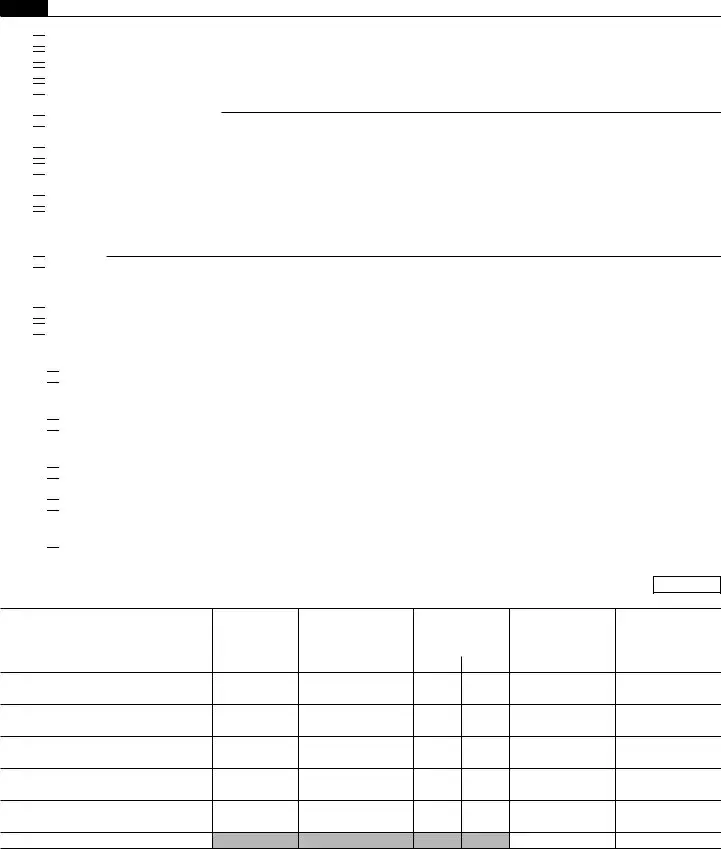

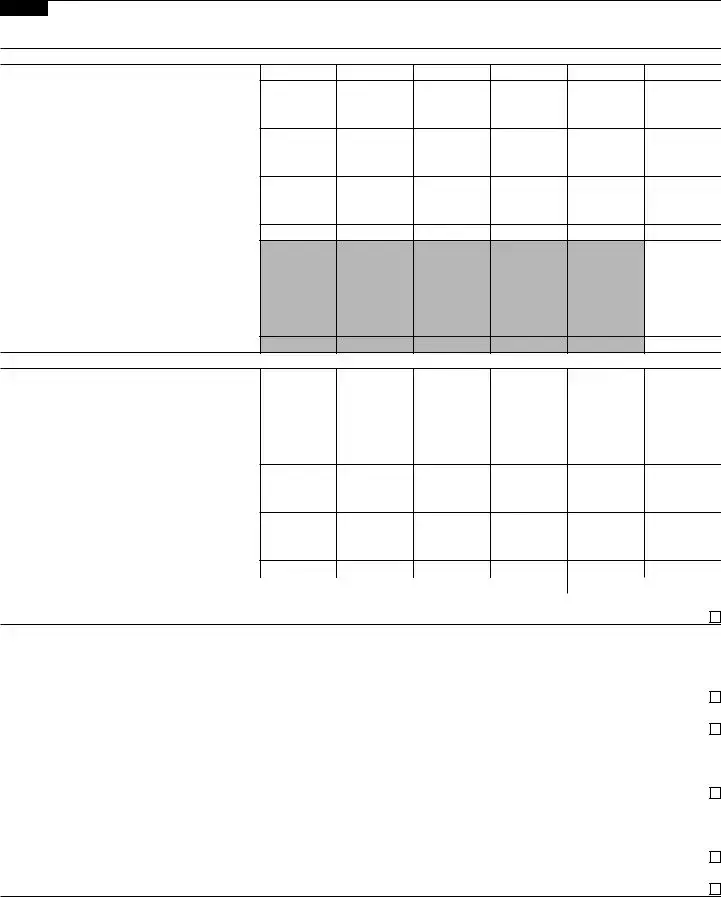

1Are all of the organization’s supported organizations listed by name in the organization’s governing documents? If “No,” describe in Part VI how the supported organizations are designated. If designated by class or purpose, describe the designation. If historic and continuing relationship, explain.

2Did the organization have any supported organization that does not have an IRS determination of status under section 509(a)(1) or (2)? If “Yes,” explain in Part VI how the organization determined that the supported organization was described in section 509(a)(1) or (2).

3a Did the organization have a supported organization described in section 501(c)(4), (5), or (6)? If “Yes,” answer

(b) and (c) below.

bDid the organization confirm that each supported organization qualified under section 501(c)(4), (5), or (6) and satisfied the public support tests under section 509(a)(2)? If “Yes,” describe in Part VI when and how the organization made the determination.

cDid the organization ensure that all support to such organizations was used exclusively for section 170(c)(2)(B) purposes? If “Yes,” explain in Part VI what controls the organization put in place to ensure such use.

4a Was any supported organization not organized in the United States (“foreign supported organization”)? If “Yes,” and if you checked 12a or 12b in Part I, answer (b) and (c) below.

bDid the organization have ultimate control and discretion in deciding whether to make grants to the foreign supported organization? If “Yes,” describe in Part VI how the organization had such control and discretion despite being controlled or supervised by or in connection with its supported organizations.

cDid the organization support any foreign supported organization that does not have an IRS determination under sections 501(c)(3) and 509(a)(1) or (2)? If “Yes,” explain in Part VI what controls the organization used to ensure that all support to the foreign supported organization was used exclusively for section 170(c)(2)(B) purposes.

5a Did the organization add, substitute, or remove any supported organizations during the tax year? If “Yes,” answer (b) and (c) below (if applicable). Also, provide detail in Part VI, including (i) the names and EIN numbers of the supported organizations added, substituted, or removed; (ii) the reasons for each such action;

(iii)the authority under the organization’s organizing document authorizing such action; and (iv) how the action was accomplished (such as by amendment to the organizing document).

bType I or Type II only. Was any added or substituted supported organization part of a class already designated in the organization’s organizing document?

cSubstitutions only. Was the substitution the result of an event beyond the organization’s control?

6Did the organization provide support (whether in the form of grants or the provision of services or facilities) to anyone other than (i) its supported organizations, (ii) individuals that are part of the charitable class benefited by one or more of its supported organizations, or (iii) other supporting organizations that also support or benefit one or more of the filing organization’s supported organizations? If “Yes,” provide detail in Part VI.

7Did the organization provide a grant, loan, compensation, or other similar payment to a substantial contributor (as defined in section 4958(c)(3)(C)), a family member of a substantial contributor, or a 35% controlled entity with regard to a substantial contributor? If “Yes,” complete Part I of Schedule L (Form 990 or 990-EZ).

8Did the organization make a loan to a disqualified person (as defined in section 4958) not described in line 7? If “Yes,” complete Part I of Schedule L (Form 990 or 990-EZ).

9a Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified persons as defined in section 4946 (other than foundation managers and organizations described in section 509(a)(1) or (2))? If “Yes,” provide detail in Part VI.

bDid one or more disqualified persons (as defined in line 9a) hold a controlling interest in any entity in which the supporting organization had an interest? If “Yes,” provide detail in Part VI.

cDid a disqualified person (as defined in line 9a) have an ownership interest in, or derive any personal benefit from, assets in which the supporting organization also had an interest? If “Yes,” provide detail in Part VI.

10a Was the organization subject to the excess business holdings rules of section 4943 because of section 4943(f) (regarding certain Type II supporting organizations, and all Type III non-functionally integrated supporting organizations)? If “Yes,” answer 10b below.

bDid the organization have any excess business holdings in the tax year? (Use Schedule C, Form 4720, to determine whether the organization had excess business holdings.)

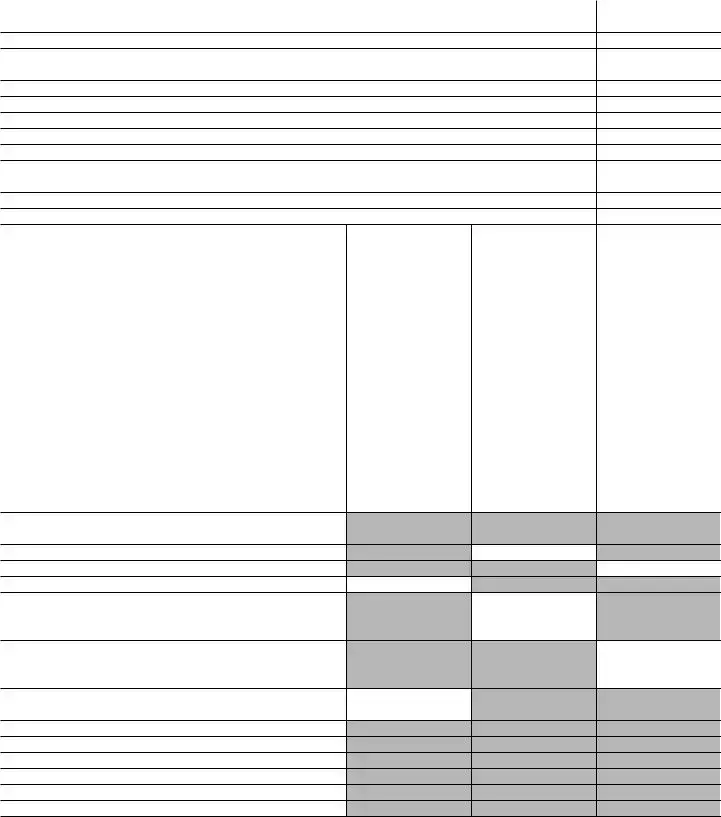

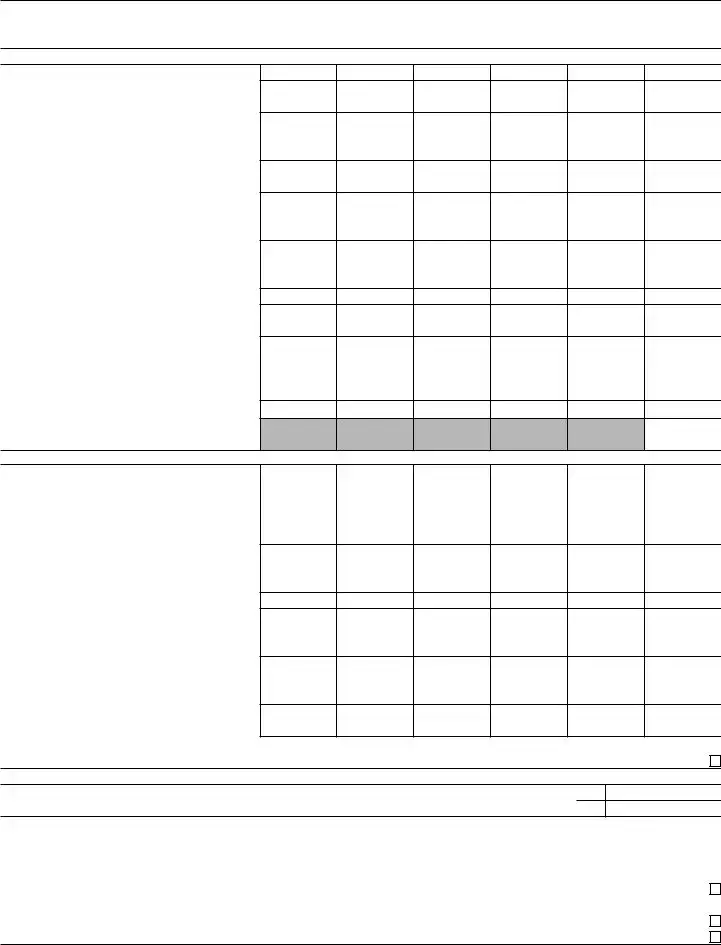

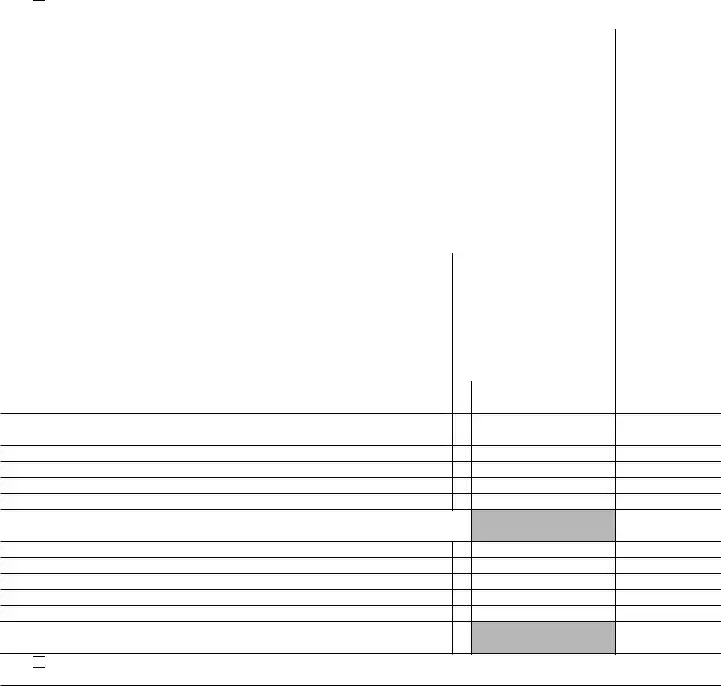

A church, convention of churches, or association of churches described in

A church, convention of churches, or association of churches described in

A school described in

A school described in

A hospital or a cooperative hospital service organization described in

A hospital or a cooperative hospital service organization described in

A medical research organization operated in conjunction with a hospital described in

A medical research organization operated in conjunction with a hospital described in

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

A federal, state, or local government or governmental unit described in

A federal, state, or local government or governmental unit described in

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in

A community trust described in

A community trust described in  An agricultural research organization described in

An agricultural research organization described in

An organization that normally receives: (1) more than 33

An organization that normally receives: (1) more than 33

An organization organized and operated exclusively to test for public safety. See

An organization organized and operated exclusively to test for public safety. See

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or more publicly supported organizations described in

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or more publicly supported organizations described in

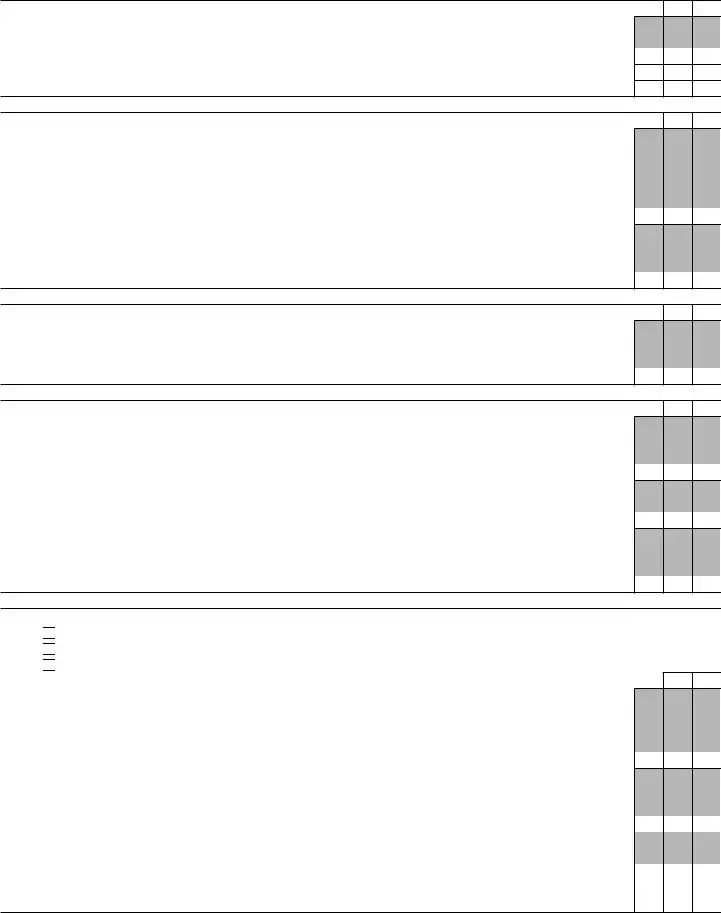

Check this box if the organization received a written determination from the IRS that it is a Type I, Type II, Type III functionally integrated, or Type III

Check this box if the organization received a written determination from the IRS that it is a Type I, Type II, Type III functionally integrated, or Type III

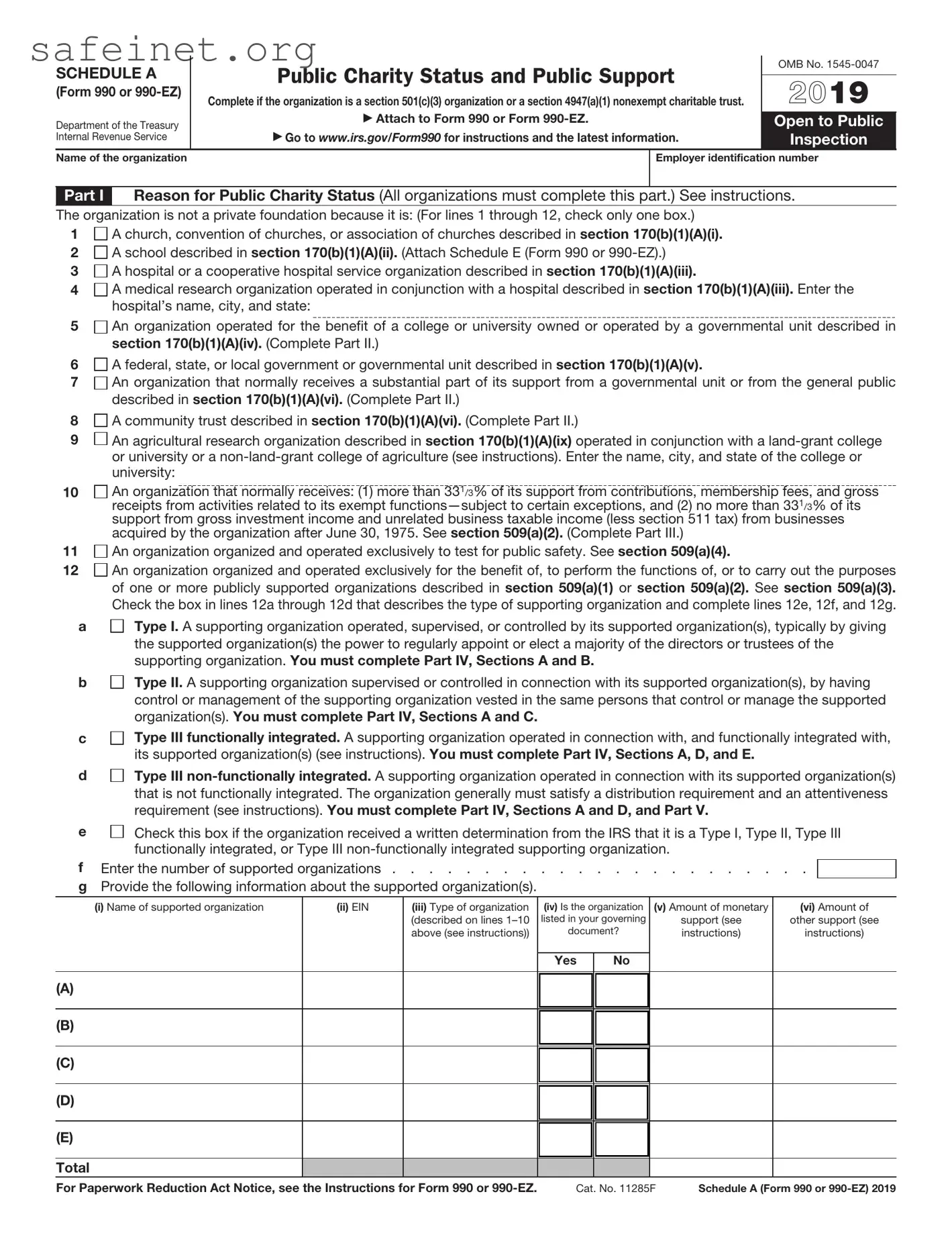

The organization satisfied the Activities Test.

The organization satisfied the Activities Test.

The organization is the parent of each of its supported organizations.

The organization is the parent of each of its supported organizations.

Check here if the organization satisfied the Integral Part Test as a qualifying trust on Nov. 20, 1970 (explain in Part VI).

Check here if the organization satisfied the Integral Part Test as a qualifying trust on Nov. 20, 1970 (explain in Part VI).

Check here if the current year is the organization’s first as a

Check here if the current year is the organization’s first as a