The IRS Schedule EIC (Form 1040) is a document related to the Earned Income Tax Credit, much like Schedule 8812, which also deals with credits for families. Both forms are designed to help lower-income families receive refunds or reduce tax liability. While Schedule EIC focuses on earned income and qualifying children, Schedule 8812 expands its scope to include the Child Tax Credit, allowing taxpayers to claim additional benefits for eligible dependents.

Form 8862 is another relevant document because it is used to claim the Earned Income Tax Credit (EITC) after a prior disallowance. Similar to Schedule 8812, it addresses eligibility and qualifying criteria for credits. Anyone whose EITC claim was denied in previous years must complete Form 8862 to prove they indeed qualify for the credit in the current tax year.

Form 2441 connects to Schedule 8812, as it addresses the Child and Dependent Care Credit. Both forms consider the financial burden of raising children. However, while Schedule 8812 is focused on the Child Tax Credit primarily, Form 2441 provides credits for child care expenses that allow parents to work or attend school, thus promoting work among families.

Also similar is Form 8863, which is used for education credits like the American Opportunity and Lifetime Learning Credits. Much like Schedule 8812, this form is aimed at benefiting taxpayers with dependents, but it focuses on their education expenses. Families can potentially reduce their tax burden by claiming credits for tuition and related costs through Form 8863.

Form 8880 offers another avenue for families, as it deals with the Retirement Savings Contributions Credit. Similar to Schedule 8812, this document is aimed at lower and moderate-income families. It incentivizes saving for retirement while acknowledging the importance of financial support for dependents, in the same way that Schedule 8812 acknowledges financial pressures from raising children.

Form 8889, utilized for Health Savings Accounts (HSAs), shares thematic similarities with Schedule 8812. Both documents underscore significant financial commitments faced by families, though the focus is distinctly different. While Schedule 8812 highlights the support for children, Form 8889 promotes saving for healthcare expenses, enabling families to navigate rising medical costs more effectively.

Form 5329 pertains to Additional Taxes on Qualified Plans (including IRAs) and can complement discussions found in Schedule 8812. Although they serve different purposes, both documents demonstrate an understanding of budget constraints faced by families. While Schedule 8812 is concerned with credits for children, Form 5329 ensures that families adhere to tax laws related to retirement savings, an essential part of long-term financial planning.

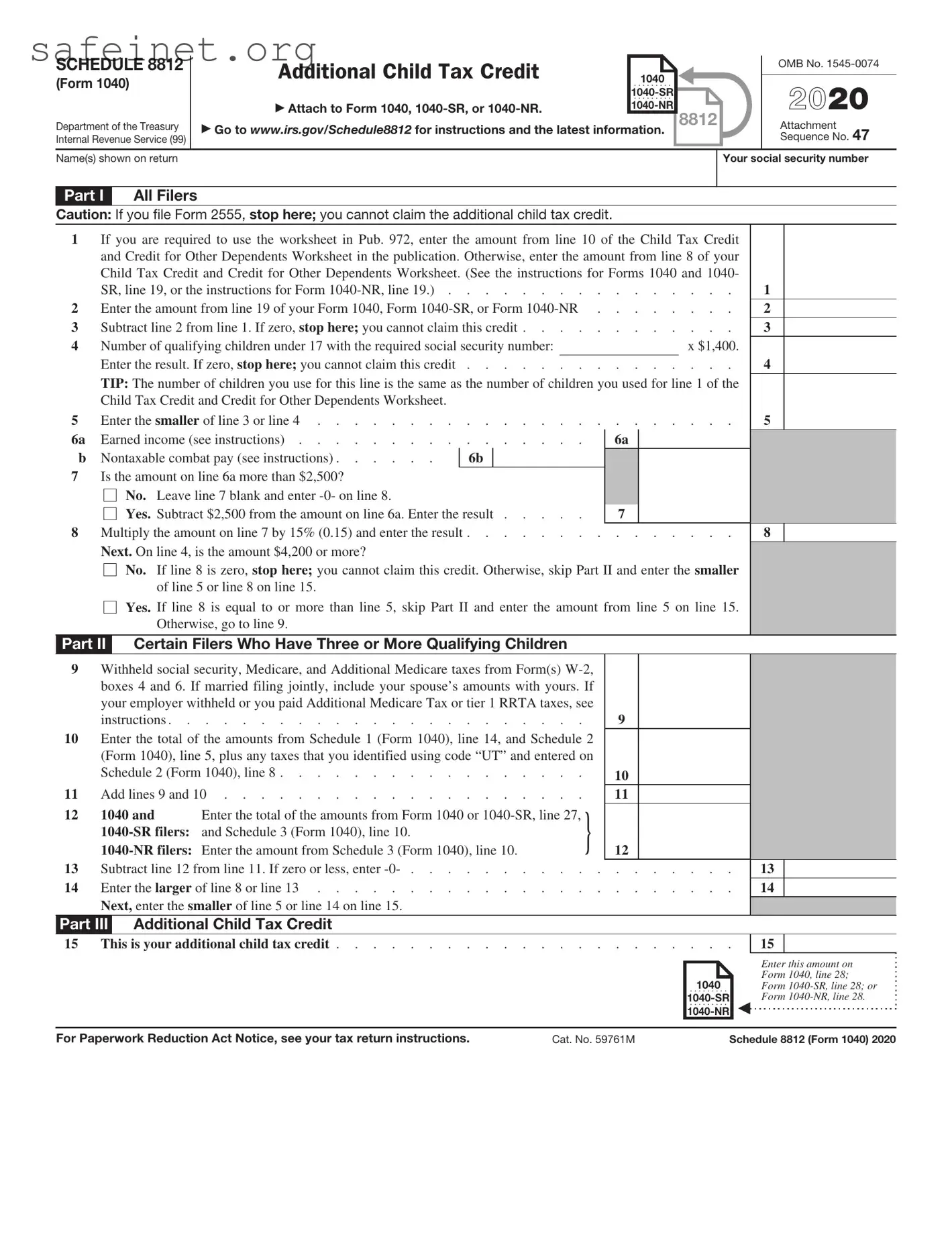

The Federal Form 1040 itself is essential in this context, acting as the overarching tax return document. Schedule 8812 supplements this form by allowing taxpayers to claim additional credits specific to families with dependent children. Essentially, Schedule 8812 is an add-on to the 1040, narrowing down some aspects of the taxpayer’s financial situation and providing further avenues for savings or refunds.

The IRS Publication 972, while not a form, functions as an important resource akin to Schedule 8812. This publication elaborates on the Child Tax Credit and other credits for families. It serves as a guide and educational tool, helping taxpayers understand the ins and outs of claiming these credits while Schedule 8812 offers the mechanism to claim them on the tax return.

Lastly, Form 8886 might be considered somewhat similar, despite its focus on reportable transactions. While it doesn’t directly relate to credits for families, the form emphasizes compliance and transparency for complex financial arrangements. Like Schedule 8812, which aids in proper tax reporting for families, Form 8886 ensures taxpayers are aware of their reporting requirements, promoting responsible financial behavior.