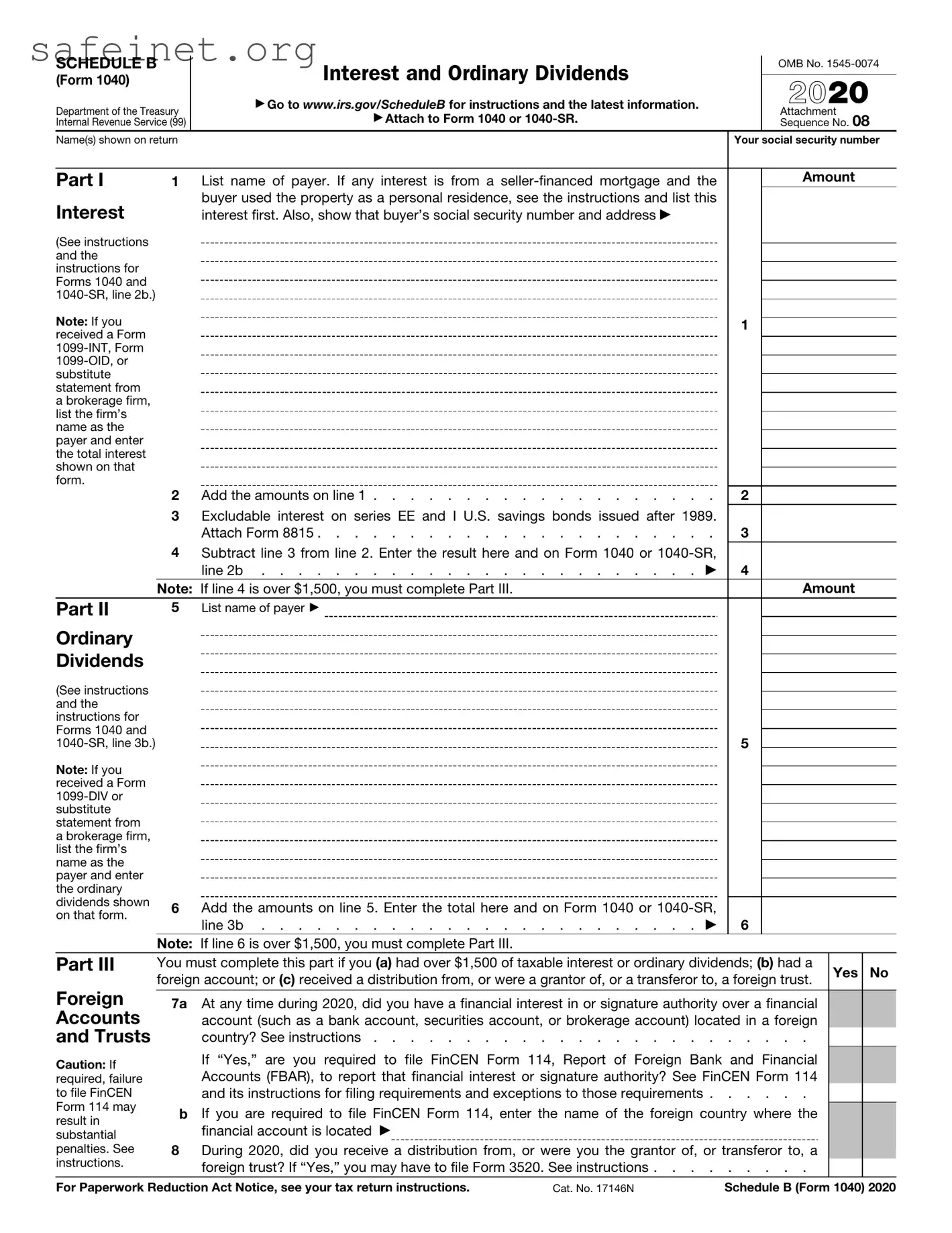

The IRS Form 1040 Schedule B is similar to the 1099 form series. Both documents are used to report income from sources other than traditional employment. For instance, if an individual receives interest, dividends, or any other type of income, they would typically report this on a 1099 form as well as on Schedule B. This helps ensure that all income is accounted for when filing taxes.

The W-2 form is another document related to income reporting. Unlike Schedule B, which focuses on income from investments, the W-2 is used to report wages and salaries earned from an employer. However, both forms are essential for accurately reporting an individual’s overall income. Workers use the W-2 to show their earnings, while Schedule B allows them to disclose additional income generated through investments.

The IRS Form 8889 is similar in that it deals with reporting income but is specifically used for Health Savings Accounts (HSAs). Individuals must report contributions and distributions related to their HSAs on this form, and if they earn any interest on those accounts, it would also be reported on Schedule B. Both forms play a role in ensuring transparency in financial matters related to health care.

The Schedule D form, which reports capital gains and losses, also shares similarities with Schedule B. Investors use both forms to report different types of income derived from investments. While Schedule B focuses on dividends and interest, Schedule D handles the sale of assets, emphasizing the comprehensive nature of reporting various income sources.

The Form 8606 is another document that resonates with Schedule B, particularly regarding certain tax-deferred accounts. Individuals report their non-deductible contributions to traditional IRAs with Form 8606. If a taxpayer earns interest or dividends on IRA investments, they would include that information on Schedule B. This connection helps clarify how various types of income relate to retirement accounts.

Form 4562, which deals with depreciation and amortization, has a connection to Schedule B when discussing rental income. If a taxpayer owns rental property and earns interest on security deposits, they are required to report this on Schedule B. The depreciation aspect reported on Form 4562 can also affect the overall tax calculations resulting from that rental income.

The IRS Form 8814, the Parents' Election to Report Child's Interest and Dividends, shares a link with Schedule B. Parents can opt to report their child's unearned income, such as interest or dividends, on their own tax returns instead of having the child file separately. Thus, if a child has investment income, it will also need to be included on Schedule B for accurate reporting.

Form 5329, which addresses additional taxes on qualified plans, aligns with Schedule B in addressing tax implications surrounding retirement income. For example, if a taxpayer has taken early distributions from retirement plans, the income would be reported on Schedule B. Understanding both forms is crucial for comprehensively handling tax responsibilities related to retirement savings.

Lastly, Form 8862, which is used to claim the Earned Income Tax Credit after disallowance, can intersect with Schedule B when income qualifies or disqualifies a taxpayer for the credit. If a taxpayer’s additional income is reported on Schedule B, it might influence their ability to claim the credit, emphasizing the interconnectedness of various tax documents.