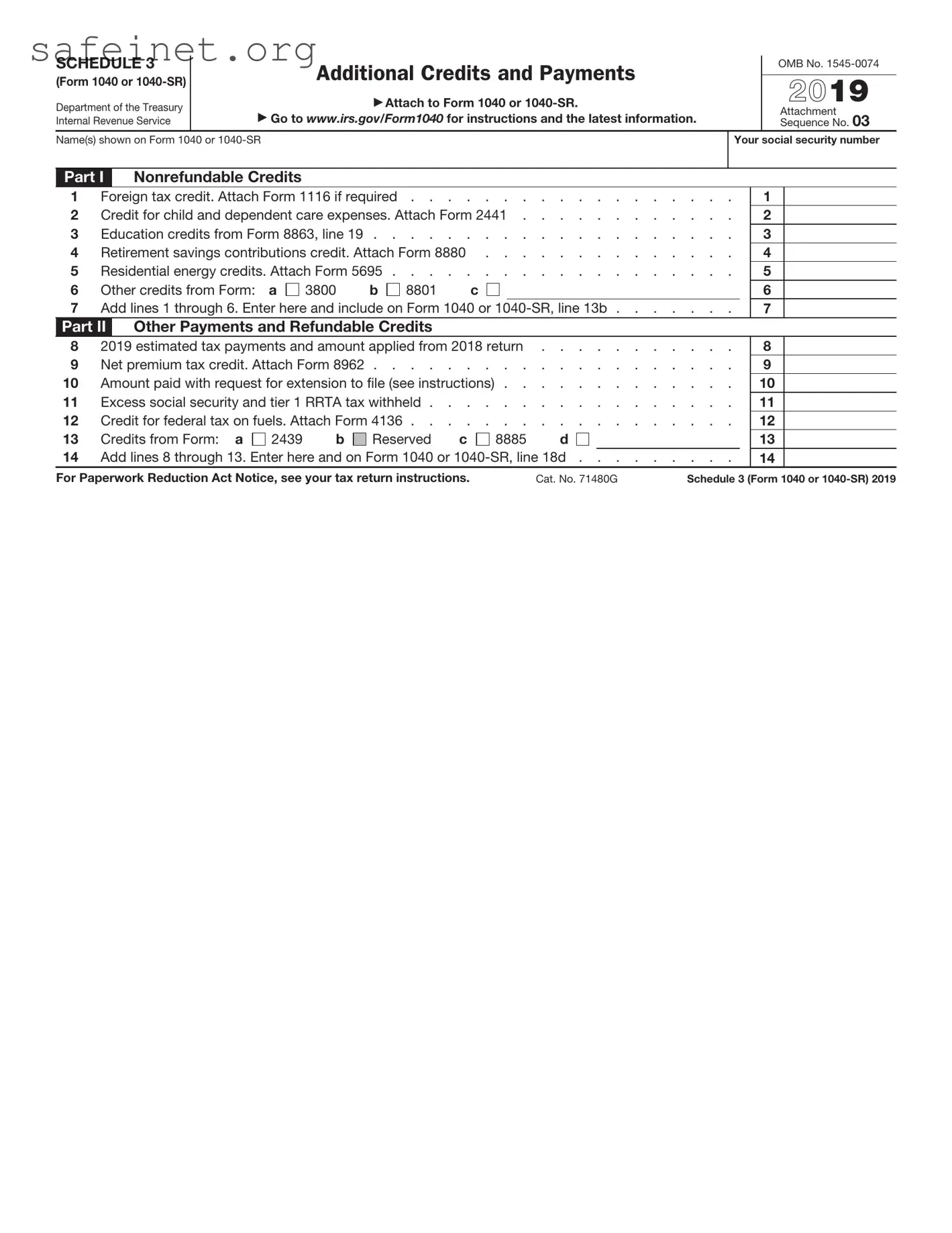

What is IRS Schedule 3?

IRS Schedule 3 is an attachment to the Form 1040 or 1040-SR, used to report certain nonrefundable credits and other payments. It helps individuals claim credits such as the foreign tax credit, the credit for child and dependent care expenses, and the credit for the elderly or the disabled, among others.

Who needs to file Schedule 3?

You must file Schedule 3 if you are claiming any of the nonrefundable credits listed on the form. This may apply to various taxpayers, including individuals who claim child tax credits, education credits, or if you have previously paid taxes to a foreign government and wish to receive a credit for it.

How do I complete Schedule 3?

To complete Schedule 3, you will need to gather relevant information regarding the credits you intend to claim. Fill out each applicable section on the form, ensuring accuracy. After completing Schedule 3, include it when you file your Form 1040 or 1040-SR. Make sure to double-check all entries for any potential errors.

What are some common nonrefundable credits reported on Schedule 3?

Some common nonrefundable credits include the Foreign Tax Credit, the Child and Dependent Care Expenses Credit, and the Credit for the Elderly or Disabled. Each of these credits has specific eligibility requirements, so it's essential to review the instructions for Schedule 3 carefully to ensure you qualify.

Is there a deadline for submitting Schedule 3?

Schedule 3 must be filed by the same deadline as your Form 1040 or 1040-SR. Typically, this deadline falls on April 15 for most taxpayers. If you are unable to file by this date, consider filing for an extension, but remember that any taxes owed still must be paid by the original deadline to avoid penalties.

Can I file Schedule 3 electronically?

Yes, you can file Schedule 3 electronically if you choose to e-file your Form 1040 or 1040-SR. Most tax software programs facilitate this process and automatically prompt you to complete any necessary attachments such as Schedule 3 if applicable.

What should I do if I made a mistake on Schedule 3?

If you realize you made a mistake after filing, you can submit an amended return using Form 1040-X. Ensure to correct the error on Schedule 3 and provide adequate documentation explaining the changes. It is crucial to act promptly to avoid any potential issues with your tax return.