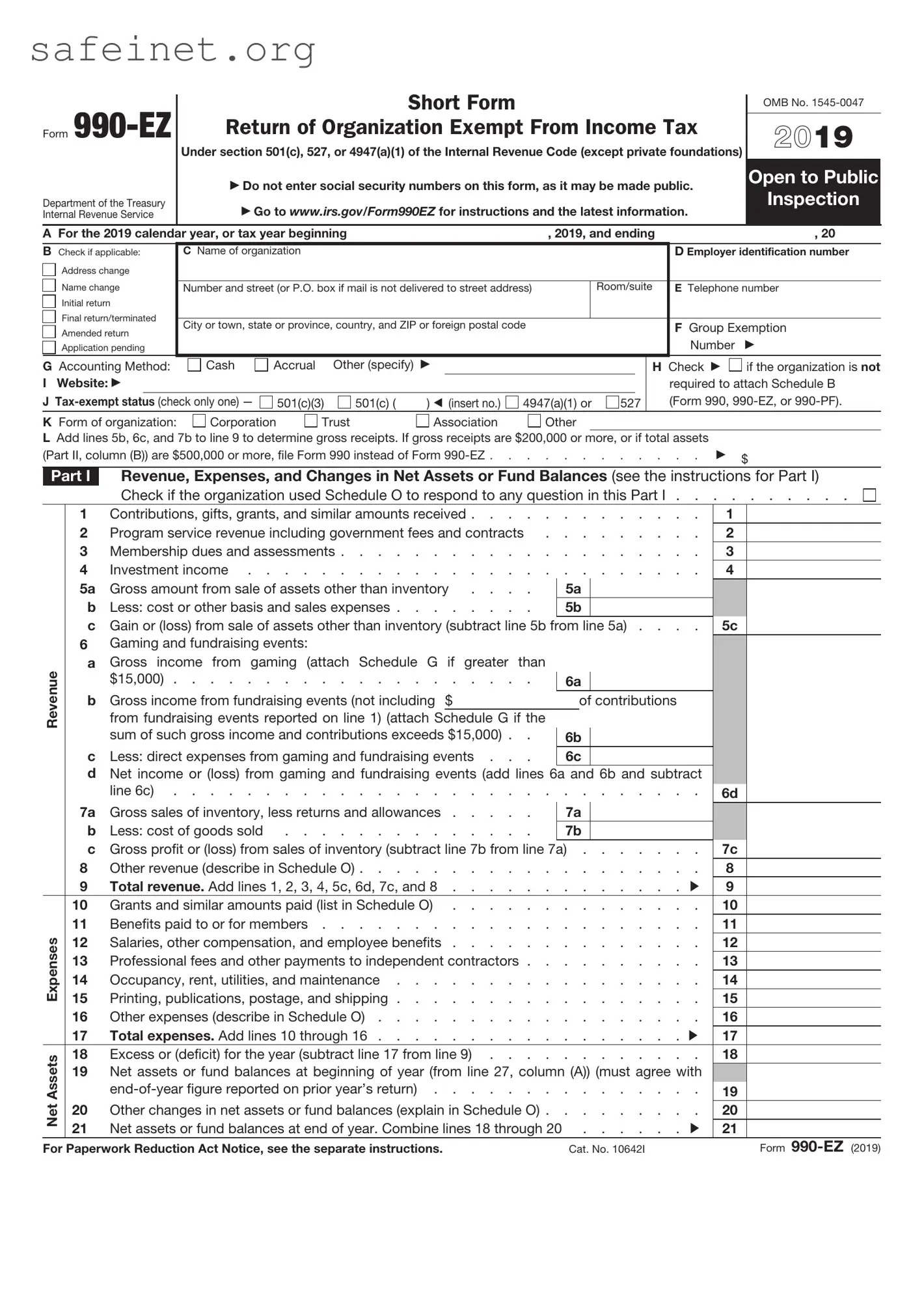

The IRS 990 form is the standard annual reporting document that tax-exempt organizations use to provide information about their financial activities. Similar to the 990-EZ, the 990 is a more detailed form that larger organizations must file. Both forms require organizations to report income, expenses, and program services, helping to maintain transparency and accountability. While the 990-EZ is tailored for smaller organizations, the 990 captures a comprehensive view of an organization's financial standing.

The IRS 990-PF form serves as an annual return for private foundations. Like the 990-EZ, it includes financial information and details on grants made during the year. The commonality lies in the objective of maintaining public trust through disclosure of financial activities. Private foundations use the 990-PF to comply with tax regulations, while smaller non-profits use the 990-EZ, ensuring both are committed to public accountability.

The IRS 501(c)(3) application is crucial for organizations seeking tax-exempt status. It is similar to the 990-EZ because it outlines essential financial and operational information. While the 501(c)(3) application is the initial step for obtaining tax-exempt status, the 990-EZ acts as a follow-up, providing ongoing financial transparency. Both documents encourage organizations to uphold their mission and remain accountable to the public.

The state-level charity registration forms are required for organizations soliciting donations within specific states. These forms resemble the 990-EZ in that they require financial data and descriptions of programs. They serve the same purpose: ensuring that organizations are transparent about their use of funds and that they adhere to state regulations regarding fundraising activities. Both types of documents help protect the interests of donors and the public.

The IRS Form 1023 is the application for recognition of exemption from federal income tax for 501(c)(3) organizations. The 1023 and the 990-EZ share a focus on the organization's finances and programs. The 1023 establishes the organization's eligibility for tax-exempt status, while the 990-EZ ensures continued compliance by providing a financial snapshot of the organization’s operations annually. Both forms contribute to maintaining a clear public record of nonprofit activities.

The IRS Schedule A is an attachment for the 990 and 990-EZ forms that provides additional information about the organization’s public charity status and financial activities. It complements the 990-EZ by detailing the sources of funding and how they are utilized. Like the 990-EZ, Schedule A’s purpose is to ensure transparency and proper classification of the organization’s charitable status, reinforcing the commitment to integrity in operations.

The IRS Form 990-T is used by tax-exempt organizations to report unrelated business income (UBI). Similar to the 990-EZ, it requires financial disclosures, but focuses specifically on income that does not directly relate to the organization’s tax-exempt purpose. By filing both forms, an organization demonstrates its adherence to tax rules while maintaining transparency in its overall financial reporting.

The IRS Form 8872 is required for organizations engaged in political activities and is similar to the 990-EZ in that both require transparency regarding funding sources and expenditures. While the 990-EZ focuses on nonprofit activities, the 8872 ensures organizations involved in political spending disclose their activities to the public, thus promoting accountability and ethical fundraising practices.

The IRS Form 990-N, also known as the e-Postcard, is a simplified version for small tax-exempt organizations with gross receipts under a certain threshold. Like the 990-EZ, the 990-N keeps organizations accountable by requiring them to report basic financial information annually. Although it is less detailed, both forms aim to promote transparency and maintain a public record of each organization’s financial health.

The IRS Annual Information Return for Non-Profits (Form 990-Short Form) has been developed for certain organizations that qualify for a streamlined reporting process. Much like the 990-EZ, the short form requires essential information about the organization’s finances while relieving smaller entities from the burden of cumbersome reporting. Both forms reflect a commitment to transparency and responsible management within the nonprofit sector.