The IRS Schedule A is similar to Schedule 1 in that it provides details about specific deductions the taxpayer can claim. While Schedule 1 focuses on additional income and adjustments to income, Schedule A allows individuals to report itemized deductions such as mortgage interest, property taxes, and medical expenses. Taxpayers can choose between taking standard deductions or itemizing their deductions, but both forms help in accurately reporting their financial situation to the IRS.

Just like Schedule 1, Schedule C is used by self-employed individuals to report income and expenses. It summarizes the financial activity related to a business. While Schedule 1 might include income from various sources such as unemployment benefits or rental income, Schedule C is dedicated solely to the business's profits or losses. Both schedules ensure that all income is reported correctly, but they apply to different types of earners.

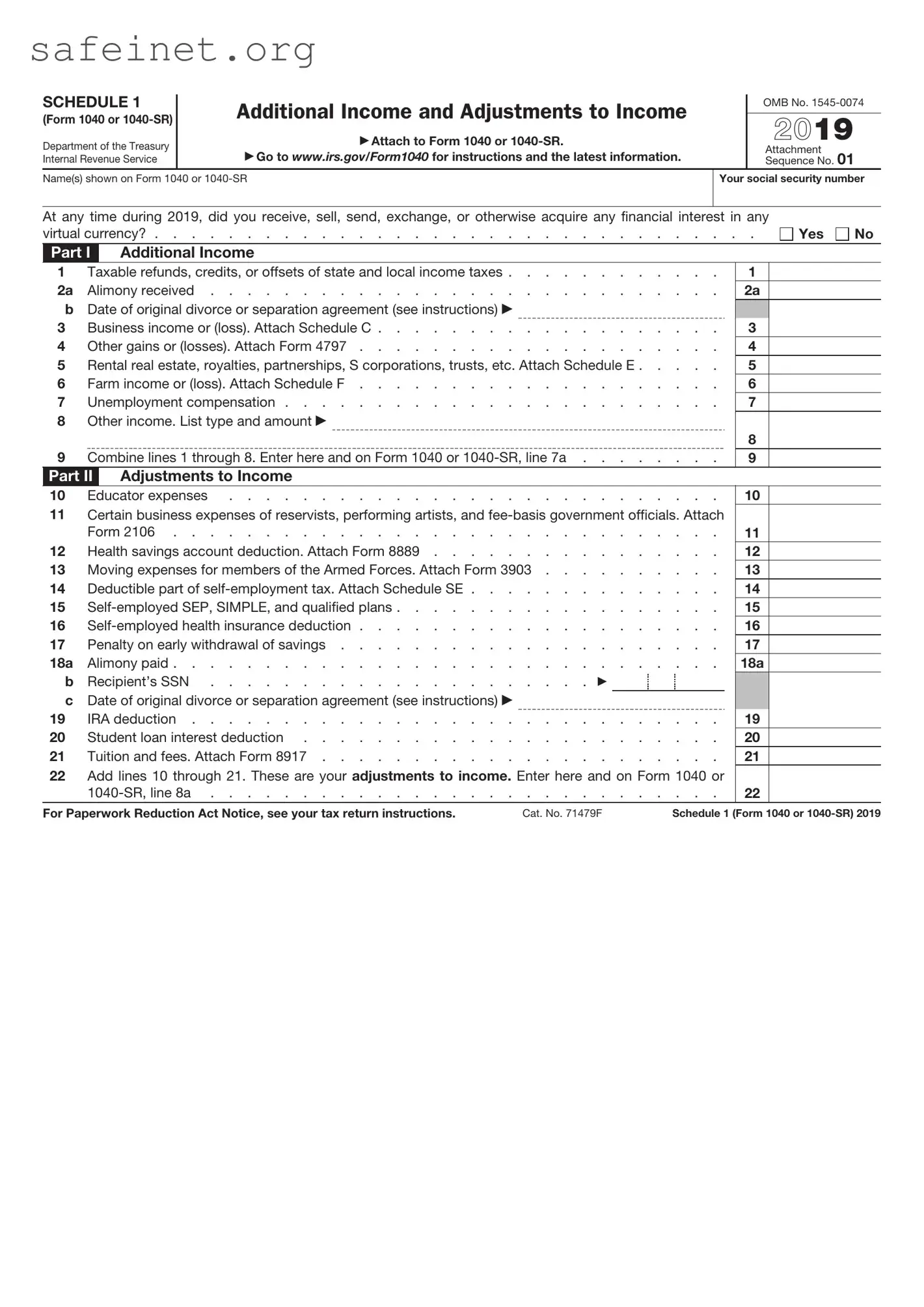

The IRS Form 1040 itself serves as the primary tax return form for individuals. It is similar to Schedule 1 in that they both collect vital information to calculate a taxpayer's overall tax liability. Schedule 1 supplements Form 1040 by providing additional income and adjustment entries. Together, they create a comprehensive picture of a taxpayer's financial standing, ensuring all income and potential deductions are accounted for.

Form 8862, the Information to Claim Earned Income Credit After Disallowance, is also related to Schedule 1. If a taxpayer's Earned Income Credit (EIC) was previously denied, Form 8862 must be filled out for future claims. This form verifies eligibility, while Schedule 1 might report different income types that contribute to qualifying for EIC. Both focus on meeting specific requirements, thus ensuring that taxpayers navigate credit eligibility accurately.

Schedule D is another form that complements Schedule 1. It reports capital gains and losses from investments. While Schedule 1 covers various types of income like side jobs or hobby income, Schedule D focuses specifically on investment returns. Both forms work together to ensure that taxpayers disclose all relevant financial information, thereby impacting their overall tax calculations.

Form 8889, which reports Health Savings Accounts (HSAs), shares similarities with Schedule 1 regarding specific adjustments related to health expenses. Schedule 1 may indicate adjustments to income for contributions made to HSAs, while Form 8889 details the actual contributions and distributions. Together, they ensure that taxpayers accurately report health-related financial activities and receive the appropriate tax benefits.

Schedule E helps the taxpayer report income and losses from rental real estate and other pass-through entities. Like Schedule 1, it captures additional sources of income beyond wages. While Schedule 1 may focus on income from freelance gigs or unemployment, Schedule E zeroes in on rental properties and partnerships. Both provide essential details in crafting a comprehensive tax return and help taxpayers track their income accurately.

Lastly, Form 4852, used as a substitute for W-2 or 1099-R forms, can be likened to Schedule 1 in terms of income reporting requirements. If a taxpayer did not receive their proper tax documents, Form 4852 allows them to estimate their earnings. Schedule 1 captures various income types that may not have standard tax documents available, ensuring all income is reported. Together, they help taxpayers accurately report their earnings, even when facing document discrepancies.