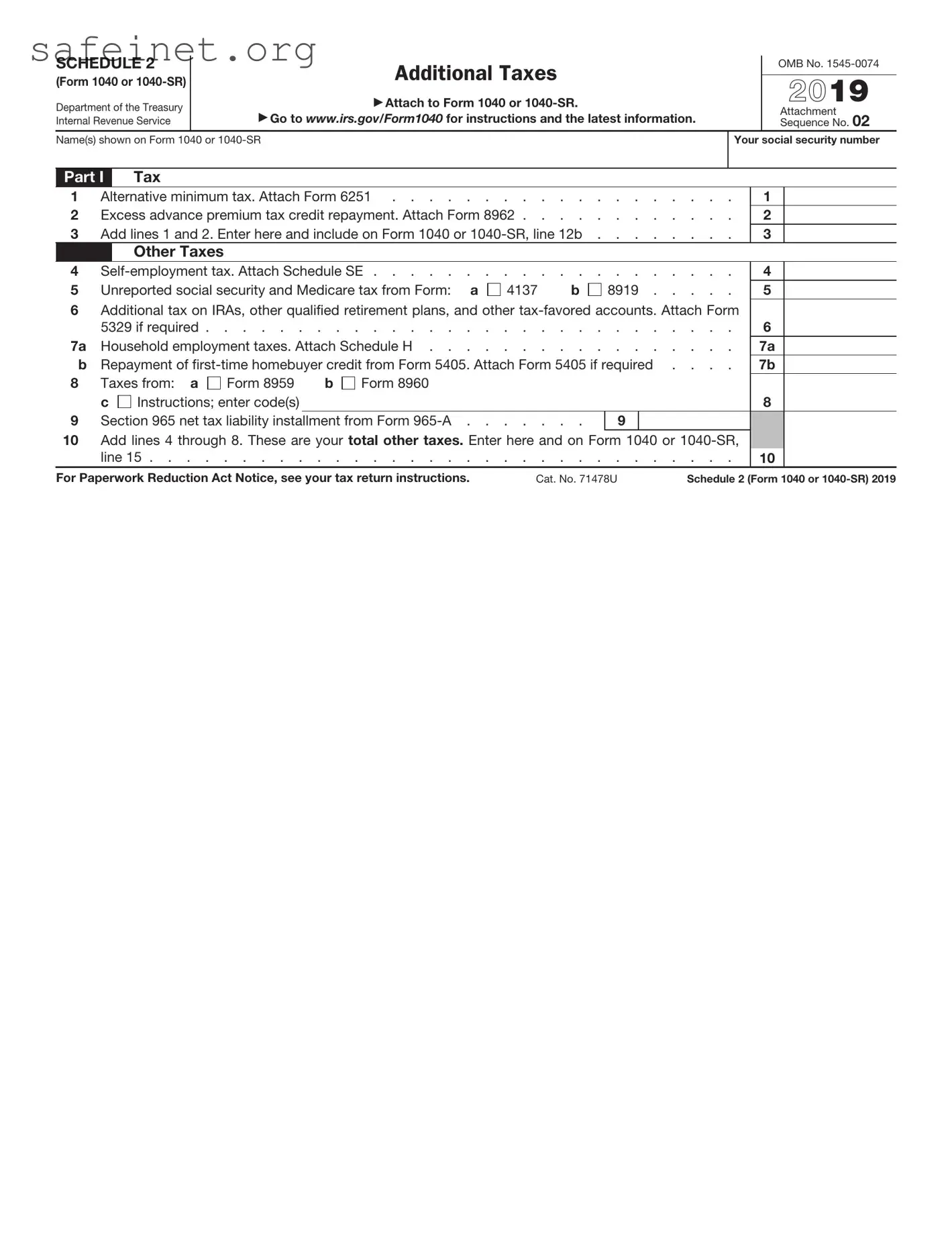

What is IRS Schedule 2?

IRS Schedule 2 is a form used to report additional taxes that are owed beyond what is reported on the standard Form 1040 or 1040-SR. It is typically required for taxpayers who have specific types of income or owe certain taxes, such as self-employment tax or alternative minimum tax. This form helps ensure that the IRS has a complete understanding of your financial obligations for the tax year.

Who needs to file Schedule 2?

Generally, taxpayers who have specific tax liabilities must file Schedule 2 along with their Form 1040 or 1040-SR. This includes individuals who owe the self-employment tax because they earned income from self-employment, or those subject to additional taxes on retirement plans or health savings accounts. If you are unsure whether you need to file Schedule 2, reviewing the IRS guidelines or consulting a tax professional may be beneficial.

What are some examples of additional taxes reported on Schedule 2?

Schedule 2 includes several types of additional taxes. Some common examples are the self-employment tax, which applies to self-employed individuals, and the alternative minimum tax (AMT), which may affect high-income earners. Other additional taxes may arise from excess contributions to retirement accounts or early distributions from retirement plans. Each of these scenarios has specific calculations and requirements detailed in the form instructions.

How do I complete Schedule 2?

Completing Schedule 2 involves gathering the necessary information regarding your additional tax liabilities. You'll need to follow the instructions provided on the form, which will guide you through each section. Begin by entering your name and Social Security number at the top. Then, fill out the various sections related to the specific additional taxes applicable to your situation. It's important to double-check your calculations to ensure accuracy before submitting.

Where do I submit Schedule 2?

Schedule 2 is submitted along with your main tax return, either Form 1040 or 1040-SR. Make sure to include it in the same envelope if you're mailing a paper return. If you file electronically, the software will typically handle the inclusion of Schedule 2 for you. Always ensure that all forms are properly attached and submitted to avoid delays in processing your tax return.

Is there a deadline for filing Schedule 2?

Like Form 1040 and 1040-SR, Schedule 2 must typically be filed by April 15 of the year following the tax year in question. However, if these dates fall on a weekend or holiday, the deadline is extended to the next business day. If additional time is necessary, taxpayers can file for an extension, allowing for a later submission date, though any taxes owed must still be paid by the original deadline to avoid penalties.

What if I make a mistake on Schedule 2?

If you discover a mistake after filing Schedule 2, it is crucial to correct it as soon as possible. You can do this by filing an amended return using Form 1040-X. This form allows you to update any inaccuracies, including those on Schedule 2. Be sure to explain the changes clearly and attach any supporting documentation that may be required for the IRS to understand your corrections.