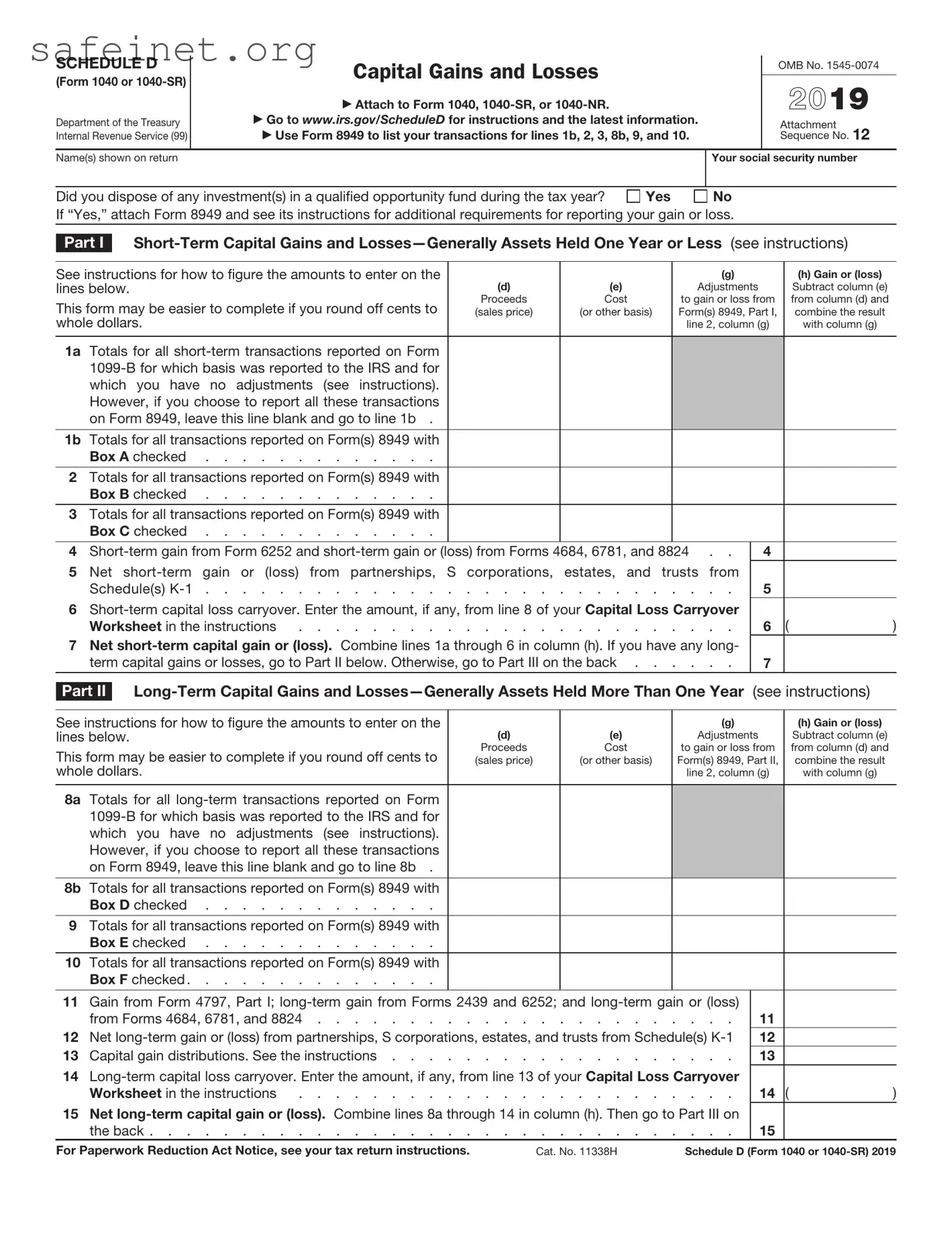

Another document comparable to Schedule D is the IRS Form 8949, which is used to report sales and other dispositions of capital assets. Taxpayers list individual transactions on Form 8949, detailing proceeds and costs associated with sales of assets. Schedule D summarizes these transactions, often incorporating totals from Form 8949, to present the overall capital gain or loss for the tax year.

In terms of reporting stocks and securities, the IRS Form 4797 is relevant as it addresses the sale of business property, including stocks held by business owners. Like Schedule D, Form 4797 demands accurate reporting of gains and losses from the sale of assets. Both forms involve recognizing the financial implications of asset sales for the purpose of tax reporting.

The IRS Form 8862 can also be compared to Schedule D in that both documents involve claiming entitlements related to past tax events. While Form 8862 is necessary for taxpayers trying to reclaim the Earned Income Tax Credit after it was denied previously, the Schedule D may also be used by taxpayers who have held onto capital assets for extended periods, impacting the credit they might access based on prior losses or gains.

Likewise, the tax credit forms, such as the Child and Dependent Care Expenses Credit form (Form 2441), could be seen as somewhat comparable to Schedule D. While not directly related to capital assets, both involve compiling and reporting financial information relevant for tax credits. They each require individuals to consider different aspects of their financial circumstances that may lead to reduced tax liability.

Scholarship applications can resemble Schedule D, as both documents require careful and thoughtful reporting of income sources. When applying for scholarships, students often need to disclose information about their family's financial situation. Similarly, Schedule D requires taxpayers to report their financial activities, revealing insights that might impact eligibility for financial aid or other programs.

Additionally, the annual income tax return Form W-2 has a similarity with Schedule D, given that both contribute to the overall understanding of taxable income. Form W-2 reports earnings from employment, while Schedule D accounts for capital gains or losses. The accurate aggregation of both forms helps ensure that individuals meet their tax obligations effectively.

Lastly, the IRS Form 1040-X, used for amending tax returns, can be related to Schedule D, as it can be utilized to correct any errors involving capital gain or loss reporting. Individuals must ensure that all financial transactions are accurately reported, and any adjustments made on Form 1040-X will often stem from discrepancies identified on the Schedule D, making both essential for providing a true and accurate representation of one’s tax situation.

Yes.

Yes.

No.

No.